Achieving sustained success in both physical fitness and financial stability often feels like an uphill battle against the daily grind. Both domains demand consistent effort, delayed gratification, and an unwavering commitment over the long haul. But what specific mindset ingredients allow some individuals to consistently show up, save, invest, and exercise, while others falter?

The Undeniable Parallels: Fitness Meets Finance

At first glance, working out and managing money might seem like disparate endeavors. However, they share fundamental psychological requirements. Both are long-term games with compounding effects. A missed workout today won’t ruin your physique, just as one splurge won’t bankrupt you. But consistent neglect in either area leads to detrimental outcomes, while consistent, small positive actions accumulate into significant gains over time.

The core challenge lies in overcoming the human tendency towards instant gratification. Our brains are wired to prefer immediate rewards, making it difficult to choose a future benefit (health, wealth) over a present pleasure (dessert, impulse purchase). Sustaining consistency, therefore, requires a deliberate shift in perspective.

Pillars of a Sustaining Mindset

1. Long-Term Vision and Purpose

The most crucial element is understanding your “why.” Why do you want to be fit? Why do you want financial security? Connecting your daily actions to a deeper, meaningful purpose provides the intrinsic motivation needed when external motivation wanes. A clear vision of your future self—healthy, financially free—acts as a powerful magnet, pulling you through difficult days.

2. Discipline Through Habit Formation

Willpower is finite; habits are automatic. The sustained achievers in fitness and finance don’t rely solely on motivation; they build robust systems and routines. They turn beneficial actions into non-negotiable rituals. This involves starting small, making incremental changes, and gradually stacking habits until they become second nature. Daily meditation, a morning run, reviewing your budget, or automating savings are examples of habits that remove decision fatigue and streamline consistency.

3. Resilience and Adaptability

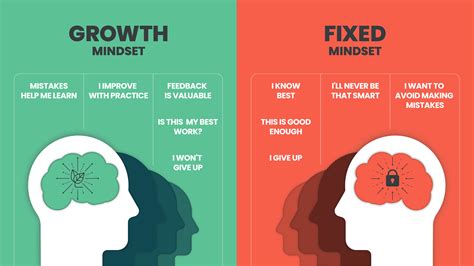

Life happens. There will be missed workouts, unexpected expenses, and moments of weakness. The sustaining mindset doesn’t aim for perfection but for persistence. It understands that setbacks are inevitable and sees them as data points, not failures. The key is to quickly recover, learn from the deviation, and get back on track without self-recrimination. Flexibility in approach, rather than rigid adherence, ensures long-term commitment.

4. Self-Compassion and Patience

Progress is rarely linear. There will be plateaus, slow periods, and even regressions. A critical mindset can lead to burnout and giving up. Cultivating self-compassion—treating yourself with the same kindness you’d offer a friend—allows for grace during challenging times. Patience reminds us that meaningful results take time and consistent effort, not sporadic intensity. Celebrate small wins to reinforce positive behavior.

5. Continuous Learning and Adjustment

The world of fitness and finance is dynamic. New information, changing personal circumstances, or evolving goals require a willingness to learn, adapt, and refine your strategies. Sticking rigidly to an outdated plan can be as detrimental as having no plan at all. Regularly reviewing your progress, seeking knowledge, and being open to expert advice ensures your efforts remain effective and relevant.

Translating Mindset into Action

An effective mindset isn’t just theoretical; it translates into practical steps. This includes setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals for both your physical activity and financial milestones. It involves meticulously tracking your progress—whether it’s logging workouts, monitoring your diet, or diligently tracking expenses and investments. This data provides objective feedback, reinforces positive behavior, and highlights areas needing adjustment.

Furthermore, surrounding yourself with a supportive community or accountability partners can significantly bolster your resolve. Sharing goals and celebrating successes with others creates a positive feedback loop that strengthens your commitment to the daily grind.

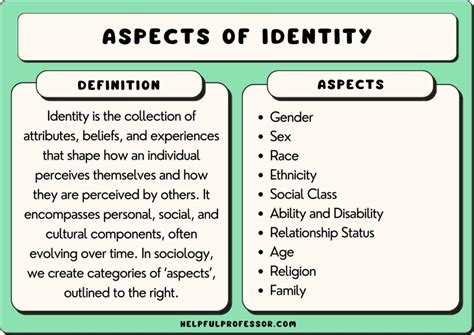

The Power of Identity

Ultimately, sustaining consistency often boils down to identity. It’s not just about what you do, but who you are. If you identify as “a fit person” or “a financially responsible individual,” your actions naturally align with that self-perception. This deep-seated belief system makes the difficult choices easier and reinforces the positive cycle of consistency. You don’t just go to the gym; you are someone who works out. You don’t just save money; you are a saver.

Conclusion

The daily grind in fitness and finance isn’t about Herculean efforts but about the relentless accumulation of small, intentional choices. The mindset that sustains this consistency is built on a bedrock of long-term vision, disciplined habit formation, resilient adaptability, compassionate patience, and a commitment to continuous improvement. By cultivating these mental attributes, you transform the daunting “grind” into a powerful, compounding journey towards lasting health and wealth.