Taking Control of Your Financial Future

For many men, credit card debt can feel like a relentless opponent, constantly sapping energy and resources. But it doesn’t have to be a permanent fixture in your financial life. Crushing that debt and building a robust net worth isn’t just about spreadsheets; it’s about adopting a strategic mindset and implementing actionable steps. This guide will provide a clear roadmap to empower you to take charge, eliminate debt, and accelerate your journey toward financial freedom.

Phase 1: Annihilating Credit Card Debt

High-interest credit card debt is a wealth killer. Every dollar paid in interest is a dollar not invested or saved. Your primary mission should be to eliminate this burden as quickly as possible. This requires discipline and a targeted approach.

First, identify all your credit card balances and interest rates. Then, choose your attack strategy: the Debt Snowball or the Debt Avalanche. The Debt Avalanche method, where you pay off the card with the highest interest rate first while making minimum payments on others, is mathematically superior as it saves you the most money on interest. Once that highest-interest card is paid off, you roll its payment amount into the next highest interest card.

Crucially, stop accumulating new debt. Cut up your credit cards if necessary, or at least freeze them. Focus every spare dollar on your chosen debt. Consider a balance transfer to a lower-interest card if you qualify, but be wary of fees and ensure you pay it off before the promotional rate expires.

Phase 2: Supercharging Your Income & Savings

Eliminating debt is step one; boosting your net worth requires proactive income generation and disciplined saving. Your net worth is simply your assets minus your liabilities. The more assets you accumulate and the fewer liabilities you carry, the higher your net worth.

Start with a detailed budget. Understand exactly where your money goes each month. This isn’t about deprivation, but awareness. Identify areas where you can trim unnecessary expenses and redirect those funds towards debt repayment or savings. A budget is your financial GPS.

Next, explore ways to increase your income. This could involve negotiating a higher salary at your current job, taking on a profitable side hustle (freelancing, consulting, gig work), or investing in new skills that command higher pay. Every extra dollar you earn, when directed strategically, can dramatically accelerate your financial goals.

Finally, automate your savings. Set up automatic transfers from your checking to your savings account immediately after you get paid. Start with an emergency fund – typically 3-6 months of living expenses – to prevent future debt. Once that’s established, automate contributions to investment accounts.

Phase 3: Investing Smart for Long-Term Wealth

With credit card debt under control and a solid emergency fund in place, it’s time to put your money to work. Investing is how you build true, generational wealth. The power of compounding interest is your greatest ally over the long term.

Prioritize tax-advantaged retirement accounts. If your employer offers a 401(k) or similar plan, contribute at least enough to get the full company match – that’s free money. Beyond that, consider maxing out a Roth IRA or traditional IRA, depending on your income and tax situation. These accounts offer significant tax benefits that supercharge your growth.

For your investments, focus on diversification. Instead of trying to pick individual stocks, consider low-cost index funds or Exchange Traded Funds (ETFs) that track broad market indices like the S&P 500. This provides broad market exposure and reduces risk. Consistency is key; invest regularly, regardless of market fluctuations.

Phase 4: Cultivating a Wealth-Building Mindset

Financial success isn’t solely about numbers; it’s deeply rooted in your habits and mindset. Developing a long-term perspective and commitment to continuous learning is vital.

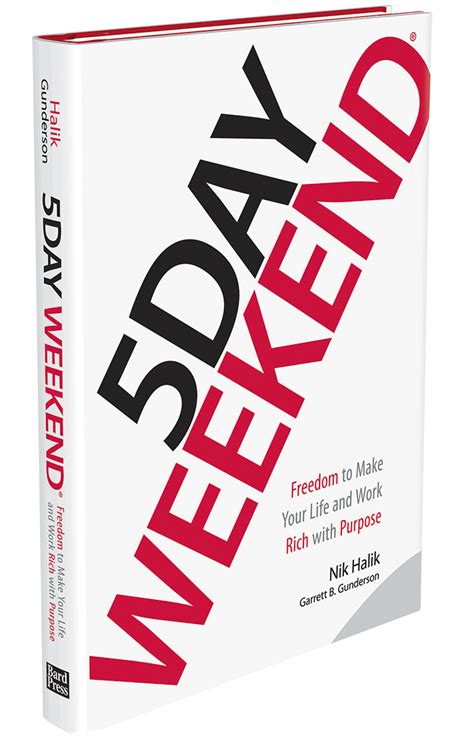

Commit to ongoing financial education. Read books, listen to podcasts, and follow reputable financial news sources. The more you understand about personal finance, investing, and economics, the more confident and effective you’ll become in making financial decisions. Knowledge is power, especially when it comes to your money.

Regularly review your financial progress. Schedule monthly or quarterly financial check-ins with yourself. Are you sticking to your budget? Are your investments performing as expected? Are your goals still relevant? Adjust your strategy as life changes and markets evolve. Set clear, measurable financial goals – whether it’s paying off a specific debt, saving a certain amount, or reaching a particular net worth target – to keep you motivated and on track.

The Path to Financial Freedom

Crushing credit card debt and boosting your net worth is a journey that requires patience, perseverance, and strategic action. By systematically attacking high-interest debt, relentlessly growing your income and savings, and investing wisely for the long term, you lay a solid foundation for financial independence.

Remember, building net worth is a marathon, not a sprint. There will be setbacks, but consistency and discipline will ultimately lead to success. Start today, stay committed, and watch your financial future transform.