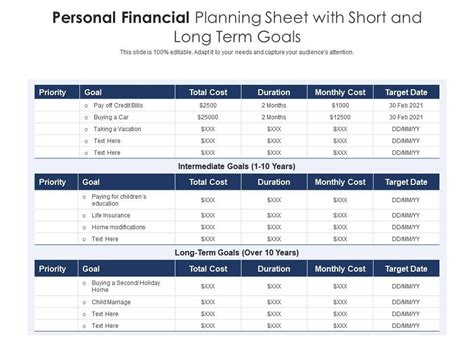

The Pursuit of Purpose-Driven Autonomy

While the aspiration for a comfortable retirement and owning a home remains foundational, a significant and often less discussed long-term financial goal for many men today is the accumulation of sufficient capital and passive income to achieve full financial autonomy. This autonomy isn’t merely about retiring early, but rather about gaining the freedom to pivot careers, launch a significant entrepreneurial venture, or dedicate themselves to a passion project without the immediate pressure of financial necessity. It’s about curating a life where work is a choice driven by purpose, impact, and personal fulfillment, rather than obligation.

This objective represents a profound shift from traditional career ladders. It involves meticulously building a financial fortress that provides the security to take calculated risks, invest time and resources into a nascent idea, or even embark on a journey of personal development that might not offer immediate financial returns. It’s a pursuit rooted in the desire for control, the drive to create something meaningful, and often, the ambition to leave a tangible legacy beyond accumulated wealth.

Strategic Financial Pillars for the Pivot

Achieving this level of financial liberation requires a multi-faceted approach far exceeding basic savings. Men actively working towards this goal typically focus on several key financial pillars:

- Aggressive Investment Portfolio Growth: Beyond standard 401(k)s, there’s often a concentrated effort on taxable brokerage accounts, real estate investments, or even direct stakes in private businesses, all aimed at generating substantial passive income or significant capital appreciation.

- Emergency Runway and Opportunity Fund: Maintaining a much larger emergency fund—often 1-3 years of living expenses—provides the cushion needed to transition away from a traditional salary without immediate financial strain. An additional ‘opportunity fund’ might be earmarked specifically for the startup costs of a future venture.

- Debt Minimization: A critical step is systematically eliminating high-interest debt and striving for a low debt-to-income ratio, ensuring financial commitments don’t tether them to jobs they wish to leave.

- Skill Acquisition and Network Building: While not strictly financial, investing in new skills (e.g., coding, digital marketing, project management) and building a robust professional network are considered invaluable investments that directly contribute to the viability of future ventures.

The Discipline of Delayed Gratification

This ambitious goal demands significant discipline and delayed gratification. It often means making different lifestyle choices than peers: driving older cars, living in more modest homes, or foregoing frequent extravagant vacations. Every dollar saved and invested is seen as a brick in the foundation of their future autonomy. Many men might engage in rigorous side hustles, freelance work, or develop passive income streams (like rental properties or digital products) while still employed, using these avenues to accelerate their capital accumulation.

It’s a long game, requiring meticulous budgeting, continuous learning about personal finance and investment strategies, and a steadfast commitment to a vision that may be years, or even decades, away. The psychological aspect is also crucial; it requires a strong belief in their future ability to execute a venture and the resilience to weather financial market fluctuations.

Beyond Personal Wealth: Creating Impact and Legacy

What differentiates this goal from simple early retirement is often its intrinsic link to impact and legacy. For many, the ultimate aim is not just personal comfort, but to leverage their accumulated freedom and resources to create something enduring. This could manifest as:

- Launching a social enterprise addressing community needs.

- Building a business that revolutionizes an industry.

- Mentoring the next generation of entrepreneurs.

- Funding and leading a non-profit organization aligned with deep personal values.

The financial goal, therefore, becomes a means to a greater end: the capacity to contribute meaningfully to the world on one’s own terms, to solve problems they care deeply about, and to leave a mark that extends beyond their lifetime. This offers a profound sense of purpose that traditional career paths often fail to satisfy.

The Evolving Definition of Success

This less common but increasingly significant financial goal reflects an evolving definition of success among men. It’s moving beyond the mere accumulation of wealth or climbing a corporate ladder, towards a more holistic vision that prioritizes autonomy, purpose, and the capacity to make a chosen impact. It’s a challenging path, demanding foresight, discipline, and often personal sacrifice, but for those actively pursuing it, the promise of self-directed work and a life of profound meaning serves as a powerful and compelling motivator.