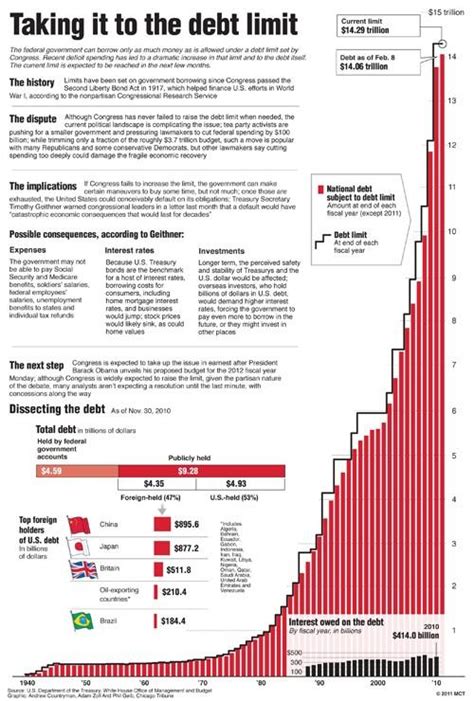

Taking Command: Why High-Interest Debt is a Financial Battlefield

For many men, high-interest debt can feel like an insurmountable obstacle, silently eroding financial stability and future potential. Whether it’s credit card balances, personal loans, or other forms of consumer debt, the compounding interest can turn a molehill into a mountain if not addressed strategically. The good news is that with a disciplined approach and the right battle plan, you can not only eliminate this debt but also build a stronger financial foundation for yourself and your family.

This article will outline aggressive, actionable strategies designed to help men cut through high-interest debt quickly, empowering them to reclaim their financial autonomy and accelerate their journey towards wealth building.

Step 1: Assess and Strategize – Know Your Enemy

The first critical step in any debt elimination strategy is a thorough understanding of your current financial landscape. List all your debts, noting the creditor, the outstanding balance, and most importantly, the interest rate for each. This clear picture will reveal which debts are costing you the most money and demand immediate attention. Many men find this exercise challenging but incredibly empowering, as it transforms vague anxiety into concrete data points.

Next, create a detailed budget. Track every dollar coming in and every dollar going out. Identify areas where you can cut expenses, even temporarily, to free up more cash for debt repayment. This isn’t about deprivation, but about intentional reallocation of resources to achieve a greater goal – financial freedom.

Step 2: The Aggressive Payoff Battle Plan

When it comes to high-interest debt, two popular strategies stand out: the Debt Avalanche and the Debt Snowball. Both are highly effective, but they appeal to different motivations.

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first, regardless of balance size. You make minimum payments on all other debts and direct any extra funds to the one with the highest rate. Once that’s paid off, you take the money you were paying on it and apply it to the next highest interest rate debt. This is the mathematically most efficient method, saving you the most money on interest over time.

The Debt Snowball method focuses on psychological wins. You pay off the smallest debt balance first, while making minimum payments on all others. Once that smallest debt is gone, you roll that payment into the next smallest debt. This method provides quick victories, building momentum and motivation to keep going, even if it costs slightly more in interest over the long run.

For men driven by logic and efficiency, the Debt Avalanche is often the preferred choice. For those who thrive on tangible progress and need consistent boosts of motivation, the Debt Snowball can be a powerful tool. Choose the method that best aligns with your personality and stick to it rigorously.

Step 3: Fueling the Offensive – Increase Your Income

While cutting expenses is vital, increasing your income can dramatically accelerate your debt repayment. Consider taking on a side hustle – freelancing, gig work, or even selling items you no longer need. Explore opportunities for overtime at your current job, or invest in skills that could lead to a higher-paying position. Every additional dollar earned, when directed straight to your highest-interest debt, acts as a powerful accelerant.

The key here is intentionality. Don’t let extra income simply disappear into discretionary spending. Treat it as ammunition for your debt elimination campaign. Imagine how quickly a significant chunk of your high-interest debt could vanish with an extra $500 or $1000 per month dedicated solely to its demise.

Step 4: Explore External Reinforcements – Consolidation and Negotiation

In certain situations, external tools can provide a significant advantage. A debt consolidation loan, for instance, can combine multiple high-interest debts into a single loan with a lower interest rate. This simplifies payments and can reduce the overall cost of your debt, but requires a good credit score to qualify for favorable terms.

Another option is a balance transfer credit card with a 0% introductory APR. If you can transfer high-interest balances to such a card and pay them off completely before the introductory period ends, you can save a substantial amount on interest. However, be cautious: if balances aren’t paid off, the interest rate can jump dramatically.

Don’t be afraid to negotiate directly with your creditors. Many are willing to work with you, especially if you have a good payment history or can demonstrate hardship. You might be able to secure a lower interest rate or a more manageable payment plan. A simple phone call can sometimes yield surprising results.

Maintaining Discipline and Building Financial Resilience

Eliminating high-interest debt isn’t a sprint; it’s a marathon that requires unwavering discipline. Regularly review your budget, track your progress, and celebrate milestones to stay motivated. As you pay off each debt, you’ll feel a surge of accomplishment and see the light at the end of the tunnel grow brighter.

Once your high-interest debt is eliminated, immediately pivot to building an emergency fund. This financial buffer will prevent you from falling back into debt when unexpected expenses arise. With your debt gone and an emergency fund in place, you’ll be well-positioned to pursue long-term financial goals, from investments to homeownership, with confidence and control.

Taking command of your finances, especially when battling high-interest debt, is a testament to strength and foresight. By applying these aggressive strategies – assessing your debts, choosing a focused payoff plan, boosting your income, and leveraging smart financial tools – men can rapidly eliminate high-interest debt and forge a path towards lasting financial freedom.