The Indispensable Role of Mindset in Overcoming Life’s Hurdles

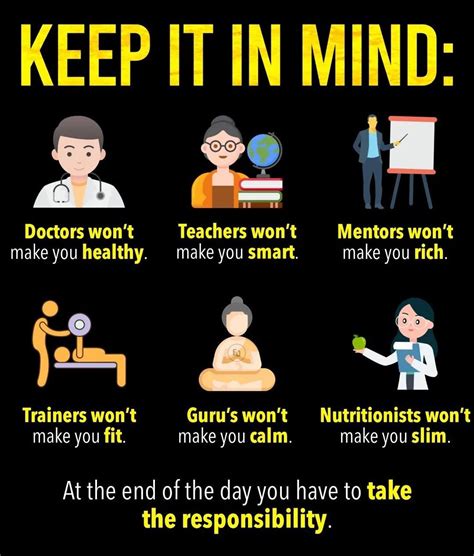

Life is an unpredictable journey, and setbacks are not a question of ‘if’ but ‘when.’ Whether it’s a fitness plateau, an injury, unexpected financial expenditure, or market volatility, our ability to bounce back is often less about external circumstances and more about our internal framework. The mind is a powerful tool, and specific mindset shifts can act as a psychological armor, fortifying both our physical health and financial stability against adversity.

Embrace a Growth Mindset Over a Fixed One

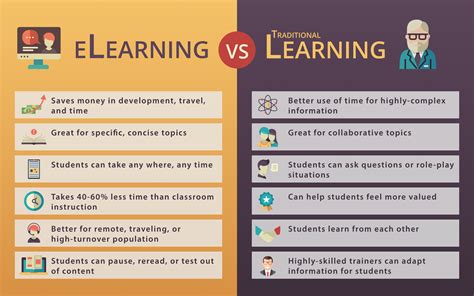

A fundamental shift is moving from a fixed mindset to a growth mindset. A fixed mindset believes abilities are inherent and unchangeable, leading to despair when challenges arise. A growth mindset, however, sees challenges as opportunities to learn and develop. In fitness, this means viewing an injury not as the end of your journey, but as a chance to explore new forms of exercise, focus on rehabilitation, or learn more about your body. Financially, a market downturn isn’t just a loss, but an opportunity to re-evaluate your portfolio, learn about investment strategies, or identify new savings avenues.

Cultivate Long-Term Vision and Delayed Gratification

Short-term thinking often leads to impulsive decisions that undermine long-term goals. Developing a robust long-term vision for both your fitness and financial health can make you impervious to immediate setbacks. For fitness, this means prioritizing sustainable habits over quick-fix diets or intense, injury-prone workouts. You understand that progress is a marathon, not a sprint, and a few missed workouts won’t derail years of effort.

Financially, this translates to prioritizing saving and investing for future goals – retirement, a down payment, education – over instant gratification like unnecessary purchases. When an unexpected expense arises, your long-term vision reminds you why you built an emergency fund, providing a buffer that prevents a single setback from becoming a crisis.

Practice Acceptance and Adaptability

Some things are beyond our control. A crucial mindset shift is the ability to accept what cannot be changed and adapt proactively. In fitness, this could mean accepting an aging body requires different forms of exercise, or that a busy schedule means shorter, more frequent workouts. Instead of lamenting what was, you adapt to what is.

Financially, this adaptability is vital. A job loss, a medical emergency, or an economic recession demands a pivot. Instead of clinging to outdated plans, an adaptable mindset allows you to adjust your budget, explore new income streams, or re-strategize investments without being paralyzed by fear or regret.

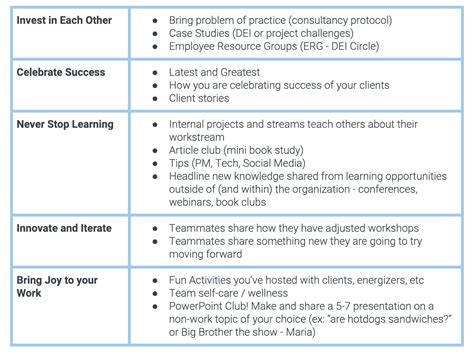

Develop Proactive Planning and Scenario Thinking

While we can’t predict everything, we can certainly plan for potential scenarios. This proactive mindset involves anticipating challenges and building safeguards. For fitness, this might mean having a backup workout plan for bad weather, or cross-training to prevent overuse injuries. It’s about building a robust system that accounts for minor disruptions.

