Unlocking Financial Power Through Automation

For many men, the pursuit of financial security and wealth building is a key life goal. However, the complexities of budgeting, saving, and investing can often feel overwhelming, leading to inaction or inconsistent efforts. The secret to powerful wealth accumulation isn’t constant vigilance, but rather strategic automation. By setting up systems that handle your money movement for you, you can remove emotion from the equation, ensure consistency, and harness the incredible power of compounding over time.

Why Automation is Your Strongest Financial Ally

Automating your financial life offers several significant advantages:

- Consistency: Regular, automatic contributions ensure you never miss an opportunity to save or invest, even when life gets busy. This consistent habit is the bedrock of long-term wealth.

- Removes Emotion: Investing can be an emotional rollercoaster. Market dips can tempt you to sell, and highs might encourage risky moves. Automation keeps you disciplined, sticking to your plan regardless of short-term market fluctuations.

- Harnesses Compounding: The earlier and more consistently you invest, the more time your money has to grow exponentially. Automation ensures your money is always working for you.

- Reduces Decision Fatigue: By setting up automatic transfers and investments, you free up mental energy for other areas of your life, knowing your financial future is being proactively managed.

Step-by-Step: Automating Your Wealth-Building Journey

1. Automate Your Savings

The first step is to ensure a portion of every paycheck goes directly into a savings account before you even see it. Many employers offer direct deposit splits, allowing you to send funds to multiple accounts. If not, set up an automatic transfer from your checking to a dedicated high-yield savings account (HYSA) on payday. Prioritize building an emergency fund first – typically 3-6 months of living expenses – before moving on to investing.

2. Automate Your Investing

This is where real wealth building happens. Leverage the following:

- Retirement Accounts (401k, IRA): If your employer offers a 401(k), sign up and automate contributions, especially if there’s a company match (which is free money!). For IRAs (Traditional or Roth), set up automatic monthly or bi-weekly transfers from your bank account to your investment brokerage.

- Brokerage Accounts: Beyond retirement, open a taxable brokerage account for additional investments. Most brokerages allow you to set up recurring investments into specific ETFs, mutual funds, or even fractional shares of individual stocks.

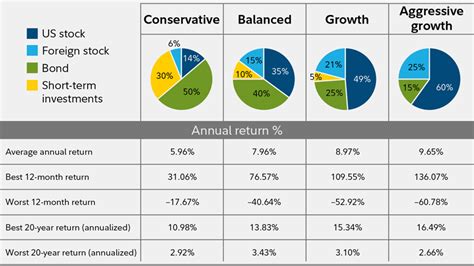

- Robo-Advisors: Services like Betterment or Wealthfront automate portfolio management based on your risk tolerance and goals. You simply set up recurring deposits, and they handle the asset allocation, rebalancing, and diversification for you. This is an excellent option for hands-off investing.

3. Automate Debt Repayment (Smartly)

While not strictly savings or investing, automating debt payments, especially high-interest debts like credit cards, is crucial. Set up auto-pay for minimum payments to avoid late fees, and if possible, automate additional principal payments to accelerate debt freedom. Once high-interest debt is gone, those extra payments can be redirected to savings and investments.

Tools and Platforms to Supercharge Your Automation

Modern financial technology makes automation easier than ever:

- Your Bank’s Online Portal: Set up recurring transfers between your checking, savings, and even external accounts.

- Investment Brokerages: Platforms like Fidelity, Schwab, Vanguard, E*TRADE, or Robinhood offer robust auto-investing features.

- Robo-Advisors: Betterment, Wealthfront, and Acorns are designed for automated investing and rebalancing.

- Budgeting Apps: While not direct automation tools, apps like Mint or YNAB help you track where your money is going, identify areas for increased savings, and ensure you have enough funds to automate.

The Mindset Shift: From Active Management to Passive Growth

Embracing financial automation requires a shift in perspective. Instead of constantly monitoring every dollar, you focus on setting up robust systems that work in the background. Your primary tasks become reviewing your automated plan periodically (annually is often sufficient), increasing your contributions as your income grows, and educating yourself on broader financial principles. This passive approach allows for active living, knowing your money is diligently working towards your future.

Build Your Automated Wealth Machine Today

Automating your savings and investing isn’t just about convenience; it’s about building a powerful, disciplined, and consistent engine for wealth creation. By taking the time now to set up these systems, men can significantly enhance their financial trajectory, ensuring a more secure and prosperous future. Start small, be consistent, and watch your wealth grow.