For many men, taking control of personal finances – specifically crushing debt and building a strong credit score – is a crucial step towards long-term security, achieving life goals, and reducing stress. While the principles of money management are universal, the motivation and approach can often be framed in ways that resonate strongly with men’s aspirations for independence, responsibility, and providing. This article will lay out a robust roadmap to help you tackle debt head-on and elevate your credit profile.

Understand Your Financial Battlefield

Before you can conquer debt, you need to know exactly what you’re up against. This means a clear and honest assessment of your income, expenses, and all outstanding debts. Create a detailed budget that tracks every dollar coming in and going out. Use spreadsheets, budgeting apps, or even pen and paper – whatever works best for you to see the full picture.

- List All Debts: Document every credit card, loan (student, auto, personal), and mortgage. Note the outstanding balance, interest rate, and minimum monthly payment for each.

- Track Spending: For at least a month, meticulously track where your money is going. You might be surprised by how much is spent on non-essentials.

- Identify Your ‘Why’: What is your motivation? Is it a new home, a secure retirement, peace of mind, or providing better for your family? Having a strong ‘why’ fuels your discipline.

Aggressive Debt Reduction Strategies

Once you have a clear picture, it’s time to choose your weapon for debt elimination. Two popular and effective methods are the Debt Snowball and Debt Avalanche.

The Debt Snowball Method

This method focuses on psychological wins. You list your debts from smallest balance to largest. Pay only the minimum on all debts except the smallest one, which you attack with extra payments. Once the smallest debt is paid off, you take the money you were paying on it and add it to the payment for the next smallest debt. This builds momentum and keeps you motivated.

The Debt Avalanche Method

This method focuses on saving money on interest. You list your debts from highest interest rate to lowest. Pay only the minimum on all debts except the one with the highest interest rate, which you attack with extra payments. Once it’s paid off, you roll that payment into the next highest interest rate debt. This is mathematically more efficient but might take longer to see the first debt completely eliminated.

Whichever method you choose, the key is consistency and dedicating extra funds to paying down principal.

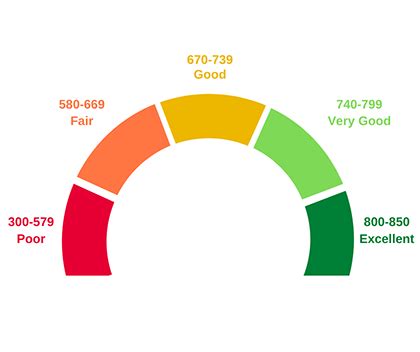

Supercharge Your Credit Score

While paying off debt significantly helps your credit score, there are other direct actions you can take to boost it. A strong credit score opens doors to better loan rates, lower insurance premiums, and even easier rental applications.

- Payment History (35% of score): This is the most critical factor. Pay all your bills on time, every time. Set up automatic payments to avoid missing due dates.

- Credit Utilization (30% of score): This refers to how much of your available credit you’re using. Keep your credit utilization ratio below 30%, ideally even lower (10% is excellent). For example, if you have a $10,000 credit limit, try to keep your balance below $3,000.

- Length of Credit History (15% of score): The longer your accounts have been open and in good standing, the better. Avoid closing old credit accounts unless absolutely necessary.

- Types of Credit (10% of score): A mix of different credit types (revolving like credit cards and installment like loans) can be beneficial, but only if managed responsibly.

- New Credit (10% of score): Avoid opening too many new credit accounts in a short period, as this can signal risk to lenders.

Specific Levers for Men to Pull

While the above strategies are universal, men often find particular avenues impactful:

- Optimize Career Earnings: Look for ways to increase your income – negotiate raises, seek promotions, pursue certifications, or explore side hustles that leverage your skills. Extra income can directly accelerate debt repayment.

- Embrace Frugality as a Strength: Frame smart spending and saving not as deprivation, but as a strategic move towards financial independence and building a legacy. Challenge yourself to find cost-effective alternatives in areas like entertainment, hobbies, and transportation.

- Involve Your Partner (if applicable): If you’re in a relationship, make financial planning a team effort. Open communication and shared goals can significantly strengthen your resolve and accelerate progress.

Stay Consistent and Seek Support

Crushing debt and boosting your credit score is a marathon, not a sprint. There will be setbacks, but consistency is key. Regularly review your budget, celebrate small wins, and don’t be afraid to seek professional guidance if you feel overwhelmed. A certified financial planner or credit counselor can offer personalized advice and help you navigate complex situations.

Conclusion

Taking charge of your finances is a powerful declaration of self-reliance and a vital step towards securing your future. By understanding your current situation, diligently applying effective debt reduction strategies, and actively building a strong credit profile, you can achieve financial freedom. The path requires discipline and patience, but the rewards – peace of mind, expanded opportunities, and the ability to pursue your ambitions – are immeasurable. Start today, and build the financial future you envision.