Taking Control: Why Eliminating Debt is a Power Move

For many men, carrying credit card debt can feel like a silent burden, a constant drag on financial freedom and future aspirations. But it doesn’t have to be a permanent state. Taking control of your debt is not just about numbers; it’s about reclaiming your financial power and building a foundation for robust personal growth. This isn’t just about paying bills; it’s about strategically outmaneuvering a financial adversary.

Step 1: Confront the Numbers – Know Your Battlefield

You can’t win a battle if you don’t know your enemy. The first, most crucial step is to get a clear, unflinching look at your credit card debt:

- List All Debts: Gather every credit card statement. Create a simple spreadsheet or use a notebook to list each card, the outstanding balance, and, most importantly, the interest rate (APR).

- Stop the Bleeding: Cut up or freeze your credit cards. While you’re aggressively paying down debt, new spending on credit cards is strictly off-limits. Use cash or a debit card for all purchases.

Step 2: Forge a Budget – Your Strategic Financial Blueprint

A budget isn’t about restriction; it’s about direction and control. It’s your financial blueprint that dictates where every dollar goes, ensuring you have enough to live, save, and aggressively repay debt.

- Track Every Dollar: For at least a month, track every single penny you spend. Use an app, a spreadsheet, or even a simple notepad. This reveals where your money is actually going versus where you *think* it’s going.

- Categorize and Cut: Identify essential vs. non-essential spending. Be ruthless. Can you cut back on dining out, subscriptions, or entertainment for a few months? Every dollar freed up is a dollar that can go towards debt.

- Allocate Debt Payments: Clearly define how much extra money you can consistently put towards your credit card debt each month. This isn’t just your minimum payment; it’s the accelerated payment.

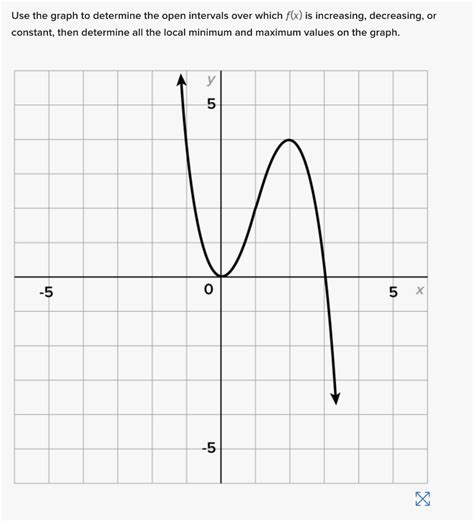

Step 3: Choose Your Weapon – Debt Repayment Strategies

There are two primary, proven strategies for tackling multiple credit card debts:

- The Debt Avalanche Method (Mathematically Optimal): Focus on paying off the card with the highest interest rate first, while making minimum payments on all others. Once the highest-rate card is paid off, take the money you were paying on it and apply it to the next highest-rate card. This saves you the most money on interest over time.

- The Debt Snowball Method (Psychologically Powerful): Focus on paying off the smallest balance first, while making minimum payments on all others. Once the smallest balance is gone, roll that payment amount into the next smallest balance. This provides quick wins and momentum, which can be highly motivating.

- Consider Balance Transfers (Use with Caution): If you have good credit, you might qualify for a 0% APR balance transfer card. This can give you a crucial window (typically 12-18 months) to pay down debt without accruing interest. Be sure to understand the transfer fees and have a concrete plan to pay off the balance before the promotional period ends, as interest rates usually skyrocket afterward.

Step 4: Amplify Your Attack – Boost Income & Slash Expenses

Sometimes, simply budgeting isn’t enough. You need to expand your resources or shrink your footprint.

- Side Hustles & Overtime: Can you pick up extra shifts, freelance, drive for a ride-share service, or offer a skill you have (e.g., handyman services, tutoring)? Every extra dollar earned should go directly to debt.

- Sell Unused Assets: Look around your home. Do you have electronics, tools, sporting equipment, or other items you no longer use? Sell them on marketplaces like eBay, Facebook Marketplace, or local consignment shops.

- Negotiate for Lower Rates: Don’t be afraid to call your credit card companies and ask for a lower interest rate. Explain your commitment to paying off the debt; sometimes they’ll work with you, especially if you have a good payment history.

- Radical Expense Cuts: For a defined period (e.g., 6 months), consider going truly minimalist. Pack lunches, brew coffee at home, cancel non-essential memberships, opt for free entertainment.

Step 5: Stay Consistent and Celebrate Milestones

Eliminating debt isn’t a sprint; it’s a marathon. Consistency is key. Stick to your budget, execute your repayment strategy, and resist the urge to use credit cards for new purchases.

- Track Your Progress: Seeing your balances shrink is incredibly motivating. Update your spreadsheet or debt tracker regularly.

- Reward Small Wins: When you pay off a card, celebrate with a small, non-financial reward (e.g., a special meal cooked at home, a walk in nature, an hour of guilt-free video games). This reinforces positive behavior without derailing your progress.

Reclaim Your Financial Horizon

Eliminating credit card debt fast requires discipline, a clear plan, and consistent action. But the payoff is immense: reduced stress, greater financial flexibility, and the ability to build wealth for your future. By following these actionable steps, you’re not just paying off debt; you’re building a stronger, more resilient financial self. Take charge, implement these strategies, and watch your financial future transform.