Navigating Your Debt Repayment Journey: Snowball vs. Avalanche

For anyone serious about becoming debt-free, the journey can feel daunting. Fortunately, two popular and highly effective strategies stand out: the debt snowball and the debt avalanche methods. Both offer structured approaches to tackle outstanding balances, but they appeal to different psychological and financial priorities. Understanding the nuances of each can help you choose the path that best suits your financial situation and personality, paving your way to financial freedom.

The Debt Snowball Method: Building Momentum

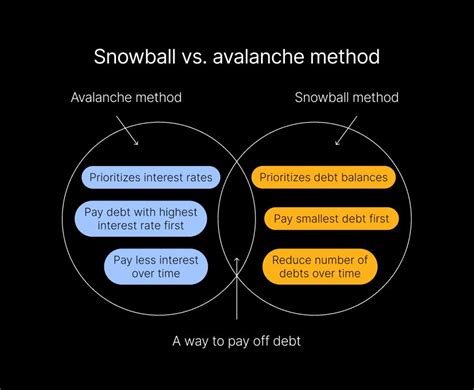

The debt snowball method, popularized by financial guru Dave Ramsey, focuses on psychological wins to keep you motivated. Here’s how it works: you list all your debts from the smallest balance to the largest, regardless of their interest rates. You then make minimum payments on all debts except the smallest one. On that smallest debt, you throw every extra dollar you can find. Once the smallest debt is paid off, you take the money you were paying on it (minimum payment plus extra) and apply it to the next smallest debt. This process continues, with the amount you’re paying on each subsequent debt “snowballing” as you eliminate the previous one.

Pros: The primary benefit is the quick psychological boost from paying off an entire debt. These early wins provide immense motivation, making you feel like you’re making progress and are more likely to stick with the plan. It’s particularly effective for individuals who need encouragement and a sense of accomplishment to stay focused on their long-term financial goals.

Cons: Mathematically, the debt snowball method is less efficient. By prioritizing smallest balances over highest interest rates, you often end up paying more in interest over the long run. If your smallest debt happens to have a low interest rate, you’re delaying tackling a larger debt with a high interest rate, which will accrue more interest during that time.

The Debt Avalanche Method: Maximizing Savings

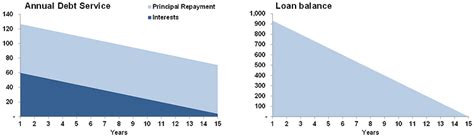

In contrast, the debt avalanche method is the most mathematically efficient way to pay off debt. This strategy prioritizes saving money on interest. With the avalanche method, you list all your debts from the highest interest rate to the lowest, regardless of the balance. Like the snowball method, you make minimum payments on all debts except the one with the highest interest rate. On that high-interest debt, you direct all your extra funds. Once it’s paid off, you apply that payment amount (minimum plus extra) to the debt with the next highest interest rate, continuing until all debts are cleared.

Pros: The biggest advantage of the debt avalanche method is that it saves you the most money in interest charges. By systematically eliminating the most expensive debts first, you reduce the overall cost of your debt. This method is ideal for those who are disciplined, analytical, and focused on financial optimization.

Cons: The main drawback is that it can take longer to see the first debt completely eliminated, especially if your highest interest debt is also a large one. This lack of immediate “wins” can be demotivating for some, potentially leading to burnout or abandonment of the plan.

Which Method is Right for You?

The “best” method isn’t universal; it’s the one you’ll stick with. Consider these points when making your decision:

- Choose Snowball If: You need psychological wins to stay motivated. You have several small debts that you can quickly eliminate. You tend to get discouraged easily by slow progress.

- Choose Avalanche If: You are highly disciplined and motivated by saving money. You have significant high-interest debt (e.g., credit cards). You understand and appreciate the mathematical efficiency.

It’s also worth noting that you don’t have to strictly adhere to one method forever. Some people start with a snowball to gain momentum, then switch to an avalanche once they feel more confident and disciplined.

Beyond Snowball and Avalanche: Core Principles

Regardless of the method you choose, a few core principles will always accelerate your debt repayment:

- Create a Detailed Budget: Understand exactly where your money is going and identify areas to cut back.

- Find Extra Income: Consider a side hustle, selling unused items, or temporary freelance work to boost your debt payments.

- Avoid New Debt: During your repayment journey, commit to not taking on any new debt.

- Build an Emergency Fund: Even a small starter emergency fund can prevent new debt if unexpected expenses arise.

Conclusion

Both the debt snowball and debt avalanche methods are powerful tools for achieving debt freedom. The snowball method leverages human psychology for motivation, while the avalanche method prioritizes mathematical efficiency to save you money. Reflect on your personal financial discipline and motivation style to determine which strategy will empower you most effectively on your path to a debt-free future. The most important step is to choose a method and commit to it, making consistent progress toward your financial goals.