For many, the idea of financial freedom feels like a distant dream, often overshadowed by the pressing weight of credit card debt. Yet, achieving true financial independence – where your money works for you, rather than the other way around – is an attainable goal. It requires a clear strategy, discipline, and a steadfast commitment to both eradicating debt and intentionally building wealth. The good news is that these two objectives, while seemingly separate, are deeply interconnected and, when tackled correctly, can accelerate your journey to financial peace.

Understanding the Debt Burden

Before you can accelerate your path to freedom, you must first confront what’s holding you back: high-interest credit card debt. Unlike other forms of debt, credit card balances typically come with exorbitant interest rates that can quickly spiral out of control, making it incredibly difficult to make meaningful progress. Each payment often feels like it’s barely scratching the surface, with a large portion eaten by interest. This not only saps your financial resources but also takes a toll on your mental and emotional well-being.

Recognizing the corrosive nature of this debt is the first critical step. It’s not just a balance on a statement; it’s a barrier to saving, investing, and truly living the life you envision. Therefore, aggressively tackling this debt must be the absolute priority, laying the essential groundwork for any future wealth-building efforts.

Phase 1: Eradicating High-Interest Debt

Your journey to financial freedom begins with a laser focus on debt elimination. This isn’t just about making minimum payments; it’s about creating an actionable plan to systematically crush your balances.

Assess and Budget

Start by gathering all your credit card statements. List every card, its balance, and most importantly, its interest rate. This clear picture will help you understand the full scope of your challenge. Next, create a detailed budget. This means tracking every dollar that comes in and goes out. Identify areas where you can cut expenses – perhaps temporarily reducing dining out, subscriptions, or entertainment – to free up as much money as possible for debt repayment. Every extra dollar allocated to debt is a dollar saved from future interest.

Choose Your Strategy

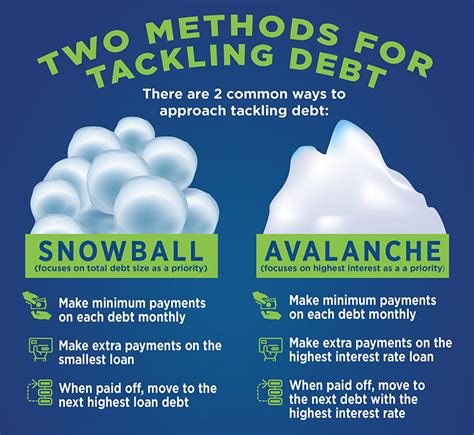

There are two primary, proven strategies for debt repayment:

- Debt Snowball Method: List your debts from smallest balance to largest. Focus all extra payments on the smallest debt while making minimum payments on the others. Once the smallest is paid off, take the money you were paying on it and add it to the payment for the next smallest debt. This method provides psychological wins early on, keeping you motivated.

- Debt Avalanche Method: List your debts from highest interest rate to lowest. Focus all extra payments on the debt with the highest interest rate first, while making minimum payments on the others. This method is mathematically optimal as it saves you the most money in interest over time.

Choose the method that best aligns with your personality and stick with it. Some people prefer the quick wins of the snowball, while others are motivated by the greater financial efficiency of the avalanche. Both are effective if applied consistently.

Phase 2: Building a Wealth Foundation

Once your high-interest credit card debt is largely under control or completely eliminated, you shift gears from defense to offense. This is where you begin to strategically build your financial future.

Establish Your Emergency Fund

Before diving into investments, prioritize building a robust emergency fund. This fund, ideally 3-6 months’ worth of essential living expenses, should be held in an easily accessible, liquid account (like a high-yield savings account). It acts as a crucial buffer against unexpected job loss, medical emergencies, or car repairs, preventing you from falling back into debt. Without this safety net, one unforeseen event could derail all your hard-earned progress.

Invest for Growth

With an emergency fund in place, it’s time to put your money to work through investing. The power of compound interest – earning returns on your returns – is your greatest ally in wealth building. Start by contributing to tax-advantaged retirement accounts like a 401(k) (especially if your employer offers a match – that’s free money!) and an IRA (Roth or traditional). These accounts offer significant tax benefits that can dramatically boost your long-term growth.

Beyond retirement accounts, consider opening a brokerage account to invest in a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs). Diversification across various asset classes (stocks, bonds, real estate) and geographies is key to mitigating risk and achieving steady growth. Remember, investing is a marathon, not a sprint; consistency and patience are far more important than trying to time the market.

Maintaining Your Financial Journey

Financial freedom isn’t a destination you arrive at and then stop. It’s an ongoing journey that requires continuous attention and adaptation. Regularly review your budget, track your net worth, and adjust your investment strategy as your life circumstances and goals evolve. Stay committed to avoiding new high-interest debt and continuously educate yourself about personal finance. The more you learn, the more empowered you become to make smart financial decisions.

Conclusion

The fastest path to financial freedom isn’t a secret formula, but rather a disciplined, two-step process: ruthlessly eliminating credit card debt and then strategically building wealth. By first severing the ties that bind you to high-interest payments, you free up significant capital to then fund your future. With an emergency fund as your shield and smart investments as your engine, you can transform your financial life from one of struggle to one of abundance. The journey demands effort and patience, but the destination – a life lived on your own terms – is undoubtedly worth every step.