Achieving financial freedom is a goal many men aspire to, yet the path can often seem daunting. It’s not just about earning more; it’s about strategic planning, disciplined execution, and cultivating a robust financial mindset. This guide outlines actionable steps specifically tailored to help men build wealth, secure their future, and achieve true financial independence.

Laying the Foundation: Mastering Your Finances

Before you can build, you must first understand your current financial landscape. This foundational phase is crucial for identifying areas of improvement and setting realistic goals.

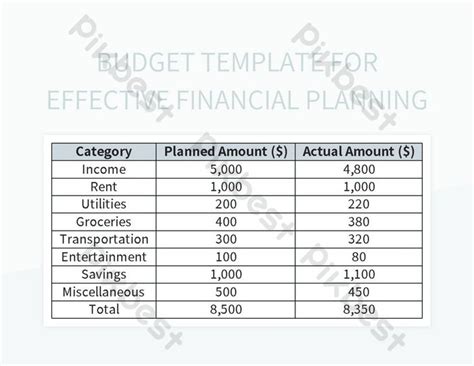

Start by creating a detailed budget and tracking every dollar. Use apps, spreadsheets, or even a pen and paper to categorize your income and expenses. This clarity will reveal where your money is actually going and highlight areas where you can cut back or reallocate funds. Knowledge is power, and knowing your cash flow is the first step to controlling it.

Next, tackle high-interest debt aggressively. Credit card debt, personal loans, or any other high-interest obligations act as anchors, preventing you from building momentum. Prioritize paying these off using strategies like the debt snowball or debt avalanche method. Eliminating this burden frees up capital for investments and accelerates your journey to financial freedom.

Simultaneously, build a robust emergency fund. Aim for at least 3-6 months’ worth of living expenses saved in an easily accessible, high-yield savings account. This fund acts as a financial safety net, protecting you from unexpected job loss, medical emergencies, or other unforeseen circumstances without derailing your long-term financial plan.

Accelerating Growth: Smart Investing Strategies

Once your foundation is solid, it’s time to put your money to work for you. Investing is the cornerstone of wealth building and essential for outpacing inflation.

Educate yourself on basic investment principles, such as compound interest and diversification. Compound interest is often called the eighth wonder of the world – money earning money, which then earns more money. Diversification means spreading your investments across various asset classes to minimize risk. Don’t put all your eggs in one basket.

Consider long-term investment vehicles like index funds or exchange-traded funds (ETFs). These offer broad market exposure, low fees, and typically outperform actively managed funds over the long run. They are an excellent way for most men to invest without needing to become a stock market expert.

Maximize contributions to retirement accounts. If your employer offers a 401(k) or similar plan, contribute at least enough to get the full company match – that’s free money! Beyond that, fully fund an Individual Retirement Account (IRA), choosing between Roth or Traditional based on your income and tax situation. These tax-advantaged accounts are powerful tools for long-term wealth accumulation.

Boosting Income: Beyond the Paycheck

While cutting expenses and investing smartly are crucial, increasing your income significantly accelerates your path to financial freedom.

Focus on continuous skill development and career advancement. Identify high-demand skills in your industry or learn new ones that can lead to promotions, higher-paying jobs, or opportunities for entrepreneurship. Invest in courses, certifications, or advanced degrees that enhance your market value.

Explore side hustles and passive income streams. This could be anything from freelancing in your area of expertise, driving for a ride-share service, creating digital products, or investing in real estate. The goal is to diversify your income sources, making you less reliant on a single paycheck and providing additional capital for savings and investments.

For the ambitious, consider entrepreneurship. Starting your own business, even a small one, can offer unparalleled income potential and control over your financial destiny. Begin small, validate your ideas, and scale thoughtfully.

Protecting Your Assets and Future

Wealth building isn’t just about accumulation; it’s also about protection. Safeguarding your assets ensures that unforeseen events don’t erode your hard-earned progress.

Ensure you have essential insurance policies in place. This includes health insurance, life insurance (especially if you have dependents), and disability insurance to protect your income in case you can’t work. Review your policies regularly to ensure they meet your current needs.

Don’t neglect basic estate planning. While it might seem like a distant concern, having a will, designating beneficiaries for your accounts, and potentially setting up power of attorney can save your loved ones significant stress and financial burden down the line. It ensures your assets are distributed according to your wishes.

Cultivating a Wealth Mindset

Ultimately, building wealth and achieving financial freedom is as much about mindset as it is about mechanics. Your attitude towards money and your long-term vision are critical determinants of success.

Commit to continuous financial learning. Read books, listen to podcasts, follow reputable financial experts, and stay informed about economic trends. The more you know, the better decisions you can make.

Practice delayed gratification and avoid lifestyle inflation. As your income grows, resist the urge to immediately upgrade your lifestyle proportionally. Instead, use extra income to save and invest more. Understand that true financial freedom often means living below your means in the present to build a richer future.

Building wealth and achieving financial freedom for men is a journey that requires discipline, education, and consistent action. By laying a strong financial foundation, investing wisely, actively boosting your income, protecting your assets, and cultivating a growth-oriented mindset, you can systematically work towards a future of financial independence and security. Start today, stay consistent, and watch your financial future transform.