Reclaiming Control: Why Debt Repayment is Crucial for Men

For many men, financial freedom isn’t just about accumulating wealth; it’s about control, security, and the ability to make choices without the burden of outstanding obligations. Debt, whether from student loans, credit cards, or mortgages, can feel like an invisible chain, limiting opportunities and creating undue stress. This article will delve into the most effective debt repayment strategies specifically geared towards helping men fast-track their journey to financial liberation.

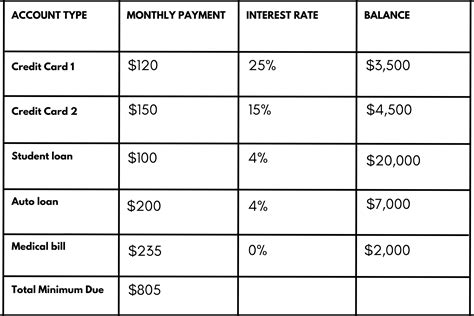

The path to financial freedom starts with a clear understanding of your current financial landscape. This means meticulously cataloging all your debts, including interest rates, minimum payments, and total balances. Once you have a complete picture, you can choose a strategy that aligns with your personality and financial goals.

The Two Pillars: Debt Snowball vs. Debt Avalanche

There are two primary methods for tackling multiple debts, each with its own psychological and mathematical advantages. Understanding these can help you pick the best approach for your financial temperament.

The Debt Snowball Method: Building Momentum

Popularized by financial gurus, the debt snowball method focuses on psychological wins. Here’s how it works: you list your debts from the smallest balance to the largest, regardless of interest rate. You make minimum payments on all debts except the smallest one, on which you focus all your extra money. Once the smallest debt is paid off, you take the money you were paying on it and add it to the payment of the next smallest debt. This creates a ‘snowball’ effect, as each cleared debt frees up more money to throw at the next one.

This method is highly effective for men who need to see tangible progress quickly to stay motivated. The rapid succession of paying off smaller debts provides a strong psychological boost, reinforcing discipline and encouraging continued effort.

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](/images/aHR0cHM6Ly90czIubW0uYmluZy5uZXQvdGg/aWQ9T0lQLkkzdG9qX2RzclNicmJzbnpwM2RWcUFIYUlBJnBpZD0xNS4x.webp)

The Debt Avalanche Method: Maximizing Savings

In contrast, the debt avalanche method is the mathematically optimal choice. With this strategy, you list your debts from the highest interest rate to the lowest. You then make minimum payments on all debts except the one with the highest interest rate, on which you focus all your extra money. Once that debt is paid off, you move to the debt with the next highest interest rate.

This method saves you the most money in interest over time. It’s ideal for men who are more analytical, disciplined, and motivated by the long-term financial benefit rather than immediate psychological victories. While it might take longer to pay off the first debt, the savings can be significant.

Practical Steps for Men to Accelerate Debt Freedom

Beyond choosing a repayment strategy, several practical steps can significantly speed up your journey to financial freedom.

1. Create a Rock-Solid Budget

A budget isn’t about restriction; it’s about control and intentionality. Track every dollar coming in and going out. Identify areas where you can cut back, even temporarily, to free up more money for debt repayment. This might mean fewer impulse purchases, cooking at home more often, or re-evaluating subscriptions. Understanding where your money goes empowers you to direct it towards your goals.

2. Increase Your Income Streams

While cutting expenses is vital, increasing your income can be a powerful accelerator. Consider taking on a side hustle, freelancing, seeking a promotion, or investing in skills that lead to higher earning potential. Every extra dollar earned and directed towards debt repayment brings you closer to your goal faster.

3. Negotiate Interest Rates and Consolidate

Don’t be afraid to call your creditors and negotiate lower interest rates, especially on credit card debt. Even a few percentage points can make a substantial difference over time. For high-interest debts, consider consolidating them into a lower-interest personal loan or using a balance transfer credit card, if you’re confident you can pay it off within the promotional period. Be cautious with consolidation, ensuring it doesn’t just extend your repayment period or add new fees.

4. Automate Your Payments

Set up automatic payments for at least the minimum amount on all your debts. Then, automate the extra payment you’ve committed to your chosen debt repayment strategy. This ensures consistency and prevents missed payments, which can incur fees and negatively impact your credit score. Automation removes the guesswork and keeps you on track.

Maintaining Momentum and Mindset

Debt repayment is a marathon, not a sprint. There will be challenging months, but maintaining a strong mindset is key. Regularly review your progress, celebrate small victories, and remind yourself of the ‘why’ behind your efforts – the ultimate financial freedom and control it will bring. Surround yourself with supportive people who understand your goals and can hold you accountable.

By choosing the right strategy, implementing practical financial habits, and maintaining unwavering discipline, men can effectively fast-track their journey to eliminating debt and achieving the financial freedom they desire. The effort put in today will pay dividends for a lifetime of independent choices and peace of mind.