Navigating the Financial Tightrope: Debt vs. Investment

For many men, the pursuit of financial independence presents a complex challenge: how to simultaneously dismantle existing debt while aggressively building wealth through investment. It’s a strategic tightrope walk where every decision carries significant weight. The conventional wisdom often preaches eradicating debt before considering significant investments, yet the power of compounding and market growth tempts many to invest sooner. This article explores practical strategies for men to strike an optimal balance, ensuring both financial stability and accelerated wealth accumulation.

The Imperative of Debt Management

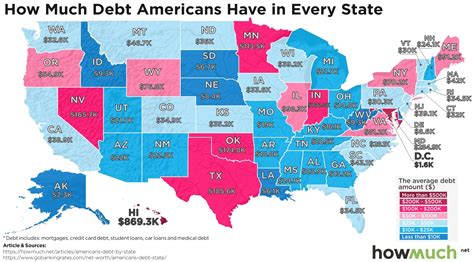

Before diving into aggressive investment, it’s crucial to understand the nature of your debt. Not all debt is created equal. High-interest debts, such as credit card balances, personal loans, or payday loans, act as significant headwinds against wealth building. The interest payments on these can quickly erode any potential investment gains, making them a priority for repayment.

Conversely, lower-interest debts like mortgages or student loans (especially those with fixed, favorable rates) can sometimes be managed alongside investment, allowing your capital to potentially earn a higher return in the market than the interest you’re paying. The psychological burden of debt, however, regardless of its interest rate, can also be a powerful motivator for accelerated repayment.

Embracing Aggressive Investment for Growth

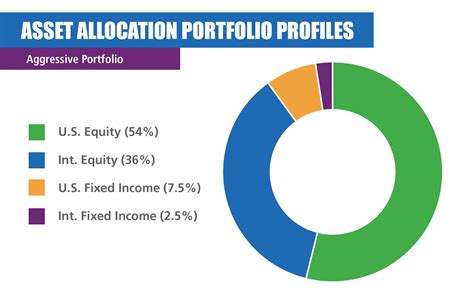

Aggressive investment typically involves allocating a larger portion of one’s portfolio to higher-risk, higher-reward assets such as growth stocks, emerging market funds, or specific sectors with high growth potential. The goal is to maximize returns over the long term, leveraging the power of compounding to build substantial wealth. For men in their prime earning years, a longer time horizon often allows for greater risk tolerance, as there’s more time to recover from market downturns.

The danger, of course, lies in the volatility. Aggressive portfolios can experience significant swings, and a strong understanding of market dynamics, diversification within aggressive assets, and an iron stomach are essential. The reward, however, can be exponential growth that far outpaces inflation and safer, more conservative investments.

Crafting a Balanced Strategy: Debt Paydown Meets Investment Growth

Successfully navigating both debt repayment and aggressive investment requires a well-thought-out, personalized strategy. Here are key approaches:

1. The Hybrid Approach: Prioritize High-Interest Debt

This is often the most recommended strategy. Focus intensely on eliminating all high-interest debt (e.g., above 7-8% interest) first. While doing so, maintain consistent, perhaps smaller, contributions to a diversified investment portfolio, particularly in tax-advantaged accounts like a 401(k) or IRA, especially if there’s an employer match. Once high-interest debt is gone, redirect those freed-up funds aggressively into investments.

2. Build a Robust Emergency Fund

Before any aggressive moves, ensure you have an emergency fund covering 3-6 months of essential living expenses. This acts as a crucial buffer, preventing you from incurring new debt or being forced to sell investments at a loss during unexpected financial hardships.

3. Automate Your Financial Life

Set up automatic transfers for both debt payments and investment contributions. This removes the decision-making friction, ensuring consistency. Treat your investment contributions like a bill you must pay yourself first.

4. Maximize Income and Minimize Expenses

The more disposable income you generate, the faster you can tackle debt and fund investments. Look for opportunities to increase your income through side hustles, skill development, or career advancement. Simultaneously, critically evaluate your expenses to find areas where you can reduce spending without significantly impacting your quality of life.

Understanding Risk Tolerance and Seeking Guidance

An aggressive investment strategy is not suitable for everyone. Your personal risk tolerance, financial goals, time horizon, and current financial obligations should dictate your approach. It’s vital to be honest with yourself about how much volatility you can stomach without losing sleep or making rash decisions.

Consider consulting with a qualified financial advisor. They can help you assess your current situation, understand the nuances of various investment vehicles, and craft a personalized plan that aligns with your specific goals and risk profile. Their expertise can be invaluable in creating a roadmap that effectively balances debt reduction with aggressive wealth creation.

Conclusion

Balancing debt repayment with aggressive investment is an active and dynamic process, not a one-time decision. For men aiming for significant wealth accumulation, it demands discipline, strategic planning, and a clear understanding of personal financial priorities. By systematically addressing high-interest debt, building a solid financial foundation, and consistently committing to a well-diversified aggressive investment strategy, you can confidently navigate the path to financial prosperity and build a robust legacy of wealth.