The Dual Challenge: Eradicating Debt and Building a Safety Net

For many, the path to true financial fitness involves navigating two critical objectives simultaneously: aggressively paying down high-interest credit card debt and establishing a robust emergency fund. While these goals might seem to compete for your hard-earned money, a strategic approach allows you to tackle both effectively, setting a solid foundation for your financial future.

Conquering Credit Card Debt: Your Attack Plan

High-interest credit card debt is a wealth destroyer, siphoning off your money through interest payments. The first step is to get a clear picture of all your debts: list every card, its balance, interest rate, and minimum payment. This clarity is crucial for choosing your attack strategy.

Strategy 1: The Debt Avalanche

This method prioritizes paying off debts with the highest interest rates first. Mathematically, it’s the most efficient way to save money on interest over time. You make minimum payments on all cards except the one with the highest interest, on which you throw every extra dollar you can find. Once that’s paid off, you roll its payment (plus any extra funds) into the next highest interest rate card.

Strategy 2: The Debt Snowball

Psychologically, the debt snowball can be incredibly motivating. With this method, you focus on paying off the smallest balance first, regardless of interest rate. Once that small debt is gone, you use the freed-up payment to tackle the next smallest debt, gaining momentum (like a snowball rolling downhill). While it might cost a bit more in interest, the quick wins can keep you committed.

Building Your Financial Fortress: The Emergency Fund

An emergency fund is your shield against life’s unpredictable curveballs – a sudden job loss, unexpected medical bills, or major car repairs. Without one, these events often force people back into debt. The goal is to have 3-6 months’ worth of essential living expenses saved in an easily accessible, separate savings account.

Start Small, Grow Big

Don’t be intimidated by the final goal. Begin by saving just $500 or $1,000 as a mini-emergency fund. This initial cushion can cover many common emergencies and prevent new debt from forming. Automate your savings by setting up a recurring transfer from your checking to your savings account each payday. Even small, consistent contributions add up quickly.

Boost Your Savings

Look for opportunities to increase your savings. Can you cut discretionary spending? Pick up a side hustle? Sell unused items around your house? Every extra dollar you dedicate to your emergency fund brings you closer to financial security.

The Synergistic Approach: Debt OR Fund First? Or Both?

This is where many people get stuck. Should you attack debt exclusively or build your emergency fund first? A balanced approach often works best:

- Establish a Mini-Emergency Fund: Before going all-in on debt repayment, save that initial $500-$1,000. This provides a basic buffer.

- Aggressively Attack Debt: Once you have your mini-fund, direct all extra money towards your chosen debt repayment strategy (avalanche or snowball). The high interest rates on credit cards mean every dollar paid saves you more than it would earn in a typical savings account.

- Rebuild and Grow Your Emergency Fund: Once your high-interest credit card debt is gone, pivot aggressively to building your full 3-6 month emergency fund. Without those debt payments, you’ll have significantly more cash flow to achieve this quickly.

Actionable Steps for Financial Freedom

- Create a Detailed Budget: Know exactly where every dollar goes. Identify areas where you can cut back to free up money for debt repayment and savings.

- Automate Everything: Set up automatic transfers for debt payments (above the minimum) and savings contributions. “Set it and forget it” removes the temptation to spend.

- Cut Up & Close Cards (Carefully): Once a card is paid off, consider closing it if you trust yourself not to accrue new debt. Be mindful of potential credit score impacts.

- Boost Your Income: Explore ways to earn more money, whether through a raise, a second job, freelancing, or selling goods. Every additional dollar accelerates your progress.

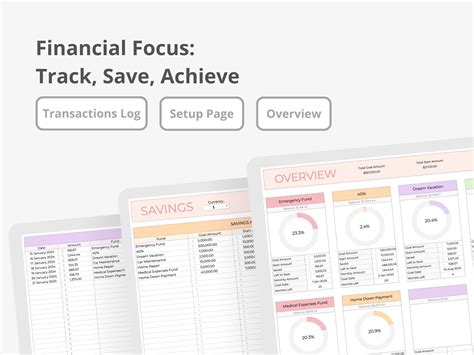

- Track Your Progress: Seeing your debt balances shrink and your savings grow provides immense motivation. Use apps, spreadsheets, or even physical charts to visualize your success.

Maintaining Long-Term Financial Fitness

Crushing debt and building an emergency fund are significant achievements, but financial fitness is an ongoing journey. Continue to budget, save, and invest wisely. Avoid returning to bad spending habits that led to debt in the first place. With discipline and consistent effort, you can not only achieve your financial goals but also maintain a secure and prosperous future.