In today’s fast-paced world, building wealth and achieving financial freedom can feel like a daunting challenge. For men, the pressure to provide and secure a stable future often amplifies this. However, with the right strategies, automating your finances and systematically crushing debt isn’t just a dream – it’s an achievable reality. This guide will walk you through actionable steps to transform your financial landscape, ensuring lasting financial freedom.

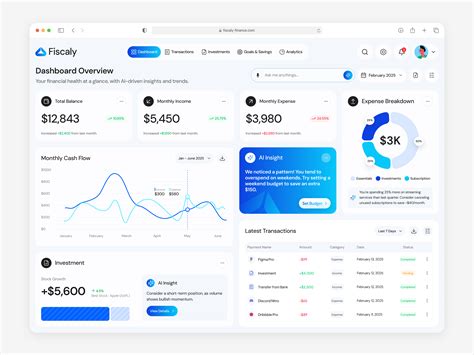

The Power of Automated Investing

Automating your investments is perhaps the single most effective way to build wealth consistently without relying on willpower or constant decision-making. It takes advantage of compound interest and dollar-cost averaging, making your money work harder for you over time.

Setting Up Your Automated Investment Blueprint

- Automate Savings First: Before investing, ensure a portion of your income automatically transfers to a dedicated savings account. This builds an emergency fund, a crucial safety net.

- Maximize Retirement Accounts: Set up automatic contributions to your 401(k) or 403(b), especially if your employer offers a match – it’s free money! If eligible, also automate contributions to a Roth IRA or Traditional IRA. These accounts offer significant tax advantages.

- Open a Brokerage Account: For investments beyond retirement accounts, set up recurring transfers from your checking account to a taxable brokerage account. Consider low-cost index funds, ETFs, or target-date funds for broad market exposure and diversification.

- Choose Your Frequency: Whether weekly, bi-weekly, or monthly, consistency is key. Set up these transfers to align with your pay schedule.

Strategies to Aggressively Crush Debt

Debt is a major roadblock to financial freedom, often accumulating interest that eats away at your potential for wealth creation. Tackling it head-on is non-negotiable.

Identifying and Prioritizing Your Debt

Start by listing all your debts: credit cards, student loans, car loans, personal loans, and mortgages. Include the balance, interest rate, and minimum monthly payment for each. This clarity is your first step towards control.

Debt Crushing Methodologies

- Debt Avalanche: This highly effective method involves paying off debts with the highest interest rates first, while making minimum payments on all others. Once the highest-interest debt is gone, you roll that payment into the next highest, saving you the most money on interest over time.

- Debt Snowball: If motivation is your primary challenge, the debt snowball method might be for you. Pay off debts with the smallest balances first, regardless of interest rate, making minimum payments on others. The psychological wins from quickly eliminating small debts can provide momentum to tackle larger ones.

- Automate Debt Payments: Set up automatic payments for at least the minimum on all your debts to avoid late fees and missed payments. For the debt you’re actively crushing, automate an additional, larger payment whenever possible.

Integrating Automation for Maximum Impact

The real power comes from combining automated investing with automated debt repayment. Instead of choosing one over the other, weave them into your financial fabric.

The Wealth-Building Flow

- Automate Income Allocation: As soon as your paycheck hits, set up automatic transfers for your savings, investments, and debt payments. Think of it as paying your future self first.

- Leverage Windfalls: Bonuses, tax refunds, or unexpected income should be directed strategically – either to accelerate debt repayment or boost your investments, depending on your current financial priorities.

- Regular Review and Adjustment: At least once a year, review your automated systems. Are your investment allocations still appropriate? Can you increase your debt payments or investment contributions? Life changes, and your financial plan should too.

Mindset for Lasting Financial Freedom

Beyond the mechanics, cultivating the right mindset is crucial. Financial freedom isn’t just about numbers; it’s about control, security, and the ability to live life on your terms. For men, this often means building a legacy and ensuring stability for loved ones.

Key Mindset Shifts

- Patience and Persistence: Wealth building and debt crushing are marathons, not sprints. Celebrate small victories and stay committed to the long-term vision.

- Continuous Learning: Stay informed about personal finance. The more you understand, the more confident you’ll become in your decisions.

- Live Below Your Means: This fundamental principle is the bedrock of all financial success. Consciously spend less than you earn to create surplus for saving, investing, and debt repayment.

Conclusion: Your Path to Financial Empowerment

Achieving lasting financial freedom isn’t about complex financial wizardry; it’s about disciplined habits and intelligent automation. By committing to automated investing and systematically crushing debt, men can take control of their financial destiny, build substantial wealth, and secure a future of stability and opportunity. Start today, automate what you can, and watch your financial future transform.