The Intertwined Path of Fitness and Finance

In our pursuit of a fulfilling life, two domains consistently challenge our resolve: personal fitness and financial stability. Both demand consistent effort, delayed gratification, and a steadfast commitment to long-term goals. Yet, both are also fertile grounds for procrastination, where immediate comfort often triumphs over future well-being. Understanding the psychological parallels between managing your physical health and your financial wealth is the first step toward mastering both.

Why Discipline is the Cornerstone

Discipline isn’t about harsh self-punishment; it’s about making conscious choices that align with your deepest values and aspirations, even when you don’t feel like it. In fitness, this means showing up for your workout when motivation wanes, or choosing a healthy meal over convenience. In finance, it translates to sticking to a budget, consistently saving, or making wise investment decisions rather than impulse purchases.

The core challenge in both realms is overcoming the allure of instant gratification. A skipped workout feels good now, but hinders long-term health. An unnecessary splurge provides momentary pleasure, but erodes financial security. Cultivating discipline involves training your mind to prioritize the long-term rewards over fleeting comforts.

Practical Strategies for Building Discipline

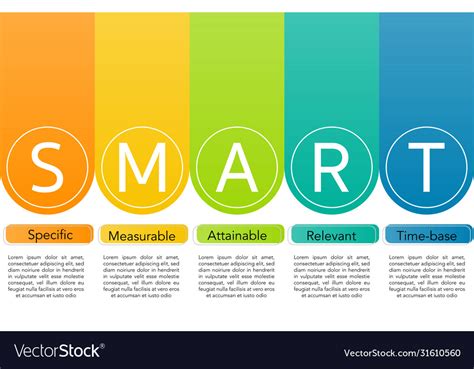

Set Clear, Achievable Goals

Vague aspirations lead to vague actions. Define specific, measurable, achievable, relevant, and time-bound (SMART) goals for both your fitness journey and financial plan. Instead of “get fit,” aim for “run a 5k in 12 weeks.” Instead of “save money,” aim for “save $500 for an emergency fund by the end of the quarter.”

Start Small and Build Momentum

Overwhelm is a prime catalyst for procrastination. Break down your larger goals into tiny, manageable actions. Can you commit to 10 minutes of exercise daily? Can you automate a $25 weekly transfer to your savings account? Small wins build confidence and establish a foundation for larger habits.

Establish Non-Negotiable Routines

Consistency is key. Schedule your workouts and financial check-ins as if they were important appointments. The more you repeat a positive action at a set time, the more it becomes an automatic behavior, reducing the mental effort required to start.

Conquering Procrastination in Both Spheres

Procrastination often stems from fear of failure, perfectionism, or simply not knowing where to start. Here’s how to tackle it head-on:

The 5-Minute Rule

Tell yourself you only have to do the task for five minutes. Often, the hardest part is simply starting. Once you’re engaged, you’ll frequently find yourself continuing for much longer. This works for putting on your running shoes for a quick walk or opening your budgeting app for a brief review.

Identify Your Triggers and Create Barriers

What causes you to procrastinate? Is it endless scrolling on your phone instead of working out? Is it impulse buying when browsing online stores? Identify these triggers and put obstacles in their way. Delete shopping apps, place your gym clothes out the night before, or use website blockers during productive hours.

Break Down Overwhelming Tasks

A large task like “create a retirement plan” can feel insurmountable. Break it into smaller, less daunting steps: “research Roth IRAs,” “calculate current expenses,” “set up an initial consultation.” Similarly, “get in shape” can become “research beginner workouts,” “buy proper shoes,” “go for a 20-minute walk.”

Mindset Shifts for Enduring Success

Embrace Discomfort as Growth

Discipline often requires choosing the harder path in the moment. Instead of viewing discomfort as a negative, reframe it as a signal of growth. That burning sensation during a workout or the slight sacrifice in spending are signs you’re building resilience and moving towards your goals.

Practice Self-Compassion, Not Perfection

You will have off days. You might skip a workout or overspend occasionally. The key is not to let a single setback derail your entire journey. Acknowledge the slip, learn from it, and get back on track without judgment. Self-compassion fosters resilience, while self-criticism often leads to giving up.

Focus on Progress, Not Just Outcomes

Celebrate small victories. Acknowledge the discipline it took to complete a tough workout, or the consistency of saving a small amount each week. Focusing on the progress you’re making reinforces positive habits and keeps motivation high, regardless of the ultimate outcome which may take time to materialize.

The Journey of Self-Mastery

Cultivating discipline and beating procrastination in fitness and finance are not destinations, but ongoing journeys of self-mastery. By applying similar principles of clear goal setting, consistent small actions, and a resilient mindset, you can build powerful habits that transform both your physical health and your financial well-being. Start today, one disciplined choice at a time, and watch as these two critical areas of your life flourish.