Conquering High-Interest Debt and Forging a Path to Wealth

For many men, the drive to provide, achieve, and secure a stable future is powerful. Yet, high-interest debt can feel like a relentless anchor, dragging down aspirations of wealth and financial freedom. This article provides a direct, aggressive roadmap for men to not only eliminate burdensome debt but also to strategically pivot towards robust wealth accumulation.

Understanding the Enemy: The Peril of High-Interest Debt

Before you can aggressively attack, you must understand your opponent. High-interest debt typically includes credit card balances, payday loans, and certain personal loans. These debts are insidious because a significant portion of your payments goes straight to interest, barely touching the principal. This creates a cycle where financial progress feels impossible, eroding your ability to save and invest.

Why Aggression is Key

Passive payment strategies are a slow death by a thousand cuts when it comes to high-interest debt. An aggressive approach means making deliberate, often uncomfortable, choices to accelerate your debt payoff. It’s about creating urgency and a laser focus to free up capital for wealth-building endeavors as quickly as possible.

Phase 1: Aggressive Debt Annihilation Strategies

1. The Debt Avalanche Method: Your Primary Weapon

While the debt snowball (paying off smallest balances first) offers psychological wins, the debt avalanche is mathematically superior for high-interest debt. List all your debts from highest interest rate to lowest. Dedicate every extra dollar to the debt with the highest interest rate while making minimum payments on the rest. Once that debt is cleared, roll the payment you were making on it into the next highest interest rate debt. This method saves you the most money on interest.

2. Drastic Budgeting and Expense Cutting

This is where aggression truly comes into play. Scrutinize every line item in your budget. Ask yourself: Is this essential? Can I live without it for the next 6-12 months? This might mean:

- Eliminating non-essential subscriptions (streaming, gym memberships you don’t use).

- Cooking at home instead of eating out.

- Temporarily cutting back on expensive hobbies or entertainment.

- Finding cheaper alternatives for services.

The goal is to free up as much cash as possible to throw at your high-interest debts.

3. Income Acceleration and Side Hustles

Paying off debt isn’t just about spending less; it’s also about earning more. Explore avenues to boost your income:

- Negotiate a Raise: If you’re due, present your case for increased compensation.

- Side Hustles: Drive for a ride-sharing service, freelance your skills, deliver food, or offer consulting. Every extra dollar earned goes directly to debt.

- Sell Unused Assets: Go through your garage, attic, and closets. Sell anything of value you no longer use or need.

4. Debt Consolidation and Refinancing (with Caution)

For some, consolidating high-interest credit card debt into a lower-interest personal loan or a balance transfer card can be a powerful tool. However, proceed with extreme caution:

- Ensure the new interest rate is significantly lower.

- Have a strict plan to pay off the consolidated debt within the promotional period (for balance transfers) or loan term.

- Avoid accumulating new debt on the old, now empty, credit cards. Cut them up if necessary.

Phase 2: Pivoting to Strategic Wealth Building

Once high-interest debt is gone, the real work of building wealth begins. The discipline and aggressive mindset you developed during debt payoff are your greatest assets in this phase.

1. Establish and Automate an Emergency Fund

Before investing heavily, build a robust emergency fund with 3-6 months of living expenses in a high-yield savings account. This acts as your financial fortress, preventing future debt should unexpected expenses arise. Automate transfers from your checking account to ensure consistent growth.

2. Maximize Retirement Accounts and Employer Matches

This is often the lowest-hanging fruit for wealth building:

- 401(k)/403(b): Contribute at least enough to get your employer’s full match – this is free money and an immediate 100% return on your investment.

- IRA/Roth IRA: Contribute the maximum allowed annually. Roth IRAs offer tax-free growth in retirement, which can be immensely powerful.

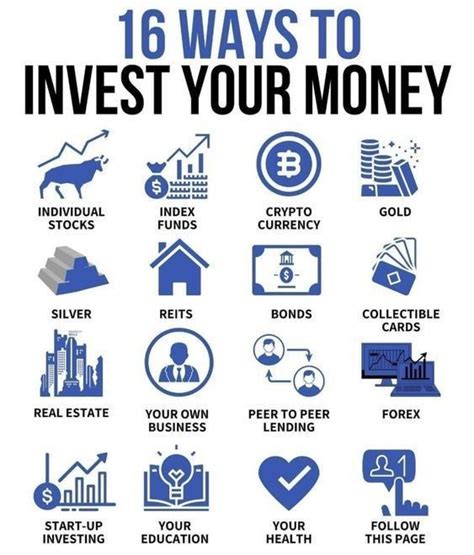

3. Intelligent Investing: Beyond Retirement Accounts

With an emergency fund and retirement accounts on track, look to diversify and expand your investment portfolio:

- Low-Cost Index Funds/ETFs: These offer broad market exposure and diversification at minimal cost.

- Real Estate: Consider rental properties or REITs as part of a diversified portfolio for long-term growth and potential passive income.

- Individual Stocks: If you enjoy research, a small portion of your portfolio can be in individual stocks, but understand the higher risk.

Automate your investments. Set up recurring transfers from your checking account to your brokerage accounts. This removes emotion from investing and ensures consistent contribution.

4. Continuous Financial Education and Lifestyle Management

Wealth building is a marathon, not a sprint. Continuously educate yourself on personal finance, investment strategies, and economic trends. Crucially, avoid ‘lifestyle creep’ – as your income grows, resist the urge to immediately inflate your expenses. Maintain a lean financial posture to accelerate wealth accumulation.

The Power of Discipline and Vision

The journey from high-interest debt to substantial wealth requires immense discipline, focus, and a clear vision of your financial future. It’s about making tough choices, staying consistent, and understanding that every dollar saved from interest or invested wisely contributes to your long-term prosperity. Embrace the challenge, stay aggressive in your pursuits, and watch your financial landscape transform.