We often dedicate significant time and energy to sculpting our physical bodies, hitting the gym, and adhering to strict diets. But what about our financial physique? Just as physical fitness requires a consistent regimen, building robust financial health and wealth demands a dedicated plan beyond mere earning. It’s about consciously building “financial muscle” that can withstand economic downturns and fuel long-term aspirations. The question isn’t just how much you earn, but how strategically you manage, save, and invest it.

The Core Principles of Financial Fitness

Think of budgeting as your financial workout plan. It’s the essential first step to understanding where your money goes and how to allocate it effectively. A well-crafted budget identifies areas for improvement, much like a fitness assessment points out weak spots. It empowers you to direct your earnings towards savings, investments, and debt reduction, rather than letting it dissipate without purpose.

Saving, then, becomes the process of building your financial reserves. This isn’t just about putting money aside; it’s about setting clear, attainable goals – whether it’s for a down payment, retirement, or an emergency fund. Consistency is paramount. Even small, regular contributions can compound over time into significant sums, providing a crucial safety net and a springboard for future growth.

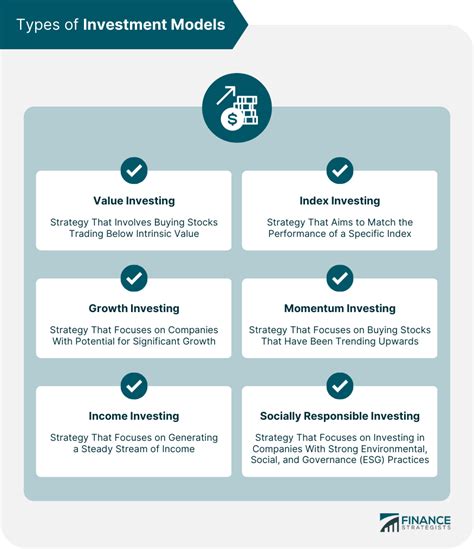

Strategic Investments: Your Growth Hormone

Once you’ve mastered budgeting and consistent saving, the next step is to make your money work harder for you through strategic investments. This is where your financial muscle truly begins to grow. Understanding the power of compounding – earning returns on your returns – is fundamental. Whether through stocks, bonds, real estate, or other vehicles, investing intelligently allows your wealth to grow exponentially over time, far outpacing inflation and simple savings accounts.

Diversification is key to managing risk, akin to cross-training in physical fitness. Spreading your investments across different asset classes and geographies reduces your exposure to any single downturn. A well-diversified portfolio is more resilient and better positioned for sustained growth, minimizing the impact of market volatility.

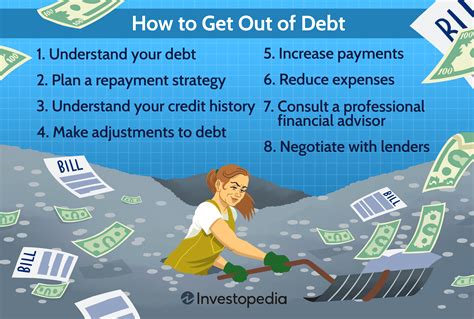

Debt Management: Shedding Financial Fat

Just as excess body fat can hinder physical performance, high-interest debt can severely impede your financial progress. Credit card debt, personal loans, and other forms of consumer debt act as a constant drain on your resources, diverting money that could otherwise be invested or saved. Developing a strategic plan to reduce and eliminate this “financial fat” is crucial for improving your overall financial health.

Prioritize paying down high-interest debts first. This often involves strategies like the debt snowball or debt avalanche methods, freeing up cash flow that can then be redirected towards wealth-building activities. Minimizing debt not only saves you money on interest payments but also significantly reduces financial stress, allowing you to focus on growth rather than constant repayment.

Protecting Your Gains: Financial Resilience

Building wealth isn’t just about accumulating assets; it’s also about protecting them. An emergency fund, typically 3-6 months’ worth of living expenses, is your first line of defense against unexpected financial setbacks, preventing you from derailing your long-term plans or going into debt. Similarly, adequate insurance – health, life, disability, and property – acts as a shield, safeguarding your assets and income against unforeseen events.

Beyond immediate protection, consider the long-term legacy you wish to build. Estate planning, while often overlooked, ensures that your wealth is distributed according to your wishes and minimizes potential tax burdens for your heirs. It’s the ultimate act of financial foresight, ensuring your financial muscle continues to benefit those you care about, even when you’re no longer around.

Consistency is Key: The Long Game

Just as a ripped physique isn’t built in a day, financial muscle and wealth are forged through consistent effort and discipline over time. Regularly reviewing your budget, tracking your investments, and adjusting your strategies as life circumstances change are all vital components of this ongoing process. Financial planning is not a one-time event; it’s a dynamic journey.

Don’t be afraid to seek professional guidance. A financial advisor can provide personalized strategies, help navigate complex investment landscapes, and keep you accountable to your goals. They can be your personal trainer for financial success, offering expert advice and motivation to help you stay on track for long-term wealth accumulation.

Moving beyond the gym, your financial well-being deserves the same dedication and strategic planning as your physical health. By adopting a disciplined approach to budgeting, saving, investing, debt management, and protection, you can build powerful financial muscle that ensures not just short-term stability, but lasting wealth and peace of mind. Start your financial workout plan today – your future self will thank you.