Balancing the immediate burden of credit card debt with the long-term goal of building wealth can feel like a tightrope walk. High-interest debt can erode your financial progress, while neglecting investments can jeopardize your future. The good news is that with a strategic approach, you can efficiently tackle both, paving a clear path to financial freedom and a secure future.

Tackling High-Interest Credit Card Debt First

Credit card debt is often considered the most urgent financial obstacle due to its high-interest rates. These rates mean a significant portion of your monthly payment goes towards interest, not the principal, making it a powerful drag on your financial potential. Before aggressively investing, it’s usually wise to minimize or eliminate this high-cost debt.

The first step is always to gain clarity: know exactly how much you owe on each card and what its interest rate is. Then, create a detailed budget to identify where your money is going and where you can cut back to free up more funds for debt repayment.

Debt Payoff Strategies: Snowball vs. Avalanche

Two popular strategies can help you systematically pay down debt:

- Debt Snowball Method: List your debts from smallest balance to largest. Pay the minimum on all debts except the smallest, on which you pay as much as possible. Once the smallest debt is paid off, take the money you were paying on it and add it to the payment of the next smallest debt. This method provides psychological wins, keeping you motivated.

- Debt Avalanche Method: List your debts from highest interest rate to lowest. Pay the minimum on all debts except the one with the highest interest rate, on which you pay as much as possible. Once that debt is paid off, move to the next highest interest rate. This method is mathematically more efficient, saving you the most money on interest.

Consider Balance Transfers and Negotiations

If you have good credit, a balance transfer card with a 0% introductory APR can be a powerful tool. This allows you to transfer high-interest balances to a new card and pay them down without interest for a specific period (e.g., 12-18 months). Be mindful of transfer fees and aim to pay off the balance before the promotional period ends to avoid high deferred interest rates.

Don’t hesitate to contact your credit card companies. They may be willing to lower your interest rate or offer a payment plan, especially if you have a history of on-time payments or are experiencing financial hardship.

Strategically Building Your Investment Portfolio

While debt repayment is critical, neglecting investments entirely can mean missing out on significant compounding growth. The key is to find a balance. Once high-interest debt is under control, or while you’re working on it, you can begin to prioritize smart investment moves.

The Foundation: Emergency Fund and Employer Match

Before any significant investment, ensure you have a solid emergency fund. This fund, typically 3-6 months’ worth of essential living expenses, should be held in an easily accessible, liquid account. It acts as a financial safety net, preventing you from incurring new debt if unexpected expenses arise.

The very first investment you should consider, often even before completely eradicating moderate-interest debt, is contributing enough to your employer’s 401(k) or 403(b) to get the full company match. This is essentially free money – a guaranteed 100% return on your investment, which is unmatched elsewhere. Don’t leave money on the table!

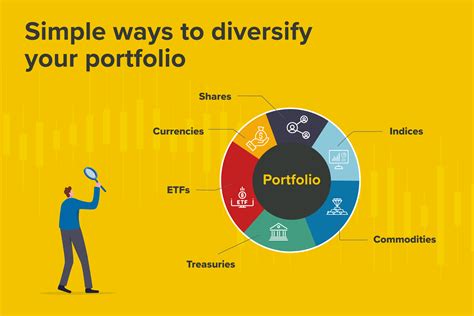

Beyond the Basics: IRAs and Diversification

After securing your emergency fund and maximizing your employer match, consider funding an Individual Retirement Account (IRA). Depending on your income and tax situation, a Roth IRA (tax-free withdrawals in retirement) or a Traditional IRA (tax-deductible contributions) can be excellent vehicles for long-term growth.

When you start investing, focus on diversification. Don’t put all your eggs in one basket. Invest across different asset classes (stocks, bonds, real estate) and geographies. Low-cost index funds or ETFs are excellent starting points for beginners, providing instant diversification across hundreds or thousands of companies with minimal effort and expense.

Integrating Debt Payoff and Investment Growth

The most efficient path often involves a hybrid approach: aggressively paying down high-interest debt while simultaneously making smart, foundational investments. This means you might prioritize paying off a credit card at 20% interest over investing in a mutual fund that historically returns 8-10%, but you won’t neglect the guaranteed return of an employer 401(k) match.

Automate Your Financial Future

One of the most powerful tools for both debt repayment and investment growth is automation. Set up automatic transfers from your checking account to your credit cards (more than the minimum), your emergency fund, and your investment accounts immediately after you get paid. This ensures you ‘pay yourself first’ and stick to your financial plan without needing to make conscious decisions each month.

Conclusion: Your Path to Financial Freedom

Efficiently paying off credit card debt and boosting investments requires discipline, planning, and a clear understanding of your financial priorities. By systematically eliminating high-interest debt, building a robust emergency fund, leveraging employer matching programs, and consistently contributing to diversified investments, you can build a strong financial foundation. Remember, consistency and patience are key. Start today, stay committed, and watch your financial future grow.