Financially, this is the cornerstone of resilience: building an emergency fund, having adequate insurance, and diversifying investments. This mindset shift views these as essential components of stability, not optional extras. When a setback hits, you’re not scrambling; you’re executing a pre-conceived plan.

![[Webinar April 18] Proactive Planning: How to help your clients gain ...](/images/aHR0cHM6Ly90czQubW0uYmluZy5uZXQvdGg/aWQ9T0lQLmxOekoxdkM5VnVMUEdIbjBCZGF0eWdIYUU4JnBpZD0xNS4x.webp)

Nurture Self-Compassion and Learn from Setbacks

It’s easy to be self-critical when we falter. However, a crucial mindset shift involves treating ourselves with the same kindness and understanding we’d offer a friend. In fitness, if you miss a week of workouts or overindulge, self-compassion means acknowledging it without judgment, learning from the experience, and gently getting back on track, rather than abandoning your goals entirely.

Financially, a bad investment or an unexpected expense can trigger regret. Instead of dwelling on mistakes, a resilient mindset allows you to analyze what went wrong, understand the lessons, and apply them to future decisions without letting past errors define your future financial health.

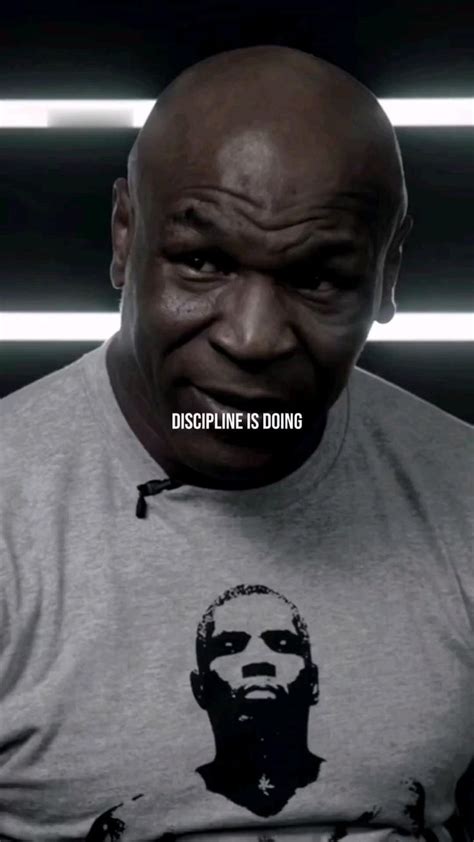

The Power of Consistency, Even Small Steps

Finally, understanding that resilience is built through consistent, small actions, not heroic feats, is a powerful mindset shift. In fitness, showing up for a 15-minute walk on a day you don’t feel like a full workout still contributes to your overall health. Financially, consistently saving a small amount, even during lean times, builds momentum and compounds over time. It’s the belief that every small effort counts and contributes to a stronger, more resilient future.

![[Video] How to make small, consistent progress today? #SmallActions # ...](/images/aHR0cHM6Ly90czIubW0uYmluZy5uZXQvdGg/aWQ9T0lQLjMxRUdvMUx1ZktaeHFaNDJnTlRsMXdBQUFBJnBpZD0xNS4x.webp)

Conclusion

Building fitness and financial resilience isn’t about avoiding setbacks; it’s about developing the mental fortitude to navigate them effectively. By cultivating a growth mindset, embracing long-term vision, practicing adaptability, engaging in proactive planning, nurturing self-compassion, and valuing consistent small steps, you can equip yourself with the psychological tools needed to not only withstand life’s inevitable challenges but to emerge from them stronger and more capable than before.