Taking Control: Why Financial Acumen Matters for Men Today

In today’s dynamic economic landscape, financial literacy and proactive planning are more critical than ever, especially for men navigating career, family, and future aspirations. This guide will equip you with actionable strategies to not only tackle existing debt head-on but also to cultivate smart investment habits that lay the groundwork for long-term wealth and financial security. It’s about taking the reins of your financial destiny, starting now.

Step 1: Conquer Your Debt – A Blueprint for Freedom

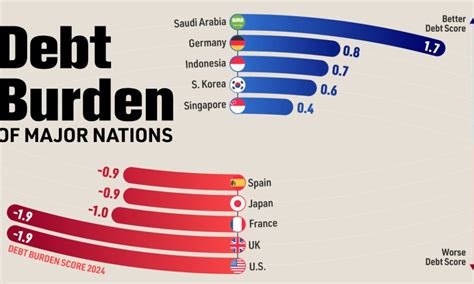

Debt can feel like a heavy burden, but with a strategic approach, it’s entirely manageable. The first step is to gain absolute clarity on your current debt situation.

Assess and Prioritize Your Debts

- List Everything: Document all your debts – credit cards, student loans, car loans, mortgages, personal loans. Include the outstanding balance, interest rate, and minimum monthly payment for each.

- Understand the Impact: High-interest debts, like credit card balances, are often the most damaging to your financial progress. Prioritizing these can save you significant money over time.

Choose Your Attack Strategy

Two popular methods for debt repayment are the Debt Snowball and Debt Avalanche methods:

- Debt Avalanche: Focus on paying off debts with the highest interest rates first, while making minimum payments on others. This method saves you the most money in interest over time.

- Debt Snowball: Pay off the smallest debt first to gain psychological momentum, then roll that payment into the next smallest debt. This method is great for motivation, even if it might cost slightly more in interest.

Optimize Your Budget and Cut Expenses

A robust budget is your most powerful tool against debt. Track where every dollar goes and identify areas where you can reduce spending. Consider temporary sacrifices – subscriptions, dining out, non-essential purchases – to free up more cash for debt repayment. Additionally, explore options for debt consolidation or refinancing higher-interest loans into a single, lower-interest payment.

Step 2: Invest Smartly – Building Wealth for Tomorrow

Once you have a clear plan for debt, or even while managing it, it’s crucial to begin building your investment portfolio. Smart investing isn’t about getting rich quick; it’s about consistent, disciplined growth over time.

Define Your Financial Goals

Before investing, know what you’re investing for. Are you saving for a down payment, retirement, your children’s education, or financial independence? Your goals will dictate your investment horizon and risk tolerance.

Establish Your Financial Foundation

- Emergency Fund First: Before investing aggressively, ensure you have 3-6 months’ worth of living expenses saved in an easily accessible, high-yield savings account. This fund acts as a buffer against unexpected life events.

- Understand Your Risk Tolerance: How comfortable are you with the potential for your investments to fluctuate in value? Your age, income stability, and financial goals all play a role in determining an appropriate risk level.

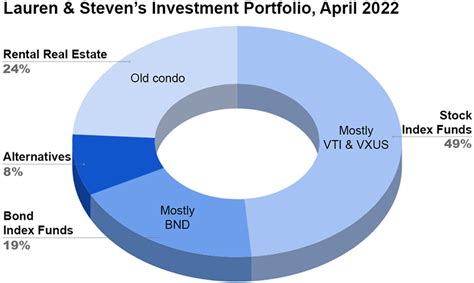

Diversify Your Portfolio

Diversification is key to mitigating risk. Don’t put all your eggs in one basket. A well-diversified portfolio might include:

- Stocks: Ownership in companies, offering potential for high growth but also higher volatility. Consider index funds or ETFs for broad market exposure.

- Bonds: Loans to governments or corporations, generally less volatile than stocks and provide regular interest payments.

- Real Estate: Can offer stable returns and appreciation, either directly or through Real Estate Investment Trusts (REITs).

- Other Assets: Depending on your risk profile, you might explore commodities, cryptocurrency (with caution), or alternative investments.

Utilize Retirement Accounts

Maximize tax-advantaged accounts like your employer’s 401(k) (especially if there’s a company match – free money!), Traditional IRAs, and Roth IRAs. These accounts offer significant tax benefits that can accelerate your wealth accumulation.

Continuous Learning and Patience

The world of finance is always evolving. Stay informed, read reputable financial news, and consider consulting a fee-only financial advisor for personalized guidance. Remember that investing is a marathon, not a sprint. Market fluctuations are normal; patience and consistency are your greatest allies.

Your Path to Financial Empowerment

Tackling debt and investing smartly are two sides of the same coin when it comes to building a robust financial future. By taking deliberate steps – assessing your situation, making a plan, and consistently executing it – you empower yourself to achieve financial freedom and secure the life you envision. Start today, and watch your financial landscape transform.