Achieving financial freedom is a journey that many aspire to, and for men, taking control of their finances can be a powerful step towards building a secure future, providing for their families, and pursuing their passions without monetary constraints. This guide offers a clear, step-by-step approach to tackling debt and building wealth through smart investing.

Step 1: Get Your Financial House in Order

Before you can accelerate your journey to financial freedom, you need a clear picture of your current financial standing. This involves understanding your income, expenses, assets, and liabilities. Start by creating a detailed budget. Track every dollar coming in and going out for at least a month. Categorize your spending to identify areas where you can cut back.

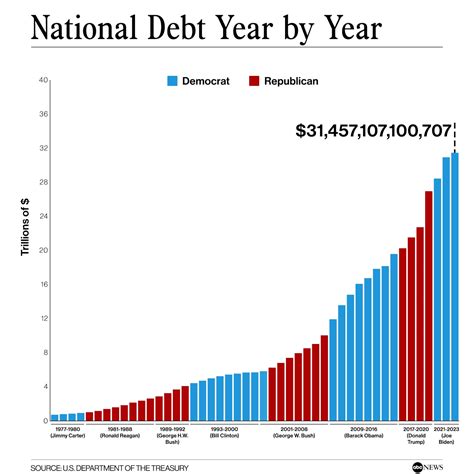

Next, understand your debt. List all your debts, including credit cards, student loans, car loans, and mortgages, noting their interest rates and minimum payments. This transparency is crucial for devising an effective repayment strategy. Finally, begin building an emergency fund. Aim for at least $1,000 to start, eventually working towards 3-6 months’ worth of living expenses. This fund acts as a buffer against unexpected events, preventing you from incurring new debt.

Step 2: Attack High-Interest Debt

High-interest debt, especially from credit cards, can severely impede your financial progress. Focus on eliminating these first. Two popular methods are the Debt Snowball and Debt Avalanche.

- Debt Snowball: Pay off your smallest debt first, then take the payment you were making on that debt and apply it to the next smallest, and so on. This method provides psychological wins, keeping you motivated.

- Debt Avalanche: Pay off the debt with the highest interest rate first, regardless of the balance. This method is mathematically more efficient, saving you the most money in interest over time.

Consider debt consolidation or refinancing options for personal loans or student loans if you can secure a lower interest rate, but be wary of hidden fees and ensure it truly benefits you in the long run. The key is consistency and discipline in making more than the minimum payments.

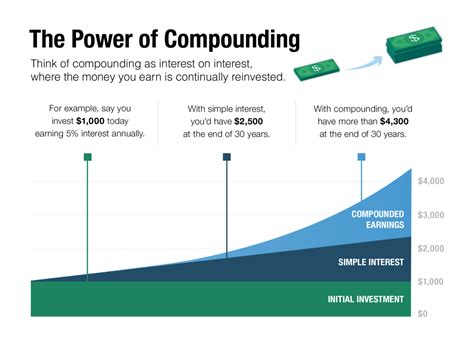

Step 3: Start Investing Early and Consistently

Once you’ve made significant progress on your high-interest debt and established an emergency fund, it’s time to pivot to investing. The power of compound interest is your greatest ally here – the earlier you start, the more time your money has to grow.

Understand Retirement Accounts

Prioritize tax-advantaged retirement accounts:

- 401(k) or 403(b): If offered by your employer, contribute at least enough to get the full company match – it’s free money!

- IRA (Individual Retirement Account): Roth IRAs offer tax-free withdrawals in retirement, while Traditional IRAs offer tax-deductible contributions now.

Explore Index Funds and ETFs

For most men starting out, investing in diversified, low-cost index funds or Exchange Traded Funds (ETFs) is a smart strategy. These funds hold a basket of stocks or bonds, giving you broad market exposure without needing to pick individual winners. They offer diversification and generally outperform actively managed funds over the long term.

Step 4: Diversify and Automate Your Finances

As your investments grow, diversification becomes even more important. Don’t put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate), industries, and geographies to mitigate risk.

The easiest way to ensure consistent saving and investing is to automate it. Set up automatic transfers from your checking account to your savings, emergency fund, and investment accounts. Treat these transfers like bills that must be paid. This removes the temptation to spend the money and ensures your financial plan stays on track, even when life gets busy.

Step 5: Cultivate a Wealth Mindset

Financial freedom isn’t just about numbers; it’s about mindset. Continuously educate yourself on personal finance and investing. Read books, listen to podcasts, and follow reputable financial experts. Stay disciplined and avoid lifestyle inflation – as your income grows, resist the urge to immediately upgrade your lifestyle to match it. Instead, funnel that extra income into savings and investments.

Set clear, long-term financial goals and regularly review your progress. This will keep you motivated and allow you to make necessary adjustments to your plan. Remember, financial freedom is not a destination but an ongoing journey that requires patience, persistence, and continuous learning.

Conclusion

Taking practical steps to pay down debt and invest strategically is a powerful path for men to achieve financial freedom. By gaining control of your budget, aggressively tackling debt, starting to invest early and consistently, diversifying your portfolio, and fostering a disciplined wealth mindset, you can build a robust financial future. It requires commitment and consistency, but the rewards of security, flexibility, and peace of mind are immeasurable.