Why Retirement Planning is Critical for Men Today

For men, building a robust retirement fund isn’t just about comfortable golden years; it’s about securing legacy, providing for loved ones, and maintaining financial independence. With evolving demographics and healthcare costs, proactive and strategic saving has never been more vital. Understanding how to maximize your 401k and other retirement accounts is the cornerstone of a successful financial future.

Mastering Your 401k Contributions

Your 401k is often the most accessible and powerful retirement savings tool. Maximizing it requires discipline and strategic decisions.

1. Max Out Your Contributions, Especially the Match

- Hit the Limit: Aim to contribute the maximum allowable amount set by the IRS each year. For 2024, this is $23,000 ($30,500 if you’re age 50 or older, thanks to catch-up contributions). Every dollar contributed grows tax-deferred, significantly accelerating your wealth accumulation.

- Don’t Miss the Match: If your employer offers a 401k match, contribute at least enough to get the full match. This is essentially free money and one of the easiest ways to boost your retirement savings by 50% or even 100% on those matched dollars.

2. Understand Roth vs. Traditional 401k Options

Many plans offer both Traditional (pre-tax) and Roth (after-tax) 401k options. Your choice depends on your current and anticipated future tax bracket:

- Traditional 401k: Contributions are tax-deductible in the current year, reducing your taxable income. Withdrawals in retirement are taxed. Ideal if you expect to be in a lower tax bracket in retirement.

- Roth 401k: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are completely tax-free. Ideal if you expect to be in a higher tax bracket in retirement.

Optimizing Your Investment Strategy Within Your 401k

Contributing isn’t enough; your investments need to work hard for you.

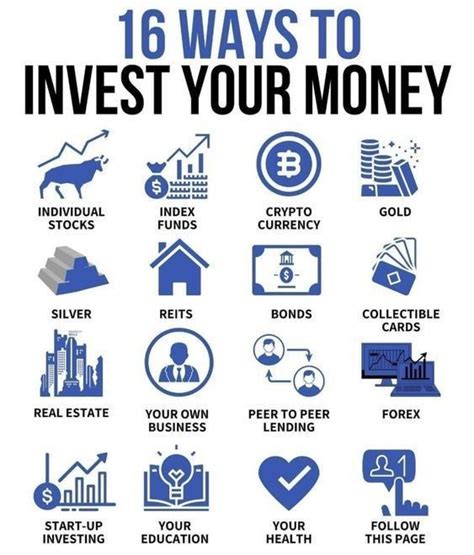

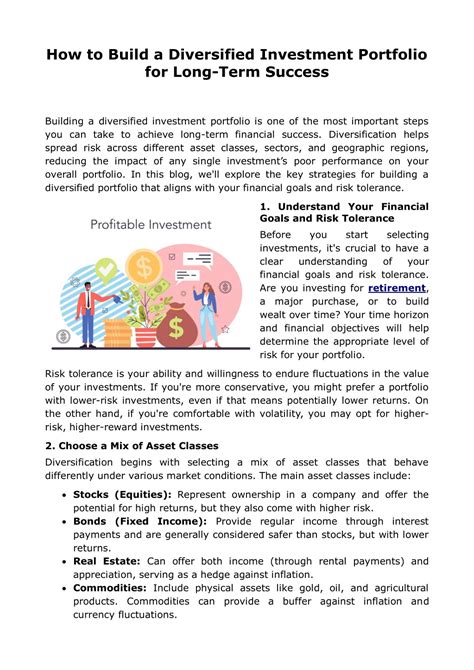

1. Diversify Your Portfolio

Ensure your 401k investments are well-diversified across different asset classes (stocks, bonds, real estate, etc.) and sectors. This helps mitigate risk and capture growth opportunities.

2. Understand Your Risk Tolerance and Age

Generally, younger men can afford to take on more risk with a higher allocation to equities, as they have a longer time horizon to recover from market downturns. As you approach retirement, gradually shift towards more conservative investments to protect your capital. Target-date funds can simplify this process, automatically adjusting your asset allocation over time.

3. Monitor Fees

High investment fees can eat into your returns over decades. Review the expense ratios of the funds within your 401k and opt for lower-cost index funds or ETFs when available and appropriate for your strategy.

Beyond the 401k: Expanding Your Retirement Horizon

While the 401k is primary, other accounts can significantly boost your retirement readiness.

1. Individual Retirement Accounts (IRAs)

- Roth IRA: Similar to a Roth 401k, contributions are after-tax, but qualified withdrawals are tax-free. Offers more investment flexibility than many 401k plans. Income limits apply for direct contributions.

- Traditional IRA: Contributions may be tax-deductible, and growth is tax-deferred.

If you’re self-employed, consider a SEP IRA or Solo 401k, which allow for much higher contribution limits.

2. Health Savings Accounts (HSAs)

If you have a high-deductible health plan (HDHP), an HSA is a triple-tax-advantaged powerhouse:

- Tax-deductible contributions.

- Tax-free growth.

- Tax-free withdrawals for qualified medical expenses.

It can function as an investment account for future healthcare costs in retirement, or even general retirement expenses once you reach age 65.

3. Brokerage Accounts

For savings beyond tax-advantaged limits, a taxable brokerage account provides additional investment opportunities. While not offering the same tax benefits, it provides liquidity and flexibility for medium-to-long-term goals.

The Importance of Debt Management and Financial Planning

High-interest debt (credit cards, personal loans) can severely hamper your ability to save for retirement. Prioritize paying off consumer debt to free up cash flow for investments. Regular financial reviews are also crucial. Work with a financial advisor to create a personalized plan, assess your progress, and adjust your strategy as life circumstances change.

Conclusion: Start Early, Stay Consistent

The best time to start maximizing your 401k and retirement savings was yesterday; the second best time is now. Consistent contributions, smart investment choices, and leveraging all available retirement vehicles are key. By taking control of your financial future today, men can build the wealth necessary for a secure, independent, and fulfilling retirement.