Why An Emergency Fund Is Non-Negotiable

Life is full of surprises, and unfortunately, many of them come with a price tag. From unexpected car repairs and medical emergencies to sudden job loss, an emergency fund acts as your financial safety net, protecting you from falling into debt when the unforeseen happens. For beginners, the idea of saving a large sum can seem daunting, but by breaking it down into manageable steps, you can build a robust financial buffer.

Step 1: Set a Realistic Goal (and Start Small!)

The first step is to define how much you need. While the ultimate goal for an emergency fund is typically 3 to 6 months’ worth of essential living expenses, that can feel overwhelming when you’re just starting. Don’t let perfection be the enemy of good. Begin with a smaller, more achievable target. Aim for an initial “mini-fund” of $500 or $1,000. This smaller amount provides immediate peace of mind and builds momentum for your larger goal.

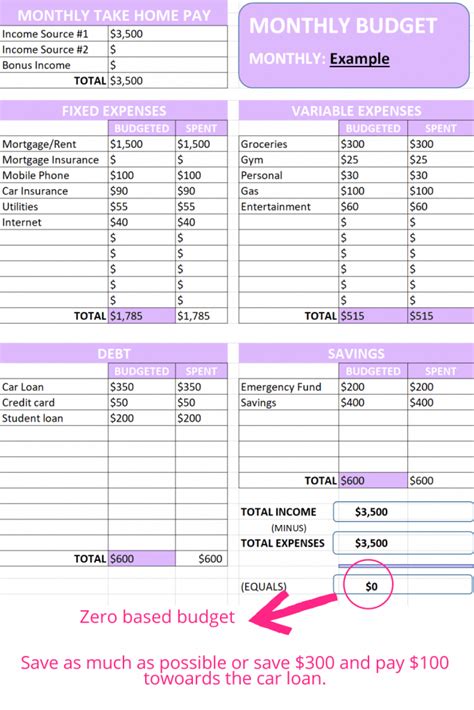

Step 2: Create a Bare-Bones Budget

You can’t save what you don’t know you have. Creating a budget is fundamental to understanding your income and expenses. Track every dollar for a month or two to see where your money is actually going. Identify your fixed expenses (rent, utilities) and variable expenses (groceries, entertainment). Once you have a clear picture, you can start identifying areas where you can trim back.

Step 3: Find Money to Contribute

Once your budget is clear, look for “found money” or areas to cut back. This could involve:

- Cutting small, recurring expenses: Daily lattes, unused subscriptions, or eating out less frequently. Even small changes add up.

- Temporary sacrifices: For a short period, consider cutting back on non-essentials like new clothes, expensive hobbies, or entertainment until you hit your first mini-fund goal.

- Side hustles or selling unused items: A quick way to boost your savings is to earn extra income or sell things you no longer need around the house.

- Windfalls: Tax refunds, bonuses, or gifts can be entirely directed towards your emergency fund.

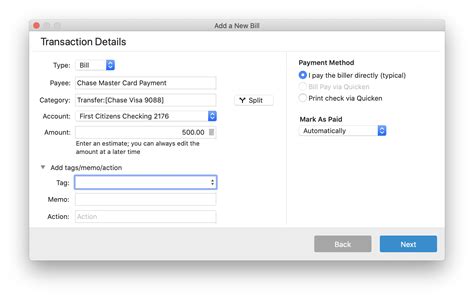

Step 4: Automate Your Savings

The easiest way to save is to make it automatic. Set up an automatic transfer from your checking account to your dedicated emergency fund savings account each payday. Even if it’s just $25 or $50 to start, consistency is key. Automating takes the decision-making out of saving, ensuring that your fund grows steadily without you having to think about it.

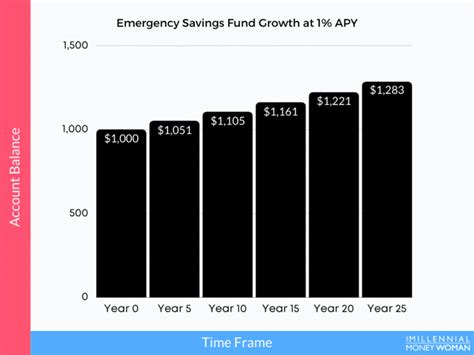

Step 5: Keep Your Emergency Fund Separate and Accessible

Your emergency fund should be stored in a separate, easily accessible account—but not so accessible that you’re tempted to spend it on non-emergencies. A high-yield online savings account is an excellent option. It keeps the money distinct from your everyday spending, allows for quick transfers if an emergency arises, and earns a bit of interest. Avoid tying it up in investments that can fluctuate in value, as you need these funds to be stable and readily available.

Step 6: Stay Consistent and Review Your Progress

Building an emergency fund is a marathon, not a sprint. Celebrate small milestones, like reaching your first $500 or $1,000. Regularly review your budget and progress, perhaps quarterly, to ensure you’re on track and to make adjustments as your financial situation changes. The more consistent you are, the faster your fund will grow, bringing you closer to true financial peace of mind.

Conclusion: Build Your Financial Shield

Starting an emergency fund might feel like a significant undertaking, but it’s one of the most empowering steps you can take for your financial well-being. By setting clear goals, diligently budgeting, automating your savings, and keeping your funds separate, beginners can effectively build a crucial financial shield against life’s inevitable curveballs. Begin today, even with a small amount, and watch your financial resilience grow.