In a world where both financial security and personal well-being are paramount, the challenge of building a robust emergency fund while simultaneously pursuing fitness goals can seem daunting. Many believe these two aspirations are in direct competition, demanding resources – both time and money – that feel mutually exclusive. However, with strategic planning and a disciplined approach, it’s entirely possible to accelerate your emergency savings while also making significant strides in your health and fitness journey.

The Power of Dual Discipline: Why Fitness and Finance Converge

At first glance, a gym membership fee or healthy food costs might appear to detract from your savings goals. Yet, a deeper look reveals a powerful synergy. The discipline required to consistently work out or adhere to a healthy diet mirrors the discipline needed for diligent budgeting and saving. Furthermore, investing in your health now can significantly reduce future medical expenses, indirectly contributing to your financial well-being. A healthier you is also a more energetic and productive you, potentially boosting earning capacity.

Fast-Tracking Your Emergency Fund: The Financial Playbook

1. Define Your Target and Timeline

An emergency fund typically covers 3-6 months of essential living expenses. Calculate your monthly non-negotiable costs (rent/mortgage, utilities, basic groceries, transport) and multiply by your target duration. Having a clear, achievable figure makes the goal tangible and motivates action. Set a realistic yet ambitious timeline for reaching this goal.

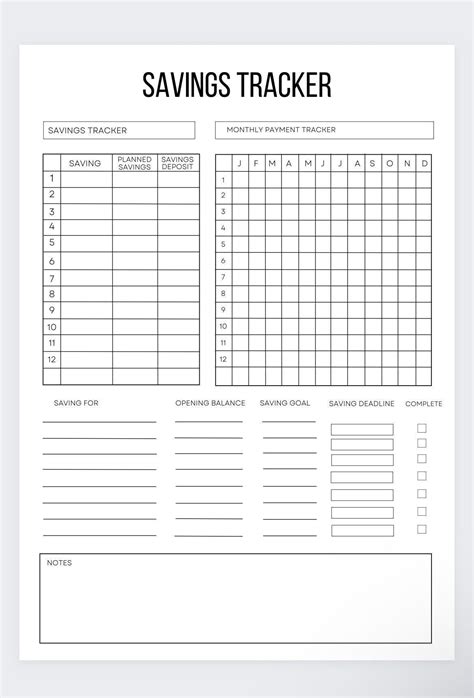

2. Ruthless Budgeting and Expense Tracking

This is the bedrock of rapid savings. Track every dollar in and out for a month to identify exactly where your money is going. Categorize expenses and pinpoint areas where you can cut back. Think of it as a financial audit. Use budgeting apps or simple spreadsheets to stay on top of your spending.

3. Trim the Fat: Finding Savings Opportunities

Look for “leaks” in your budget. This could mean renegotiating insurance premiums, canceling unused subscriptions, cooking more meals at home, or cutting down on non-essential entertainment. When balancing with fitness, consider if your current gym membership is truly the most cost-effective option, or if home workouts, outdoor activities, or more affordable community centers could suffice initially.

4. Boost Your Income (Temporarily or Permanently)

To build an emergency fund quickly, increasing income is often more impactful than just cutting expenses. Explore side hustles: freelancing, selling crafts, dog walking, driving for ride-shares, or even decluttering your home and selling unused items. Dedicate all, or a significant portion, of this extra income directly to your emergency fund.

Smart Fitness on a Budget: Integrating Health Goals

1. Cost-Effective Workouts

You don’t need an expensive gym membership to get fit. Bodyweight exercises, running, walking, hiking, cycling, and free online workout videos offer excellent ways to stay active without breaking the bank. Community parks, trails, and even your living room can become your personal gym.

2. Meal Prep for Health and Savings

Eating healthy can be expensive, but smart meal prepping is a game-changer for both your physique and your wallet. Buying ingredients in bulk, planning meals, and cooking at home dramatically reduces food costs compared to eating out or relying on processed foods. This also gives you greater control over nutrition, supporting your fitness goals.

3. Time Management is Key

Both saving and fitness require consistent effort. Schedule your workouts and your dedicated financial review time into your week. Treat these appointments as non-negotiable. Even 30 minutes of exercise a day and 15 minutes of financial planning can yield significant results over time.

Sustaining Momentum: Motivation and Consistency

Building an emergency fund and achieving fitness milestones are a marathon, not a sprint. Set mini-goals for both, celebrating small victories to maintain motivation. Track your progress visually – watch your savings grow and your fitness metrics improve. Find an accountability partner or join a supportive community. Remember, every healthy choice and every dollar saved is a step towards a more secure and vibrant future.

Balancing rapid emergency fund building with fitness goals is not just achievable; it’s a synergistic path to holistic well-being. By applying discipline, creativity, and strategic planning, you can simultaneously fortify your financial safety net and cultivate a healthier, stronger you. Start today, and watch your dual aspirations become reality.