Laying the Foundation: Understanding Your Current Financial State

For many men, the journey to financial strength begins with an honest assessment of their current situation. It’s not about judgment, but about clarity. Before you can strategize your escape from debt and build wealth, you need to know exactly where you stand. This involves two critical steps: understanding your debt and tracking your cash flow.

Identify and Categorize Your Debt

Start by listing every single debt you have – credit cards, student loans, car loans, personal loans, mortgages, etc. For each debt, note down:

- The total amount owed

- The interest rate

- The minimum monthly payment

- The due date

This comprehensive overview will reveal which debts are most damaging due to high interest rates, helping you prioritize your attack plan.

Track Your Income and Expenses

Knowing where your money goes is as crucial as knowing where your debt lies. For at least a month, track every dollar you earn and every dollar you spend. Use a spreadsheet, an app, or even a notebook. This exercise often uncovers hidden spending habits and areas where you can cut back without significantly impacting your quality of life. Once you have a clear picture, create a realistic budget that allocates funds for essentials, debt repayment, savings, and discretionary spending.

Strategic Debt Annihilation: Choose Your Weapon

With a clear understanding of your debts, it’s time to choose a strategy to eliminate them efficiently. Two popular methods stand out: the Debt Snowball and the Debt Avalanche.

The Debt Snowball Method

This method focuses on psychological wins. You list your debts from smallest balance to largest. You make minimum payments on all debts except the smallest, on which you throw every extra dollar you can find. Once the smallest debt is paid off, you take the money you were paying on it and add it to the minimum payment of the next smallest debt. This creates a ‘snowball’ effect, building momentum as you knock out debts one by one. It’s great for motivation and keeps you engaged in the process.

The Debt Avalanche Method

This method is mathematically superior. You list your debts from highest interest rate to lowest. You make minimum payments on all debts except the one with the highest interest rate, to which you direct all your extra funds. Once that’s paid off, you move to the next highest interest rate. This approach saves you the most money on interest over time, making it the most cost-effective.

Consider Debt Consolidation and Refinancing

For high-interest debts like credit cards, consolidating them into a single loan with a lower interest rate (e.g., a personal loan, balance transfer credit card, or home equity loan) can simplify payments and reduce overall interest paid. Similarly, refinancing student loans or a mortgage can secure better terms. Always compare the new interest rate, fees, and repayment terms carefully before committing.

Powering Up: Boost Income and Supercharge Savings

Crushing debt isn’t just about cutting expenses; it’s also about increasing your financial firepower. The more money you have coming in, the faster you can pay down debt and build your savings.

Explore Side Hustles and Gigs

Whether it’s freelancing, driving for a ride-share service, consulting, or selling items online, a side hustle can provide a significant boost to your income. Even a few hundred extra dollars a month can make a dramatic difference in accelerating debt repayment or building an emergency fund.

Negotiate Salary and Advance Your Career

Regularly assess your market value. Are you being paid what you’re worth? Don’t be afraid to negotiate your salary or seek promotions. Investing in new skills or certifications can also open doors to higher-paying opportunities, directly impacting your financial trajectory.

Automate Your Savings and Build an Emergency Fund

Make saving non-negotiable by setting up automatic transfers from your checking to your savings account each payday. Prioritize building an emergency fund – ideally 3-6 months’ worth of living expenses. This fund is your financial shield against unexpected job loss, medical emergencies, or significant home/car repairs, preventing you from falling back into debt.

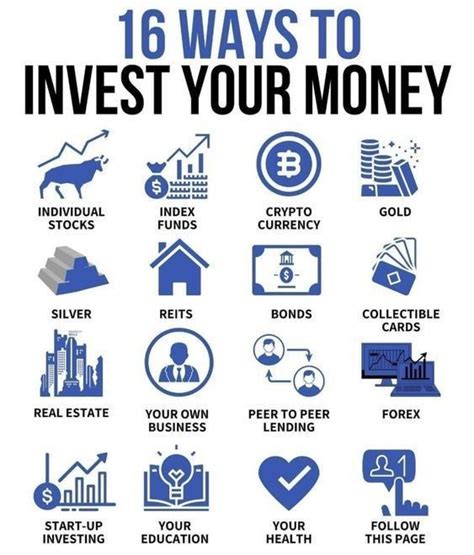

Building Wealth: Smart Investing for Long-Term Growth

Once you’ve made significant progress on debt repayment and established an emergency fund, it’s time to shift focus to building long-term wealth through investing. This is where your money starts working for you.

Understand Basic Investment Vehicles

Familiarize yourself with common investment options: stocks (ownership in companies), bonds (loans to governments or corporations), mutual funds (professionally managed portfolios of stocks/bonds), and Exchange-Traded Funds (ETFs) which are similar to mutual funds but trade like stocks. Start with broad market index funds or ETFs for diversification.

Utilize Retirement Accounts

Maximize contributions to tax-advantaged retirement accounts like a 401(k) (especially if your employer offers a match – that’s free money!) or an Individual Retirement Account (IRA) such as a Roth IRA or Traditional IRA. These accounts offer significant tax benefits that can dramatically boost your long-term growth.

Invest Consistently and for the Long Term

The power of compounding is your best friend. Start investing early, invest consistently, and resist the urge to pull your money out during market fluctuations. A long-term perspective (10+ years) allows your investments to weather ups and downs and grow substantially over time.

Cultivating a Winning Financial Mindset

Financial success isn’t solely about numbers; it’s also about developing the right habits and mindset.

Commit to Continuous Financial Education

The financial world evolves. Stay informed by reading books, reputable financial blogs, and news. Understanding economic trends and investment strategies will empower you to make better decisions.

Practice Patience and Consistency

Building wealth and crushing debt are marathons, not sprints. There will be setbacks, but consistency in your efforts, budgeting, saving, and investing will yield results over time. Avoid get-rich-quick schemes.

Seek Professional Guidance When Needed

Don’t hesitate to consult with a certified financial planner (CFP) or a fee-only financial advisor, especially as your financial situation becomes more complex. They can provide personalized advice, help you create a comprehensive plan, and ensure you’re on track to meet your goals.

Conclusion: Your Path to Financial Sovereignty

Crushing debt and building a robust financial future is an achievable goal for any man willing to commit to the process. It requires discipline, education, and strategic action. By taking a clear inventory of your finances, aggressively tackling debt, boosting your income, automating savings, and investing wisely for the long term, you can transform your financial landscape. Embrace these actionable steps, stay consistent, and unlock a future of financial freedom and security.