Navigating Credit Card Debt: Avalanche vs. Snowball for Speed

When faced with the daunting challenge of credit card debt, many individuals search for the fastest and most efficient way to become debt-free. Two popular and highly debated strategies consistently rise to the top: the debt avalanche and the debt snowball. Both aim to help you eliminate what you owe, but they approach the problem from fundamentally different angles, leading to varying outcomes in terms of speed, money saved, and psychological impact. Understanding these differences is crucial for choosing the method that best suits your financial situation and personality.

The Debt Avalanche: A Mathematically Optimized Approach

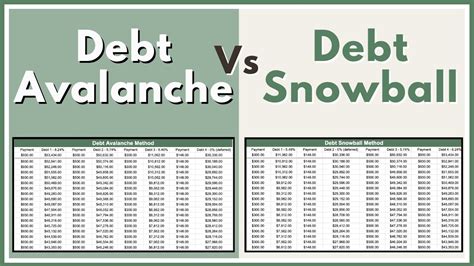

The debt avalanche method prioritizes efficiency and financial savings. With this strategy, you list all your debts from the highest interest rate to the lowest, regardless of the balance. You make minimum payments on all debts except for the one with the highest interest rate, on which you pay as much extra as possible. Once that debt is paid off, you take the money you were paying on it and add it to the payment of the next debt on your list (the one with the second-highest interest rate). This continues until all debts are clear.

- Pros: This method statistically saves you the most money in interest and often leads to the quickest overall repayment time because you are attacking the most expensive debts first.

- Cons: Psychological wins can be slow to materialize, as high-interest debts often have large balances, taking longer to pay off. This can be demotivating for some individuals who need more immediate gratification.

The Debt Snowball: Building Momentum Through Quick Wins

In contrast, the debt snowball method focuses on building momentum and psychological wins. Here, you list your debts from the smallest balance to the largest, regardless of the interest rate. Similar to the avalanche, you make minimum payments on all debts except for the one with the smallest balance, on which you pay as much extra as you can. Once the smallest debt is paid off, you take the money you were paying on it and “snowball” it into the payment of the next smallest debt. This continues, gaining momentum as each debt is cleared, until you are debt-free.

- Pros: The quick wins from paying off smaller debts rapidly provide significant psychological motivation, helping individuals stay committed to their plan. This consistent feeling of progress can be a powerful driver.

- Cons: Because it doesn’t prioritize interest rates, you will likely pay more in total interest over time compared to the avalanche method, potentially making the overall repayment cost higher and the mathematically calculated repayment time longer.

Which Method is Truly Faster for You?

When it comes to pure speed and financial efficiency, the debt avalanche typically wins. By tackling the highest interest rates first, you reduce the total amount of interest accruing, which inherently shortens the repayment period and saves you money. However, “speed” isn’t just about the mathematical calculation; it’s also about sustained effort. If the psychological boost of the debt snowball keeps you motivated and consistent where the avalanche might lead to burnout, then the snowball could paradoxically be the faster method for you in practice. The “fastest” method is ultimately the one you stick with.

Choosing Your Optimal Path: Personality Matters

Deciding between the avalanche and snowball methods depends largely on your personality, financial discipline, and how you react to financial challenges.

- Choose Avalanche if: You are highly disciplined, motivated by logical efficiency, comfortable with delayed gratification, and your primary goal is to save the most money possible on interest payments.

- Choose Snowball if: You need immediate psychological wins to stay motivated, tend to get discouraged easily without tangible progress, or struggle with maintaining long-term financial plans without consistent validation.

Conclusion: The Best Strategy is One You Stick With

Both the debt avalanche and debt snowball are powerful and proven tools for getting out of credit card debt. While the avalanche is mathematically superior for saving money and often for overall repayment time (assuming consistent application), the snowball offers a motivational edge that can be invaluable for many. The best strategy isn’t universally one or the other, but rather the one you can commit to and execute consistently until you are completely debt-free. Take an honest look at your financial personality and current situation, and choose the path that will keep you going until you reach your debt-free goal.