For many, a regular paycheck is the cornerstone of financial stability. But true financial freedom – the ability to build lasting wealth and secure a comfortable retirement – requires looking far beyond your monthly salary. It demands a strategic shift in mindset and proactive steps to make your money work harder for you.

The Mindset Shift: From Earner to Investor

The first step in building lasting wealth isn’t about how much you earn, but how you think about your money. Moving from a consumer mindset to an investor or owner mindset is crucial. Instead of just spending your income, consider how each dollar can be allocated to grow your assets. This involves prioritizing saving and investing over immediate gratification and understanding the power of compound interest.

Building Your Foundation: Budgeting and Savings

Before any significant investing can happen, a solid financial foundation is essential.

Mastering Your Budget

Understanding where your money goes is paramount. Create a detailed budget that tracks income and expenses. Identify areas where you can cut back, freeing up more funds for saving and investing. Tools and apps can make this process straightforward and insightful.

Prioritizing Emergency Savings

An emergency fund is your financial safety net. Aim to save at least three to six months’ worth of living expenses in an easily accessible, high-yield savings account. This fund prevents you from dipping into investments or incurring debt during unforeseen circumstances like job loss or medical emergencies.

Strategic Investing for Long-Term Growth

Investing is where your money truly starts to work for you. The key is to start early, invest consistently, and diversify.

Leveraging Retirement Accounts

Maximize contributions to tax-advantaged retirement accounts like 401(k)s, IRAs (Traditional or Roth), and HSAs. Employer matches on 401(k)s are essentially free money and should always be prioritized. These accounts offer significant tax benefits and encourage long-term growth.

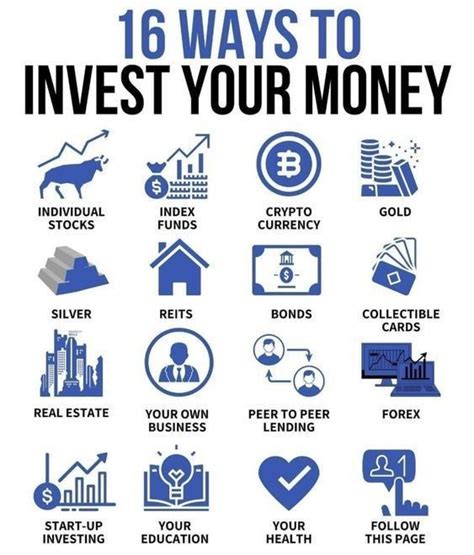

Diversifying Your Portfolio

Don’t put all your eggs in one basket. A diversified portfolio typically includes a mix of stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Consider investing in broad market index funds or target-date funds for a simpler, diversified approach. Real estate can also be a powerful wealth builder, whether through direct ownership or REITs.

Cultivating Multiple Income Streams

Relying solely on one salary can be risky. Exploring additional income sources accelerates wealth accumulation.

Side Hustles and Freelancing

Turn a hobby or skill into a side hustle. Whether it’s freelancing, consulting, teaching, or creating content, these additional income streams can supplement your savings and investment contributions.

Developing Passive Income

Passive income, which requires minimal ongoing effort once established, is the holy grail of financial freedom. Examples include rental properties, dividend stocks, royalties, or even creating and selling digital products. While it often requires an initial investment of time or capital, the long-term benefits are substantial.

Protecting Your Assets and Planning for the Future

Building wealth is one thing; protecting it is another.

Adequate Insurance Coverage

Ensure you have proper insurance: health, life, disability, home, and auto. These are crucial safeguards against events that could otherwise derail your financial progress.

Estate Planning

While often overlooked, estate planning ensures your assets are distributed according to your wishes and minimizes taxes for your heirs. This includes creating a will, establishing trusts, and designating beneficiaries.

Conclusion: Your Journey to Financial Security

Building lasting wealth and securing your retirement future is not a sprint, but a marathon. It demands discipline, strategic decision-making, and a long-term perspective. By shifting your mindset, establishing a strong financial foundation, investing wisely, diversifying your income, and protecting your assets, you can move beyond the confines of a salary and forge a path towards true financial independence and a comfortable retirement. Start today, stay consistent, and watch your financial future flourish.