In an unpredictable world, an emergency fund isn’t just a good idea; it’s a financial imperative. For men navigating careers, family responsibilities, and future aspirations, having a safety net is crucial. It protects against unexpected job loss, medical emergencies, car breakdowns, or home repairs without derailing long-term financial goals. While any savings are better than none, leveraging high-yield savings accounts (HYSAs) offers the smartest, most efficient path to building a substantial emergency fund.

Why Every Man Needs a Robust Emergency Fund

Life throws curveballs, and without an emergency fund, these can quickly become financial catastrophes. Imagine facing an unexpected car repair bill or a sudden job loss. Without readily available cash, many resort to high-interest credit cards, personal loans, or even dipping into retirement savings – all of which can have lasting negative impacts on your financial health. An emergency fund acts as a buffer, absorbing these shocks and allowing you to maintain your financial equilibrium and peace of mind.

Understanding High-Yield Savings Accounts (HYSAs)

Traditional savings accounts often offer abysmal interest rates, meaning your money barely grows. High-yield savings accounts, typically offered by online banks, stand apart by providing significantly higher annual percentage yields (APYs). While not investment accounts, the higher interest rates mean your emergency fund can grow faster, even when simply sitting there. Key benefits include liquidity (easy access to your funds), safety (FDIC insured up to $250,000), and the simple fact that your money works harder for you.

How Much Should You Save for Your Emergency Fund?

The general rule of thumb is to save 3 to 6 months’ worth of essential living expenses. However, for men with dependents, less stable employment, or those who are self-employed, aiming for 6 to 12 months’ worth of expenses might be a wiser target. Calculate your monthly essentials – rent/mortgage, utilities, food, transportation, insurance, minimum debt payments – and multiply that by your target number of months. This specific goal will make the task seem less daunting and more achievable.

Smart Strategies for Men to Build Their Fund

Automate Your Savings

The easiest way to save consistently is to make it automatic. Set up a recurring transfer from your checking account to your HYSA on payday. Treat this transfer like any other bill – a non-negotiable expense that contributes directly to your financial security. Even small, consistent contributions add up significantly over time.

Cut Unnecessary Expenses

Take a critical look at your spending. Are there subscriptions you don’t use? Daily coffees that could be made at home? Nights out that could be replaced with more budget-friendly alternatives? Redirecting even $50-$100 a month from discretionary spending directly into your emergency fund can accelerate its growth substantially.

Boost Your Income

Consider ways to increase your earnings. This could involve taking on a side hustle, freelance work, negotiating a raise at your current job, or selling unused items. Even a temporary increase in income can provide a significant boost to your emergency savings, allowing you to reach your goal faster.

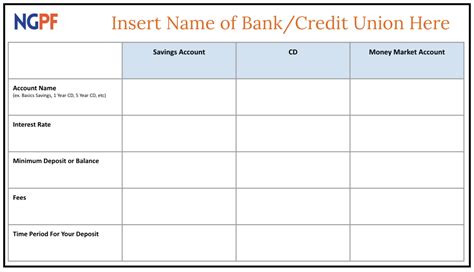

Choosing the Right High-Yield Savings Account

Compare Annual Percentage Yield (APY)

Different banks offer varying APYs. Shop around and compare rates to ensure you’re getting the best possible return on your money. Remember that rates can change, so it’s wise to occasionally review the market.

Look for Low or No Fees

Many online HYSAs come with no monthly maintenance fees or require a very low minimum balance to waive fees. Avoid accounts that will eat into your savings with unnecessary charges.

Ensure FDIC Insurance

Always verify that the bank is FDIC insured. This protects your money up to $250,000 per depositor, per insured bank, in the event of a bank failure.

Consider Accessibility and Features

While an emergency fund should be distinct from your checking account, ensure the HYSA offers easy transfers when you genuinely need the funds. Check for mobile app functionality, customer service availability, and any other features that align with your banking preferences.

Common Pitfalls to Avoid

One major mistake is dipping into your emergency fund for non-emergencies. This fund is strictly for unforeseen crises. Another pitfall is not starting soon enough; the sooner you begin, the more time compounding interest has to work in your favor. Lastly, don’t let inflation erode your savings; while HYSAs help, regularly review your fund’s size against your current living expenses to ensure it remains adequate.

Take Action Today

Building an emergency fund is a foundational step towards financial freedom and security. For men, taking proactive control of their financial future through smart savings strategies like high-yield accounts demonstrates responsibility and foresight. Start by calculating your target, setting up automated transfers, and choosing a HYSA that best fits your needs. The peace of mind that comes with a robust emergency fund is invaluable.