In today’s fast-paced world, mastering personal finance is a cornerstone of a stable and fulfilling life. For men, taking control of one’s money often means not just earning it, but strategically managing it to build a safety net and eliminate burdensome debt. This guide will walk you through actionable steps to optimize your budget, secure an emergency fund, and aggressively tackle debt, setting you on a path to lasting financial freedom.

Understanding Your Financial Landscape

Before you can optimize, you must understand. The first step in any financial overhaul is a clear, honest assessment of your current situation. This isn’t about judgment, but about gaining clarity.

Assess Current Income & Expenses

Start by listing all your sources of income. Then, meticulously track every single expense. This includes fixed costs like rent/mortgage, utilities, and loan payments, as well as variable costs like groceries, entertainment, and transportation. Many people underestimate their variable spending.

Track Every Dollar

For a month, use a spreadsheet, budgeting app, or even a simple notebook to record where every dollar goes. This exercise is often eye-opening, revealing hidden spending habits that chip away at your financial goals.

Aggressive Budgeting for Maximum Impact

Once you know where your money is going, it’s time to create a budget that aligns with your goals: building an emergency fund and crushing debt. This often requires a more aggressive approach than simply balancing the books.

Slash Unnecessary Expenses

Look critically at your tracked expenses. Where can you cut back? Do you need all those subscriptions? Can you cook at home more often instead of eating out? Are there cheaper alternatives for your phone plan or gym membership? Small cuts accumulate quickly.

The “Why” Behind Your Cuts

Remembering why you’re making these sacrifices – to secure your future and eliminate financial stress – can provide the motivation needed to stick to a leaner budget. Frame these cuts not as deprivation, but as an investment in your financial future.

Building Your Emergency Fund: Your Financial Shield

An emergency fund is non-negotiable. It’s a buffer against unexpected life events like job loss, medical emergencies, or unforeseen home repairs, preventing you from spiraling into new debt.

The “Baby Steps” Approach

Start small. Aim for an initial $1,000 to $2,000 in a separate, easily accessible savings account. This initial fund covers most minor emergencies. Once that’s established, work towards 3-6 months’ worth of living expenses. This larger fund provides substantial peace of mind.

Automate Your Savings

Set up an automatic transfer from your checking account to your emergency fund savings account each payday. This removes the temptation to spend the money and ensures consistent progress. Treat it like a non-negotiable bill.

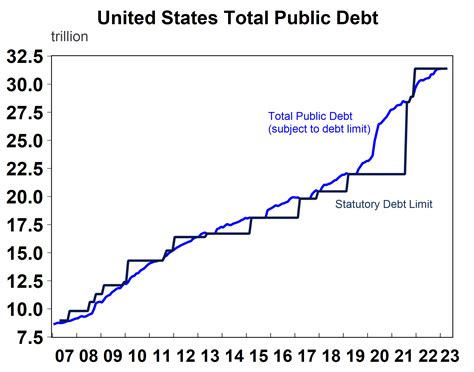

Crushing Debt with Precision

With an emergency fund started, your next major target is debt. High-interest debt, especially, acts like an anchor, pulling down your financial potential.

Debt Snowball vs. Debt Avalanche

Two popular strategies for debt repayment are the Debt Snowball and Debt Avalanche. The Debt Snowball (pay smallest debt first, then roll payments into the next smallest) builds psychological momentum. The Debt Avalanche (pay highest interest debt first) saves the most money in interest over time. Choose the method that best suits your personality and financial discipline.

Negotiate Interest Rates

Don’t be afraid to call your credit card companies or loan providers and ask for a lower interest rate. If you have a good payment history, you might be surprised by their willingness to work with you.

Consider Extra Income

To truly crush debt faster, look for opportunities to increase your income. This could be through a side hustle, freelancing, selling unused items, or taking on extra shifts. Every extra dollar you earn can be directly applied to your debt, accelerating your repayment timeline significantly.

Sustaining Momentum and Looking Ahead

Financial optimization isn’t a one-time event; it’s an ongoing process. Maintaining your momentum is crucial for long-term success.

Regular Budget Reviews

Set aside time each month or quarter to review your budget, track your progress, and make adjustments as needed. Life changes, and so should your budget.

Set Clear Financial Goals

Once your emergency fund is robust and debt is under control, pivot to long-term financial goals: retirement planning, investment, saving for a down payment, or funding future dreams. Clear goals provide direction and motivation.

Optimizing your budget to build an emergency fund and crush debt faster is a powerful journey toward financial independence. It requires discipline, consistency, and a clear understanding of your financial situation. By implementing these strategies, any man can take decisive steps to fortify his financial future, gaining peace of mind and the freedom to pursue his aspirations without the burden of debt.