In today’s fast-paced world, many ambitious men find themselves caught in a relentless pursuit of professional success, often at the expense of their personal well-being. The challenge isn’t just about accumulating wealth or achieving physical prowess; it’s about sustaining both without succumbing to the omnipresent threat of burnout. This article explores actionable strategies for busy men to optimize their financial and physical health, ensuring they can fuel their days for peak performance in all aspects of life.

The Interconnectedness of Wealth and Well-being

It’s no secret that a healthy body and a healthy bank account often go hand-in-hand. Stress from financial instability can manifest as physical ailments, while poor health can lead to reduced productivity and increased medical expenses. Recognizing this symbiotic relationship is the first step toward building a sustainable framework where both finance and fitness thrive. By addressing both simultaneously, busy men can create a powerful synergy that propels them forward.

Fueling Your Financial Engine

Financial stability isn’t about being rich; it’s about being secure and strategic. For busy men, efficiency is key.

Automate Savings & Investments

Set up automatic transfers from your checking account to savings and investment accounts on payday. This “set it and forget it” approach ensures you’re consistently building your financial future without needing to remember to do it manually. Even small, consistent contributions add up significantly over time.

Mini-Financial Reviews

Dedicate 15-30 minutes once a week or bi-weekly to review your finances. Check bank balances, credit card statements, and investment performance. This quick check helps you stay on track, catch potential issues early, and make minor adjustments as needed without requiring a lengthy budgeting session.

Smart Spending & Debt Management

Identify your “money leaks” – those small, recurring expenses that drain your budget without much value. Prioritize paying down high-interest debt, as it’s often the biggest impediment to financial freedom. Consider using a simple budgeting app to track spending effortlessly.

Powering Your Physical Performance

Just as you manage your money, you must manage your physical energy. Time is precious, so workouts and nutrition need to be effective.

Efficient Workouts

Opt for high-intensity interval training (HIIT) or compound lift routines (squats, deadlifts, bench press) that provide maximum benefit in minimum time. A 30-45 minute intense session three times a week can be more effective than longer, less focused workouts. Incorporate active recovery like walking or stretching on off-days.

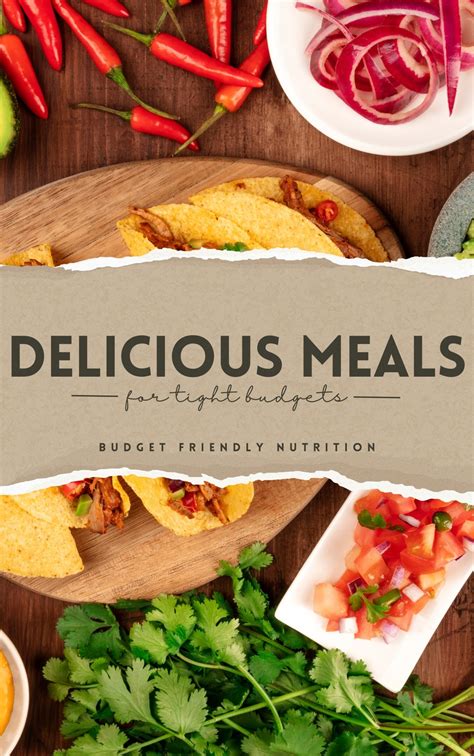

Strategic Nutrition

Meal prepping on a Sunday can save hours during the week. Focus on whole, unprocessed foods: lean proteins, complex carbohydrates, and healthy fats. Keep healthy snacks (nuts, fruit, protein bars) on hand to avoid unhealthy impulses and maintain steady energy levels throughout the day.

Prioritizing Sleep & Recovery

Sleep is non-negotiable. Aim for 7-9 hours of quality sleep per night. Create a consistent sleep schedule and a relaxing bedtime routine. Incorporate short meditation sessions or deep breathing exercises to reduce stress and aid recovery, both physically and mentally.

The Burnout Buster Blueprint

Sustainable success means actively preventing burnout. This requires intentional self-care and smart work habits.

Mindful Breaks & Digital Detox

Schedule short, mindful breaks throughout your workday. Step away from screens, stretch, or take a quick walk. Designate specific times each day (e.g., an hour before bed, Sunday mornings) for a digital detox to disconnect and recharge.

Delegating & Prioritizing

Learn to delegate tasks, both professionally and personally, where possible. Use productivity frameworks like the Eisenhower Matrix to prioritize tasks: urgent/important, important/not urgent, etc. Focus your energy on what truly matters and what only you can do.

Building a Support System

Surround yourself with a network of supportive friends, family, or mentors. Share your challenges and successes. Having a strong support system can provide encouragement, accountability, and a different perspective when you feel overwhelmed.

Fueling your day for peak finance and fitness without burnout isn’t about doing more; it’s about doing smart. By strategically integrating financial management with efficient fitness routines and prioritizing recovery, busy men can cultivate a lifestyle that supports both their ambitions and their well-being. The journey requires discipline and consistency, but the rewards – a robust financial future, vibrant health, and a resilient mindset – are immeasurable.