Building long-term wealth requires a strategic approach, and one of the most effective paths is through passive income investments. Unlike active income, which demands your direct time and effort, passive income streams generate money with minimal ongoing input, allowing your wealth to grow even while you sleep. The key is to identify investments that not only provide consistent returns but also align with your risk tolerance and financial goals for the long haul.

Understanding Passive Income for Wealth Growth

Passive income isn’t about getting rich quick; it’s about setting up systems that generate consistent cash flow over time. For long-term wealth, this means selecting investments that offer stability, growth potential, and reliable payouts. Diversification is crucial to mitigate risks and ensure a steady stream of income across various market conditions.

Real Estate: A Timeless Wealth Builder

Real estate has long been a cornerstone of wealth creation. Direct ownership of rental properties, such as residential homes or commercial spaces, can provide a steady stream of rental income and potential property appreciation. While it can be management-intensive, hiring a property manager can make it a more passive endeavor.

For those who prefer a hands-off approach, Real Estate Investment Trusts (REITs) offer an excellent alternative. REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. They trade on major stock exchanges like stocks, providing liquidity and diversification without the burden of direct property management. REITs are legally required to distribute at least 90% of their taxable income to shareholders annually in the form of dividends, making them a strong passive income source.

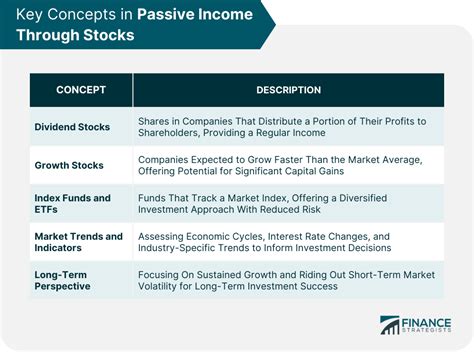

Dividend Stocks and ETFs: Income from Equities

Investing in dividend-paying stocks is a popular strategy for passive income. Companies that consistently pay dividends share a portion of their profits with shareholders, providing a regular income stream. Look for established companies with a history of increasing dividends, often referred to as “dividend aristocrats” or “dividend kings.” These companies typically have strong financial health and stable business models.

For broader diversification and reduced individual stock risk, Dividend Exchange Traded Funds (ETFs) are an excellent choice. These ETFs hold a basket of dividend-paying stocks, offering exposure to numerous companies across various sectors. They often focus on high-yield or dividend-growth strategies, providing a more diversified and often lower-volatility income stream.

Fixed Income Investments: Bonds and High-Yield Savings

While often lower-yielding than stocks or real estate, fixed-income investments offer stability and a predictable income stream, making them ideal for diversifying a passive income portfolio. Government bonds, corporate bonds, and Certificates of Deposit (CDs) pay regular interest payments to investors.

High-yield savings accounts and money market accounts, particularly in a rising interest rate environment, can also serve as a low-risk source of passive income for easily accessible funds, though their yields typically lag behind inflation over the long term. These options are best for preserving capital and earning a modest return on emergency funds or short-term savings rather than primary wealth growth.

Peer-to-Peer (P2P) Lending: Direct Lending Opportunities

Peer-to-peer lending platforms connect borrowers directly with investors, bypassing traditional banks. As an investor, you can lend small amounts to multiple individuals or businesses, earning interest on these loans. While P2P lending can offer attractive returns, it also carries higher risk, including borrower default. Diversifying your loans across many borrowers and understanding the platform’s risk assessment models are crucial for success in this space.

Conclusion: Diversify for Sustainable Long-Term Wealth

The path to long-term wealth through passive income is built on careful planning, diversification, and patience. Whether you choose the tangible assets of real estate, the consistent payouts of dividend stocks, the stability of fixed income, or the potential of P2P lending, combining several strategies can help you build a robust and resilient passive income portfolio. Always conduct thorough research, consider your risk tolerance, and consult with a financial advisor to tailor an investment strategy that best suits your individual circumstances and long-term financial aspirations.