Setting the Foundation for Financial Success

For many men, achieving financial security and building lasting wealth is a paramount goal. It’s not just about earning more, but also about intelligent management, strategic investing, and safeguarding your future. This guide will provide a comprehensive roadmap, blending career advancement tactics with robust financial planning principles to help men achieve a secure financial future.

Elevating Your Career for Higher Income

Boosting your career income is often the most direct route to accelerating wealth accumulation. This involves continuous self-improvement, strategic networking, and confident negotiation.

- Continuous Skill Development: Invest in yourself by acquiring new skills, certifications, or advanced degrees relevant to your industry. Staying competitive and indispensable often translates to higher earning potential. Look for opportunities to lead projects or take on responsibilities that showcase your value.

- Strategic Networking and Mentorship: Build a strong professional network. Connections can open doors to new opportunities, partnerships, and insights. Seek out mentors who have achieved the career success you aspire to; their guidance can be invaluable for navigating your professional path.

- Mastering Negotiation: Don’t shy away from negotiating your salary, bonuses, or promotions. Research industry benchmarks for your role and experience, and confidently articulate your value to your employer. Regular performance reviews are prime opportunities to discuss compensation adjustments.

Mastering Personal Finance and Debt Management

Earning more is only half the battle; managing your money effectively is crucial for building wealth. Poor financial habits can erode even a high income.

- Create a Detailed Budget: Understand where your money goes. A comprehensive budget helps you identify unnecessary expenses and allocate funds towards savings and investments. Regularly review and adjust your budget to ensure it aligns with your financial goals.

- Prioritize Debt Reduction: High-interest debt, such as credit card balances, can be a major hindrance to wealth building. Develop a clear strategy to pay down these debts quickly, whether it’s the snowball method or the avalanche method. Eliminating debt frees up capital for more productive uses.

- Build a Robust Emergency Fund: Aim to save 3-6 months’ worth of living expenses in an easily accessible, high-yield savings account. This fund acts as a financial safety net, protecting you from unexpected job loss, medical emergencies, or other unforeseen financial shocks, preventing you from dipping into investments or incurring new debt.

Strategic Investing for Wealth Accumulation

Investing is where your money starts working for you, leveraging the power of compound interest to build significant wealth over time.

- Start Early and Be Consistent: The earlier you begin investing, the more time your money has to grow. Even small, regular contributions can accumulate into substantial sums over decades thanks to compounding.

- Diversify Your Investments: Don’t put all your eggs in one basket. Spread your investments across various asset classes like stocks, bonds, mutual funds, exchange-traded funds (ETFs), and potentially real estate. Diversification helps mitigate risk.

- Utilize Retirement Accounts: Maximize contributions to tax-advantaged accounts like a 401(k), IRA, or Roth IRA. These accounts offer significant tax benefits and are specifically designed for long-term wealth growth for retirement.

- Consider Professional Financial Advice: If you’re new to investing or have complex financial situations, a qualified financial advisor can help create a personalized investment strategy tailored to your goals and risk tolerance.

Protecting Your Assets and Planning for the Future

Wealth building isn’t just about accumulation; it’s also about protection and ensuring your legacy.

- Secure Adequate Insurance: Life insurance provides for your dependents in case of your untimely death. Disability insurance protects your income if you become unable to work. Health insurance is crucial for covering medical expenses. These are fundamental pillars of financial security.

- Estate Planning: Create a will, and consider trusts, to ensure your assets are distributed according to your wishes and to minimize potential estate taxes. This crucial step provides peace of mind for you and your loved ones.

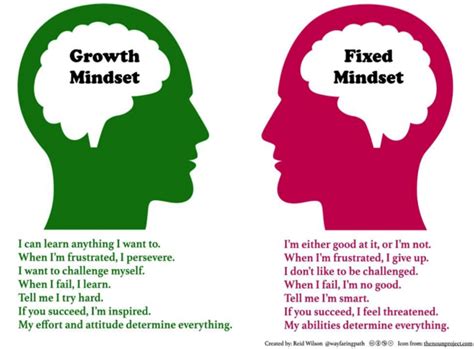

Cultivating a Wealth-Building Mindset

Beyond the practical steps, adopting the right mindset is critical for long-term financial success.

- Embrace Financial Literacy: Continuously educate yourself about personal finance, economics, and investing. The more you understand, the better decisions you’ll make.

- Practice Patience and Discipline: Building wealth is a marathon, not a sprint. It requires consistent effort, patience through market fluctuations, and the discipline to stick to your plan.

- Live Below Your Means: Resist lifestyle inflation. As your income grows, avoid the temptation to increase your spending proportionally. Instead, use increased income to boost savings and investments.

Conclusion

Achieving a secure financial future for men is a journey that combines ambition, discipline, and strategic planning. By actively boosting your career income, mastering personal finance, investing wisely, protecting your assets, and fostering a wealth-building mindset, you can lay a robust foundation for lasting financial security and prosperity. Start today, stay consistent, and watch your financial future transform.