Diversifying Beyond Traditional Retirement Accounts

For many men, the 401k is the cornerstone of their retirement planning, and rightly so. Employer-sponsored plans offer tax advantages and often a valuable employer match, making them an indispensable tool for long-term savings. However, true wealth building often requires looking beyond the confines of a single retirement account. To achieve financial independence, build a legacy, or simply enjoy greater financial flexibility, it’s crucial to diversify your investment portfolio.

Expanding your investment horizons allows for greater control, potential for higher returns, and access to different asset classes. Here are three actionable investment vehicles that men can utilize to build substantial wealth, complementing their existing 401k contributions.

1. Real Estate Investment

Real estate has historically been a powerful wealth-building tool, offering both appreciation and potential rental income. While it requires more hands-on management or careful selection, the benefits can be significant.

Actionable Steps:

- Rental Properties: Purchase residential or commercial properties to rent out. This provides a steady stream of income (cash flow) and can appreciate in value over time. Leveraging a mortgage allows you to control a valuable asset with a smaller upfront capital outlay.

- Real Estate Investment Trusts (REITs): For those who prefer a more passive approach, REITs allow you to invest in portfolios of income-producing real estate without directly owning or managing properties. They trade like stocks on major exchanges, offering liquidity and diversification.

- Real Estate Crowdfunding: Platforms like Fundrise or CrowdStreet allow you to invest in specific real estate projects with smaller amounts of capital, often targeting commercial or multi-family developments. This can offer higher potential returns but comes with less liquidity.

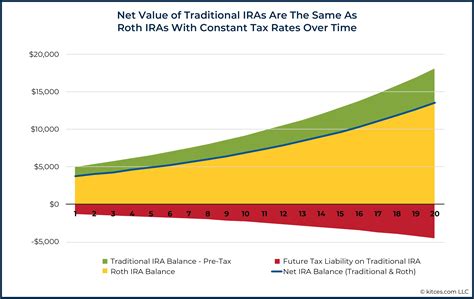

2. Individual Retirement Accounts (IRAs) – Roth or Traditional

While often seen as a retirement vehicle, IRAs offer crucial flexibility and control that can significantly enhance wealth building beyond a 401k, especially a Roth IRA. These accounts allow you to invest in a wide range of assets, from stocks and bonds to ETFs and mutual funds.

Actionable Steps:

- Max Out Contributions: Contribute the maximum allowed annually to your chosen IRA. For many, a Roth IRA is particularly attractive for its tax-free withdrawals in retirement, provided certain conditions are met. This means your growth is entirely yours.

- Strategic Fund Selection: Utilize the broader investment options in an IRA to invest in low-cost index funds, ETFs, or individual stocks that align with your risk tolerance and long-term goals. This can allow for more aggressive growth strategies than might be available in a typical 401k.

- Backdoor Roth (if applicable): If your income exceeds the Roth IRA contribution limits, explore the ‘backdoor Roth’ strategy, which involves contributing to a non-deductible Traditional IRA and then converting it to a Roth IRA. Consult a financial advisor for the nuances.

3. Taxable Brokerage Accounts for Long-Term Growth

Once you’ve maximized your tax-advantaged accounts (401k, IRA, HSA), a standard taxable brokerage account becomes the ultimate tool for additional wealth accumulation with no contribution limits. Money in these accounts is accessible at any time (though withdrawals are taxed), providing liquidity and flexibility that retirement accounts typically lack.

Actionable Steps:

- Invest in Diversified ETFs or Index Funds: Focus on low-cost, broadly diversified exchange-traded funds (ETFs) or index funds that track major markets (e.g., S&P 500, total market funds). This provides broad market exposure and consistent growth potential without the need for individual stock picking.

- Strategic Individual Stock Picking (if skilled): For those with a deep understanding of market analysis and a high tolerance for risk, a portion of this account can be dedicated to individual stocks. However, this requires significant research and conviction.

- Long-Term Holding for Tax Efficiency: Hold investments for more than a year to qualify for lower long-term capital gains tax rates. Avoid frequent trading, which generates short-term capital gains taxed at ordinary income rates.

Conclusion: Build Beyond the Basics

While the 401k is a non-negotiable component of a solid financial plan, truly accelerating wealth building for men involves looking beyond it. Real estate, Individual Retirement Accounts (especially Roth IRAs), and taxable brokerage accounts offer distinct advantages and opportunities to diversify, grow capital, and achieve financial goals beyond traditional retirement. By strategically utilizing these three actionable vehicles, you can build a robust financial future that offers both security and significant growth potential.