High-interest credit card debt can feel like an insurmountable mountain, trapping individuals in a cycle of minimum payments and ever-growing balances. The good news is that with a strategic approach and consistent effort, you can effectively tackle and eliminate this burden, paving the way for financial freedom. This article will guide you through the most effective strategies and practical steps to conquer your high-interest credit card debt.

Understanding Your Debt Landscape

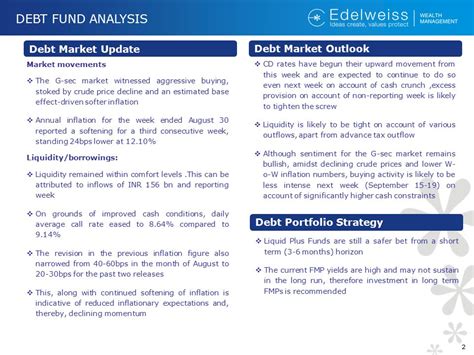

Before you can formulate a winning strategy, you need a clear picture of what you’re up against. Gather all your credit card statements and list each card’s outstanding balance, interest rate (APR), and minimum monthly payment. Pay particular attention to the interest rates – these are the real drivers of your debt’s growth. Understanding how much interest you’re paying each month can be a powerful motivator.

The insidious nature of high-interest debt lies in compound interest. Even if you make regular payments, a significant portion might go towards interest, leaving little to reduce the principal balance. This is why a targeted approach is crucial.

The Two Core Strategies: Avalanche vs. Snowball

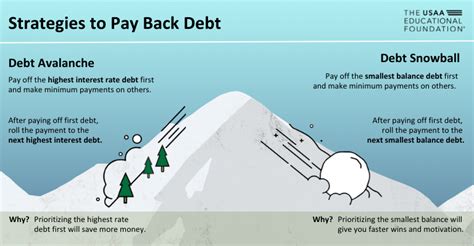

When it comes to debt repayment, two popular methods stand out: the Debt Avalanche and the Debt Snowball. Both are effective, but they appeal to different psychological and mathematical approaches.

The Debt Avalanche Method

Mathematically, the debt avalanche is the most efficient way to pay off multiple debts. With this strategy, you list all your debts from the highest interest rate to the lowest, regardless of the balance. You then make minimum payments on all cards except the one with the highest interest rate, on which you pay as much as you possibly can. Once that debt is paid off, you take the money you were paying on it and add it to the minimum payment of the next highest interest rate debt. This continues until all your debts are gone.

The primary advantage of the avalanche method is that it saves you the most money in interest over time. It’s ideal for individuals who are motivated by financial efficiency and can stick to a plan even if immediate results aren’t visible.

The Debt Snowball Method

The debt snowball method focuses on psychological wins. With this approach, you list your debts from the smallest balance to the largest, regardless of the interest rate. You make minimum payments on all debts except the one with the smallest balance, on which you pay as much extra as possible. Once that smallest debt is paid off, you take the money you were paying on it and add it to the minimum payment of the next smallest debt. This creates a “snowball” effect, gaining momentum as each debt is cleared.

While the snowball method may result in paying more interest overall compared to the avalanche, its power lies in providing quick wins and building momentum. For those who need encouragement and a feeling of progress to stay motivated, the snowball method can be incredibly effective.

Beyond the Core: Complementary Tactics

In addition to choosing an avalanche or snowball strategy, several other tactics can significantly accelerate your debt repayment journey.

- Balance Transfers: If you have good credit, consider transferring your high-interest balances to a new credit card offering a 0% introductory APR. This can give you a crucial window (often 12-21 months) to pay down a significant portion of your principal without accruing new interest. Be mindful of balance transfer fees and ensure you can pay off the transferred amount before the promotional period ends.

- Debt Consolidation Loan: A personal loan can consolidate multiple high-interest credit card debts into a single loan with a lower, fixed interest rate. This simplifies your payments and can reduce your overall interest expense. Ensure the interest rate on the consolidation loan is genuinely lower than your credit card rates.

- Negotiate with Creditors: Don’t hesitate to call your credit card companies. Explain your situation and ask if they can lower your interest rate, waive a late fee, or offer a hardship plan. Sometimes, simply asking can yield positive results, especially if you have a good payment history.

Practical Steps to Accelerate Repayment

Regardless of the primary strategy you choose, these practical steps will boost your progress:

- Create a Strict Budget: Know exactly where your money is going. Identify areas where you can cut back to free up more funds for debt repayment.

- Cut Unnecessary Expenses: Temporarily pause discretionary spending like dining out, entertainment subscriptions, or non-essential shopping. Every dollar saved can be an extra dollar towards your debt.

- Find Ways to Increase Income: Consider a side hustle, freelance work, selling unused items, or asking for a raise. The more extra income you can generate, the faster you’ll pay off debt.

- Automate Payments: Set up automatic payments for at least the minimum amount to avoid late fees. For your target debt, manually make additional payments.

- Avoid New Debt: While paying off existing debt, resist the urge to take on new credit card balances or unnecessary loans. Cut up credit cards if necessary, or put them away in a secure place.

Paying down high-interest credit card debt requires discipline, patience, and a well-defined plan. Whether you choose the mathematically superior debt avalanche or the psychologically rewarding debt snowball, combining your chosen strategy with smart complementary tactics and consistent practical steps will lead you to financial freedom. Start today, stay committed, and watch your debt diminish.