High-interest credit card debt can feel like a relentless opponent, eroding financial stability and creating immense stress. For men looking to reclaim their financial power, an aggressive, no-nonsense approach is not just beneficial—it’s essential. This article outlines a robust plan to tackle and eliminate high-interest credit card debt with focus and determination, empowering you to build a stronger financial future.

Understand Your Debt Landscape

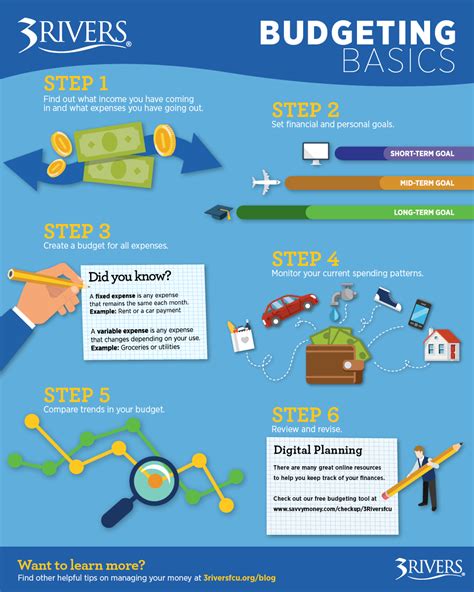

Before you can conquer your debt, you need to thoroughly understand it. Gather all your credit card statements and lay them out. Identify each card’s balance, interest rate (APR), minimum payment, and total amount owed. This clarity is the first step toward formulating an effective attack plan. High-interest debt is particularly insidious because the interest alone can make significant dents in your payments, often leaving the principal largely untouched if you’re only paying the minimum.

Cultivate an Aggressive Payoff Mindset

Paying off debt aggressively requires more than just a plan; it demands a psychological shift. You need to view this as a financial war, and you’re the general. This means committing to radical budgeting, making significant sacrifices, and maintaining unwavering discipline. Talk about your goals, enlist support from your partner or a trusted friend, and remind yourself of the freedom and opportunities that come with being debt-free. This isn’t just about money; it’s about reclaiming control over your life.

Embrace the urgency. Every dollar you spend on interest is a dollar not invested in your future, your family, or your experiences. This aggressive mindset means seeking out every possible avenue to funnel more money towards your debt, and cutting back on anything that isn’t absolutely essential.

The Two-Pronged Attack: Avalanche or Snowball

Debt Avalanche Method

This strategy is financially optimal. List your debts from the highest interest rate to the lowest. Pay the minimum on all cards except the one with the highest interest rate. Attack that high-interest card with every extra dollar you can find. Once that card is paid off, take the money you were paying on it (minimum + extra) and apply it to the card with the next highest interest rate. This method saves you the most money on interest over time.

Debt Snowball Method

While the avalanche is mathematically superior, the snowball method offers psychological wins. List your debts from the smallest balance to the largest. Pay the minimum on all cards except the one with the smallest balance. Once that smallest debt is paid off, take the money you were paying on it and apply it to the next smallest debt. The quick wins build momentum and motivation, which can be crucial for staying the course.

Boost Your Income, Slash Your Expenses

Aggressive debt repayment demands both offense and defense. On the offensive side, look for ways to increase your income. Can you pick up overtime at work? Start a side hustle (freelancing, gig work, selling items online)? Negotiate a raise? Every extra dollar earned should be earmarked directly for debt repayment.

On the defensive side, conduct a deep dive into your expenses. Track every penny for a month. Where can you cut back significantly? Think about temporary sacrifices: dining out less, canceling unused subscriptions, delaying non-essential purchases, finding cheaper alternatives for daily necessities. Create a strict budget and stick to it. This isn’t about minor adjustments; it’s about finding hundreds, or even thousands, of dollars each month to redirect towards your high-interest debt.

Consider Balance Transfers and Debt Consolidation

For individuals with good credit, a balance transfer credit card with a 0% introductory APR can be a powerful tool. This allows you to move high-interest balances to a new card and pay them down without accruing additional interest for a promotional period (typically 12-21 months). Be extremely disciplined: aim to pay off the entire balance before the promotional period ends, and avoid making new purchases on the card. There’s often a balance transfer fee (usually 3-5%), so factor that into your calculations.

Alternatively, a personal loan for debt consolidation can combine multiple credit card debts into one single payment with a potentially lower interest rate and a fixed payoff term. This simplifies your payments and can reduce the overall interest paid, but it requires diligent payment to avoid falling back into debt.

Negotiate with Creditors (If Necessary)

If you’re truly struggling and on the verge of missing payments, don’t hesitate to contact your credit card companies directly. Explain your situation and ask about options like a lower interest rate, a temporary payment plan, or even a hardship program. While not always successful, it’s worth exploring before your credit takes a major hit.

Maintain Momentum and Stay Debt-Free

Paying off high-interest debt is a marathon, not a sprint. Celebrate small victories along the way. Visualize your debt-free future. Once you’ve eliminated the debt, it’s crucial to adopt new financial habits to prevent a relapse. Build an emergency fund, continue budgeting, and use credit cards responsibly (paying off the full balance every month). This aggressive push isn’t just about getting out of debt; it’s about establishing lifelong financial discipline.

Aggressively paying off high-interest credit card debt requires a combination of strategic planning, unwavering discipline, and a willingness to make temporary sacrifices. By understanding your debt, adopting an aggressive mindset, applying effective strategies like the avalanche or snowball methods, boosting your income, cutting expenses, and utilizing tools like balance transfers, you can rapidly eliminate this burden. Take control of your finances today and pave the way for a more secure and prosperous future.