Understanding High-Interest Credit Card Debt

Credit card debt can feel like a heavy burden, especially when high-interest rates cause your balance to grow faster than you can pay it down. Understanding the mechanisms behind credit card interest is the first step towards effectively reducing it. High Annual Percentage Rates (APRs) can trap you in a cycle of minimum payments, where a significant portion of your payment goes towards interest rather than the principal.

The Power of 0% APR Balance Transfers

One of the most effective ways to combat high credit card interest is through a balance transfer. This involves moving existing high-interest debt from one credit card to a new one, typically offered with a promotional 0% APR for a limited period (e.g., 12-21 months). This window allows you to pay down your principal without any interest charges, saving you hundreds or even thousands of dollars.

However, be mindful of balance transfer fees, which are usually 3-5% of the transferred amount. Ensure you can pay off the transferred balance before the promotional period ends, as the interest rate will revert to a standard, often higher, rate.

Consolidating Debt with Personal Loans

If a balance transfer isn’t an option or you have multiple debts from various sources, a debt consolidation loan can be an excellent alternative. A personal loan often comes with a fixed interest rate that is significantly lower than typical credit card APRs. This allows you to combine several high-interest debts into one manageable monthly payment.

The benefits include a predictable payment schedule, a clear payoff date, and potentially lower overall interest costs. Your eligibility for such a loan and the interest rate offered will depend on your credit score and financial history.

Negotiating with Creditors and Smart Payment Methods

Don’t underestimate the power of direct communication. If you’re struggling, call your credit card company. Explain your situation and ask if they can lower your interest rate, waive late fees, or offer a hardship program. Many lenders prefer to work with you rather than risk you defaulting on your debt.

Beyond negotiation, strategic payment methods can make a huge difference:

- Pay More Than The Minimum: Even a small extra payment each month can dramatically reduce the total interest paid and shorten your repayment timeline.

- Debt Avalanche Method: Focus on paying off the card with the highest interest rate first, while making minimum payments on others. Once that debt is cleared, apply the extra payment amount to the next highest interest card. This method saves the most money on interest over time.

- Debt Snowball Method: (While not strictly for interest reduction, it’s a common strategy worth mentioning for completeness) Pay off the smallest debt first to gain psychological momentum, then roll that payment into the next smallest debt.

Building Long-Term Financial Resilience

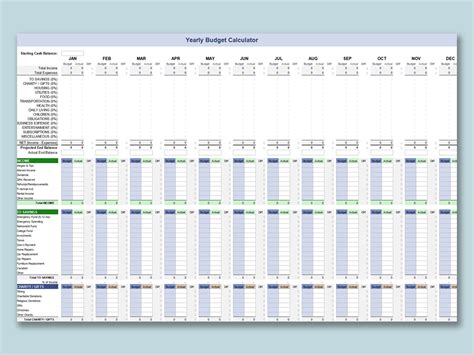

Reducing existing credit card interest is crucial, but preventing future debt is equally important. Implement these long-term strategies:

- Create a Detailed Budget: Track your income and expenses to identify areas where you can cut back and free up more money for debt repayment.

- Build an Emergency Fund: A financial safety net can prevent you from relying on credit cards for unexpected expenses. Aim for at least 3-6 months of living expenses.

- Avoid New Credit Card Debt: Once you start making progress, resist the temptation to accumulate new debt. Be mindful of your spending habits.

- Improve Your Credit Score: A better credit score can lead to lower interest rates on future loans and credit cards, making it easier to manage debt.

Taking Control of Your Credit Card Debt

Reducing credit card debt interest requires a multi-faceted approach. Whether you choose a balance transfer, a consolidation loan, direct negotiation, or a disciplined payment strategy like the debt avalanche, the key is to take action. By combining these methods with responsible financial habits, you can significantly lower your interest costs, accelerate your debt repayment, and achieve greater financial stability. Start today to take control of your financial future.