Why Financial Fitness Matters for Men

In today’s fast-paced world, financial stability is a cornerstone of a fulfilling life. For men, taking control of personal finances isn’t just about accumulating wealth; it’s about securing peace of mind, providing for loved ones, and building a foundation for future aspirations. Whether you’re just starting your career, managing a family, or planning for retirement, understanding how to budget effectively, save strategically, and eliminate debt is paramount. This guide will walk you through actionable steps to achieve financial fitness, tailored to help men take decisive action.

Step 1: Understand Your Current Financial Landscape

Before you can chart a course to financial freedom, you need to know exactly where you stand. This involves a thorough assessment of your income and expenses. Gather all your financial statements: bank accounts, credit card statements, loan documents, and pay stubs. The goal here is clarity, not judgment.

Identify All Income Sources

List every source of money coming in, including your primary salary, freelance work, side hustles, rental income, or any other regular contributions. Be comprehensive to get an accurate total.

Track Every Penny Spent

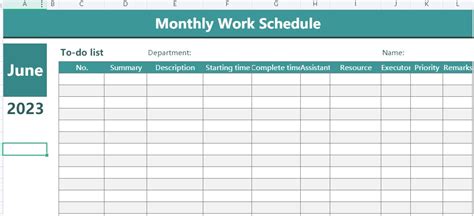

This is often the most revealing step. For at least a month, meticulously track where your money goes. Use a budgeting app, a spreadsheet, or even a simple notebook. Categorize expenses into fixed (rent/mortgage, loan payments, insurance) and variable (groceries, dining out, entertainment, fuel). Many men are surprised to see how much seemingly small, daily purchases add up.

Step 2: Crafting Your Budget Blueprint

With a clear picture of your income and expenses, you’re ready to build a budget that works for you. A budget isn’t about restriction; it’s about allocating your resources purposefully to meet your goals.

Choose a Budgeting Method

There are several popular methods: the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt), zero-based budgeting (every dollar has a job), or envelope budgeting. Pick one that resonates with your style and commitment level.

Set Realistic Categories and Limits

Based on your spending tracker, assign realistic limits to each expense category. Be honest with yourself. If you spend $400 on groceries, don’t budget $200 unless you have a concrete plan to reduce it. The key is sustainability.

Automate Where Possible

Set up automatic transfers from your checking account to your savings account, investment accounts, and debt payments. Automation reduces the temptation to spend and ensures consistency.

Step 3: Supercharging Your Savings

Once your budget is in place, the next step is to optimize your savings. Savings provide a safety net for emergencies, fund future goals, and open doors to financial independence.

Build an Emergency Fund

Prioritize saving 3-6 months’ worth of living expenses in an easily accessible, high-yield savings account. This fund protects you from unexpected job loss, medical emergencies, or large repairs.

Define Short-Term and Long-Term Goals

What are you saving for? A new car? A down payment on a house? Your children’s education? Retirement? Assign specific savings goals to each, along with a target amount and timeline. This makes saving feel purposeful.

Look for Opportunities to Cut Costs

Review your variable expenses regularly. Can you cook more at home? Negotiate insurance rates? Cancel unused subscriptions? Every dollar saved is a dollar that can be put towards your goals.

Step 4: Crushing Debt Strategically

Debt can be a significant drag on financial progress. Developing a clear plan to eliminate it is crucial for long-term financial fitness.

List All Your Debts

Compile a list of all your debts: credit cards, student loans, car loans, personal loans. Include the outstanding balance, interest rate, and minimum monthly payment for each.

Choose a Debt Repayment Strategy

Two popular methods are the Debt Snowball and the Debt Avalanche. The Debt Snowball focuses on psychological wins: pay off the smallest debt first, then roll that payment into the next smallest. The Debt Avalanche focuses on saving money: pay off the debt with the highest interest rate first, then move to the next highest. Choose the method that motivates you most.

Negotiate Lower Interest Rates

Don’t be afraid to call your credit card companies or loan providers to ask for a lower interest rate. A small reduction can save you a significant amount of money and accelerate your repayment.

Avoid New Debt

While you’re working to pay down existing debt, commit to not taking on new debt. This may require lifestyle adjustments, but it’s essential for breaking the cycle.

Sustaining Your Financial Fitness Journey

Creating a budget and implementing saving and debt repayment strategies are significant first steps, but financial fitness is an ongoing journey. Regularly review your budget, adjust it as your income or expenses change, and celebrate your milestones. Educate yourself continuously about personal finance, consider investing, and seek professional advice when needed. By taking a proactive and disciplined approach, men can build a robust financial future, ensuring security and the freedom to pursue their deepest aspirations.