High-interest debt can feel like a relentless drag on your finances, siphoning away hard-earned money and delaying your dreams of financial freedom. Whether it’s credit card balances, personal loans, or other costly obligations, these debts not only eat into your budget but also hinder your ability to save and invest for the future. The good news is that with a strategic approach and consistent effort, you can overcome high-interest debt and pivot towards robust wealth creation. This guide will provide you with actionable steps to achieve just that.

Understanding Your Enemy: High-Interest Debt

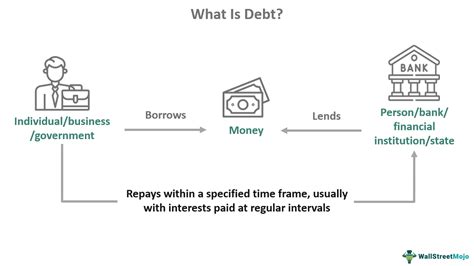

Before you can crush high-interest debt, you need to understand its nature. These are typically debts with annual percentage rates (APRs) that are significantly above the rate of inflation or common investment returns. Credit cards, payday loans, and some personal loans often fall into this category. The longer you carry these balances, the more interest accrues, making it incredibly difficult to make headway on the principal.

Identifying all your high-interest debts is the first critical step. List them out, noting the creditor, current balance, interest rate, and minimum payment. This clear picture will serve as your battle map.

Strategic Offense: Crushing High-Interest Debt

1. Choose Your Attack Strategy: Avalanche or Snowball

There are two popular and effective methods for tackling multiple debts:

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first, while making minimum payments on all other debts. Once the highest-rate debt is paid, you apply that payment amount to the next highest interest rate debt. This method saves you the most money in interest over time.

- Debt Snowball: Focus on paying off the smallest debt balance first, while making minimum payments on all other debts. Once the smallest debt is paid, you apply that payment amount to the next smallest debt. This method provides psychological wins, keeping you motivated, even if it costs slightly more in interest.

Choose the method that best suits your personality and financial situation. Consistency is key with either approach.

2. Explore Balance Transfers and Refinancing

For credit card debt, a 0% APR balance transfer card can offer a temporary reprieve from interest. Be cautious, though: ensure you can pay off the transferred balance before the promotional period ends, and be mindful of balance transfer fees. For personal loans, consider refinancing to a lower interest rate, especially if your credit score has improved.

3. Negotiate with Creditors

Don’t be afraid to call your creditors. Sometimes, they may be willing to lower your interest rate, waive fees, or work out a payment plan, especially if you’re struggling. It never hurts to ask.

Fortifying Your Finances: Post-Debt Foundations

Once you’ve made significant progress or entirely eliminated high-interest debt, it’s crucial to build a strong financial foundation to prevent future debt accumulation and kickstart wealth building.

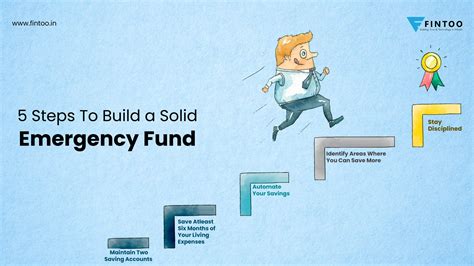

1. Build a Robust Emergency Fund

The first priority after debt is to build an emergency fund. Aim for 3-6 months’ worth of essential living expenses saved in an easily accessible, separate savings account. This fund acts as a buffer against unexpected costs like job loss, medical emergencies, or car repairs, preventing you from falling back into debt.

2. Master Your Budget and Track Spending

Create a detailed budget that tracks every dollar coming in and going out. Tools like spreadsheets, budgeting apps, or even pen and paper can help. Understanding where your money goes allows you to make conscious spending choices and allocate funds effectively towards savings and investments.

3. Automate Your Savings and Bill Payments

Set up automatic transfers from your checking account to your savings and investment accounts on payday. Treat savings as a non-negotiable expense. Similarly, automate bill payments to avoid late fees and manage your cash flow more efficiently.

Accelerating Your Wealth-Building Journey

With high-interest debt out of the way and a solid financial foundation, you’re now primed to accelerate your wealth accumulation.

1. Maximize Retirement Contributions

If your employer offers a 401(k) or similar plan, contribute at least enough to get the full company match – it’s free money! Beyond that, consider maximizing contributions to tax-advantaged accounts like a 401(k) or IRA. The power of compound interest works wonders over decades.

2. Diversify Your Investments

Beyond retirement accounts, open a brokerage account and invest in a diversified portfolio of low-cost index funds or ETFs. Diversification across different asset classes (stocks, bonds, real estate) helps mitigate risk and enhance long-term returns.

3. Increase Your Income Streams

Look for opportunities to increase your income. This could involve negotiating a raise, seeking a higher-paying job, starting a side hustle, or developing new skills. More income provides more capital to save and invest, dramatically speeding up wealth creation.

4. Continue to Educate Yourself

Personal finance is a lifelong learning journey. Stay informed about investment strategies, market trends, and tax-efficient financial planning. The more you learn, the better equipped you’ll be to make smart financial decisions.

Conclusion

Crushing high-interest debt and building wealth faster are not overnight feats, but they are entirely achievable with a disciplined and strategic approach. By systematically tackling your debts, building a strong financial safety net, and then aggressively investing and increasing your income, you can transform your financial future. Start today, stay consistent, and watch as your financial freedom becomes a reality.