Credit card debt can feel like a heavy burden, often leading to stress and uncertainty about the best way forward. With high-interest rates making it challenging to make significant progress, many individuals seek effective strategies to pay off what they owe. Fortunately, two prominent methods stand out as tried-and-true approaches for tackling credit card debt: the debt snowball and the debt avalanche. Both offer structured plans, but they cater to different psychological and financial priorities.

Understanding the Debt Snowball Method

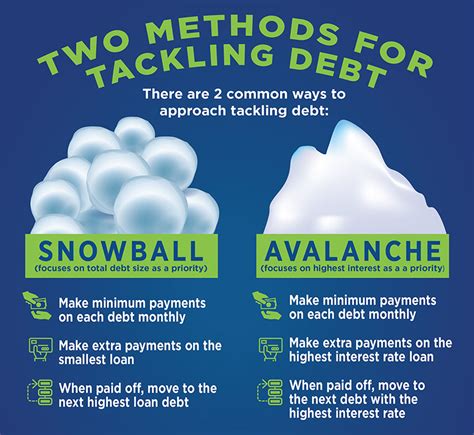

The debt snowball method, popularized by financial guru Dave Ramsey, focuses on psychological wins. The core principle is simple: list all your debts from the smallest balance to the largest, regardless of the interest rate. You make minimum payments on all debts except for the one with the smallest balance. On that smallest debt, you throw every extra dollar you can find. Once the smallest debt is paid off, you take the money you were paying on it and add it to the minimum payment of the next smallest debt. This creates a “snowball” effect, where the amount you’re paying towards the principal grows with each debt eliminated.

Proponents of the snowball method highlight its powerful motivational aspect. Rapidly eliminating smaller debts provides quick wins, which can be crucial for maintaining momentum and sticking to your repayment plan. This psychological boost can be particularly effective for those who feel overwhelmed or easily discouraged by their debt.

The Debt Avalanche Method: Maximizing Savings

In contrast, the debt avalanche method is a purely mathematical approach designed to save you the most money on interest. With this strategy, you list your debts from the highest interest rate to the lowest, regardless of the balance. Like the snowball method, you make minimum payments on all debts except for the one with the highest interest rate. All extra funds are directed towards paying down that high-interest debt first. Once it’s gone, you move on to the debt with the next highest interest rate, rolling the previous payment amount into the new one.

The primary advantage of the debt avalanche method is its financial efficiency. By targeting the most expensive debts first, you reduce the total amount of interest paid over the life of your debt, potentially saving you hundreds or even thousands of dollars. This method is often recommended by financial advisors for its sound economic rationale.

Which Method is Right for You?

The choice between the debt snowball and debt avalanche methods largely depends on your personality and financial situation. If you need quick wins and motivation to stay on track, the debt snowball might be more effective. The feeling of seeing debts disappear can be incredibly empowering and keep you committed to your goal.

However, if you’re disciplined and motivated by financial optimization, the debt avalanche will likely be your best bet. It requires a bit more patience as you tackle potentially larger, high-interest debts first, but the long-term savings are undeniable. It’s a rational, numbers-driven approach for those who can stick with it.

Consider your debt load as well. If you have many small debts that are psychologically overwhelming, the snowball can clear them quickly. If you have a few large debts with vastly different interest rates, the avalanche will be more impactful financially.

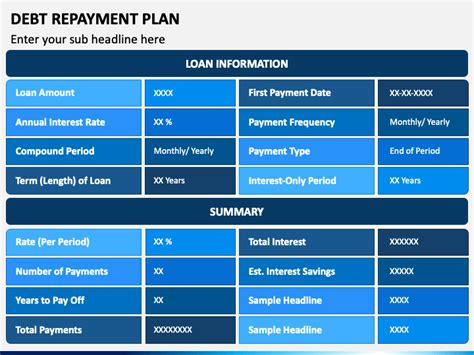

Making Your Decision and Taking Action

Ultimately, the “best” method is the one you will actually stick with. Both the debt snowball and debt avalanche methods provide a structured framework to eliminate credit card debt. The most important step is to choose a method, commit to it, and start making consistent payments beyond the minimums. Whichever path you choose, staying organized, tracking your progress, and celebrating milestones will be key to achieving debt freedom and improving your financial well-being.

You might even consider a hybrid approach, using the snowball to clear one or two very small, annoying debts quickly, then switching to an avalanche for the remaining larger, high-interest ones. The goal is the same: to become debt-free.