The Dual Challenge: Eradicating Debt and Cultivating Riches

For many, high-interest debt feels like a relentless uphill battle, siphoning away hard-earned money and stifling dreams of financial freedom. Yet, it’s entirely possible not only to conquer this debt but to simultaneously lay a robust foundation for wealth. This article outlines an actionable, step-by-step plan to achieve both, transforming your financial landscape from one of burden to one of prosperity.

Step 1: Understand Your Debt Battlefield

Before you can crush your debt, you need to know exactly what you’re up against. This means gathering all your debt statements and listing every single obligation. Focus on:

- Creditor: Who do you owe?

- Current Balance: How much is outstanding?

- Interest Rate: This is crucial – high-interest debts are your primary targets.

- Minimum Payment: What’s the smallest amount you must pay each month?

Once you have this comprehensive list, you can choose a repayment strategy. The two most popular are:

- Debt Avalanche: Prioritize paying off debts with the highest interest rates first. This saves you the most money in the long run.

- Debt Snowball: Pay off the smallest debt first to gain psychological momentum. Once that’s paid, roll its payment into the next smallest debt.

While the avalanche method is mathematically superior, the snowball can be incredibly motivating for those who need quick wins.

Step 2: Aggressive Debt Annihilation

This phase requires unwavering commitment. The goal is to free up as much cash as possible to throw at your high-interest debts.

Craft a Lean, Mean Budget

Go through every single expense. Differentiate between needs and wants. Where can you cut back? Think about:

- Dining out less frequently

- Reducing subscription services

- Finding cheaper alternatives for daily necessities

- Delaying large, non-essential purchases

Every dollar saved is a dollar that can go towards debt repayment.

Boost Your Income

If cutting expenses isn’t enough, consider ways to increase your income. This could involve:

- Taking on a side hustle (freelancing, gig work)

- Asking for a raise at your current job

- Selling unused items around your home

Consider Debt Consolidation or Refinancing

For some, consolidating multiple high-interest debts into a single loan with a lower interest rate can be a game-changer. Options include personal loans or balance transfer credit cards (be wary of fees and introductory period end dates). Always ensure the new interest rate is genuinely lower and that you don’t incur new debt.

Step 3: Building Your Wealth Foundation (Even While in Debt)

While crushing debt is paramount, there are a couple of crucial wealth-building steps you shouldn’t ignore, even if you’re still in debt.

Establish a Mini Emergency Fund

Before aggressively paying down debt, save a small emergency fund (e.g., $1,000-$2,000). This acts as a buffer against unexpected expenses, preventing you from going further into debt when life throws a curveball.

Seize Your Employer Match

If your employer offers a 401(k) match, contribute at least enough to get the full match. This is essentially free money – an immediate, guaranteed return on your investment that you shouldn’t miss out on, even if it means slightly slowing down debt repayment.

Step 4: Accelerating Wealth Accumulation (Post-High-Interest Debt)

Once your high-interest debt is vanquished, the money you were dedicating to payments can now be redirected to turbocharge your wealth growth.

Fully Fund Your Emergency Savings

Expand your mini emergency fund to cover 3-6 months of essential living expenses. This provides significant financial security.

Maximize Retirement Contributions

Increase your contributions to tax-advantaged accounts like your 401(k) and IRA. The power of compounding over decades is immense.

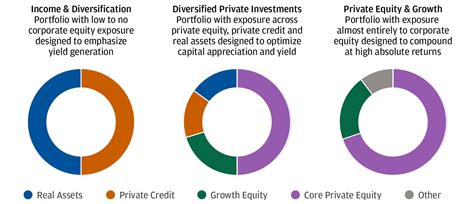

Diversify Your Investments

Beyond retirement accounts, explore other investment vehicles. Consider low-cost index funds or ETFs that offer diversification across various sectors and geographies. Work towards a balanced portfolio that aligns with your risk tolerance and financial goals.

Set and Pursue Long-Term Financial Goals

Whether it’s saving for a down payment on a home, funding your children’s education, or planning for early retirement, having clear goals will provide direction and motivation for your wealth-building efforts.

Step 5: Maintain Momentum and Financial Discipline

Financial freedom isn’t a destination; it’s an ongoing journey. To ensure your wealth continues to grow and your debt stays away, consistent discipline is key.

- Regular Financial Reviews: Annually, or even quarterly, review your budget, investments, and financial goals. Adjust as needed.

- Avoid New Bad Debt: Be vigilant about avoiding high-interest debt. If you must borrow, ensure it’s for an appreciating asset or at a very low, manageable interest rate.

- Continuous Learning: Stay informed about personal finance, investing, and economic trends. The more you know, the better decisions you can make.

- Celebrate Milestones: Acknowledge your progress! Each debt paid off, each savings goal met, is a victory worth recognizing.

Conclusion: Your Path to Financial Empowerment

Crushing high-interest debt and building lasting wealth may seem like a monumental task, but with a clear, actionable plan and consistent effort, it’s an achievable reality. By systematically tackling your debts, making smart financial choices, and committing to long-term discipline, you can transform your financial future and unlock true economic freedom. Start today, and watch your financial destiny unfold.