Don’t Let Limited Funds Stop Your Retirement Planning

It’s a common dilemma: you know you need to save for retirement, but your current budget feels stretched thin. The good news is that starting to invest for retirement with limited funds is not only possible but highly recommended. The most crucial factor isn’t how much you start with, but when you start. Even small, consistent contributions can grow significantly over decades, thanks to the magic of compounding.

The Power of Starting Small (and Early)

Many people delay investing because they feel they don’t have enough to make a difference. This couldn’t be further from the truth. Compound interest means your money earns returns, and those returns then earn their own returns. The longer your money is invested, the more time it has to grow exponentially. A small amount invested consistently over 30-40 years can easily outpace larger, later contributions.

Think of it this way: even contributing $50 a month from your early 20s can accumulate to hundreds of thousands of dollars by retirement, far more than starting with $200 a month in your late 30s. Time is your greatest asset when you have limited funds.

First Steps: Assess Your Financial Landscape

Before you even think about investment accounts, take a hard look at your current finances. Create a detailed budget to understand exactly where your money is going. This isn’t about deprivation, but about awareness and finding opportunities. Identify areas where you can trim expenses, even if it’s just $10 or $20 a week. Could you pack lunch more often, cut down on subscription services, or reduce impulse buys?

Every dollar saved and redirected towards retirement is a dollar working for your future. Look for ‘found money’ – bonuses, tax refunds, or even a raise. Instead of spending it, commit a portion of it directly to your retirement fund.

Choose the Right Investment Vehicle

When you have limited funds, choosing the right type of account is crucial. Here are the most common and beneficial options:

- 401(k) or 403(b) (Employer-Sponsored Plans): If your employer offers a retirement plan, especially one with a matching contribution, this should be your absolute top priority. An employer match is free money – essentially a 100% immediate return on your investment. Contribute at least enough to get the full match. These contributions are often pre-tax, reducing your taxable income now.

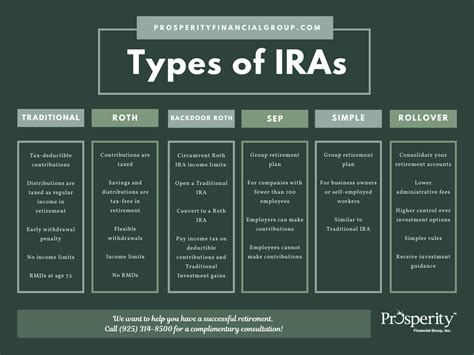

- Individual Retirement Accounts (IRAs): If you don’t have an employer plan, or if you’ve maxed out your employer match, an IRA is your next best bet. You can open one at almost any brokerage firm.

- Roth IRA: Contributions are made with after-tax money, meaning your qualified withdrawals in retirement are completely tax-free. This is often ideal for those who expect to be in a higher tax bracket in retirement than they are now, which is common for young professionals starting out.

- Traditional IRA: Contributions might be tax-deductible now (depending on your income and whether you have an employer plan), but withdrawals in retirement are taxed. This might be better if you expect to be in a lower tax bracket in retirement.

Even small contributions, like the maximum allowable for an IRA (currently $6,500 for 2023, increasing to $7,000 for 2024), can be broken down into monthly or bi-weekly amounts, making them more manageable.

Keep It Simple: Low-Cost Investment Options

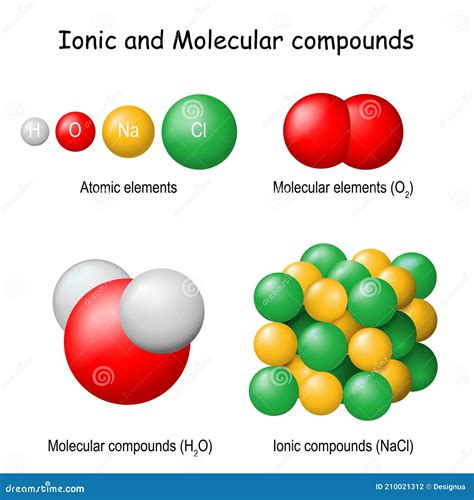

Once you’ve chosen your account, you need to decide what to invest in. With limited funds, simplicity and low costs are key:

- Target-Date Funds: These are available in most 401(k)s and IRAs. You simply choose the fund closest to your projected retirement year (e.g., a 2060 fund), and it automatically adjusts its asset allocation (stocks to bonds) as you get closer to retirement. They are diversified and professionally managed.

- Broad Market Index Funds or ETFs: These are excellent low-cost options. An S&P 500 index fund, for example, gives you exposure to the 500 largest U.S. companies. You get instant diversification without having to pick individual stocks. Exchange-Traded Funds (ETFs) are similar and can be bought and sold like stocks. They typically have very low expense ratios, meaning more of your money stays invested.

Avoid trying to pick individual stocks, especially when you’re just starting and have limited capital. The goal is broad market exposure and steady growth, not speculative gains.

Automate, Increase, and Be Consistent

The easiest way to ensure you stick to your investing plan is to automate it. Set up automatic transfers from your checking account to your IRA, or adjust your 401(k) contributions to come directly from your paycheck. This ‘set it and forget it’ approach removes the temptation to spend the money before it’s invested.

Commit to increasing your contributions whenever possible. Got a raise? Increase your contribution by at least a percentage point or two. Paid off a debt? Redirect that payment to your retirement. The more you can increase your contributions over time, the faster your nest egg will grow.

Don’t Let Perfection Be the Enemy of Good

Starting to invest for retirement with limited funds isn’t about finding the perfect strategy or having thousands of dollars ready to go. It’s about taking that first step, no matter how small, and staying consistent. Focus on maximizing any employer match, choosing low-cost, diversified funds, and automating your contributions. Your future self will thank you for starting today.