The Interplay of Discipline: Why Gym Habits Echo in Your Wallet

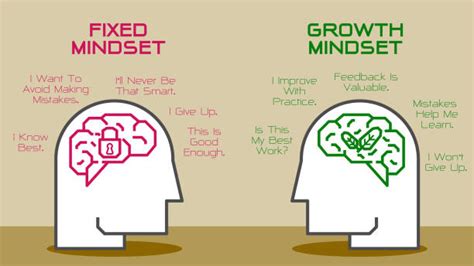

Many men grapple with the dual challenges of consistently showing up at the gym and effectively growing their financial portfolios. Both areas often fall victim to procrastination, short-term thinking, and a lack of consistent effort. However, there’s a powerful, often overlooked mindset shift that can unlock success in both arenas: treating your personal well-being and financial future as interconnected, long-term investments rather than standalone tasks.

This isn’t just about willpower; it’s about fundamentally reframing how you approach challenges and opportunities. By adopting an ‘investor’s mindset’ towards your body and your money, you cultivate a discipline that pays dividends across all aspects of your life.

From Instant Gratification to Long-Term Returns

The modern world thrives on instant gratification. We want quick results, immediate pleasure, and minimal effort. This mindset is a direct saboteur of both fitness goals and wealth accumulation. Building a strong physique and a robust financial foundation demands patience, consistency, and the ability to delay gratification for greater future rewards.

Cultivating the Investor’s Mindset in Fitness

Instead of viewing a workout as an hour of discomfort, see it as an investment in your physical health, mental clarity, and longevity. Each rep, each run, each stretch is a deposit into your ‘health bank account.’ The returns aren’t just aesthetic; they include increased energy, reduced stress, better sleep, and a lower risk of future health issues – all of which directly impact your ability to earn and enjoy life.

Applying it to Financial Prosperity

Similarly, shift your perspective on saving and investing. Every dollar saved, every wise investment made, is a ‘capital injection’ into your future self. It might not feel exciting in the moment, much like the burning sensation during a final set, but the compounding returns over years and decades are truly transformative. It requires resisting the urge for impulsive purchases and committing to a systematic approach.

The Discipline Dividend: Systems Over Motivation

Relying solely on motivation is a losing game. Motivation is fleeting; discipline, however, is a muscle that strengthens with use. The key mindset shift is moving from ‘I’ll work out when I feel like it’ or ‘I’ll save if there’s money left over’ to ‘This is part of my non-negotiable system.’

Building Unstoppable Gym Habits

- Schedule it: Treat gym time like an essential appointment you cannot miss.

- Start small: Don’t aim for perfection initially. A 15-minute walk is better than nothing.

- Track progress: Seeing tangible improvements, no matter how small, reinforces consistency.

- Accountability: Find a gym buddy or trainer, or simply tell a friend your goals.

Cultivating Financial Acumen and Growth

- Automate savings: Set up automatic transfers to your savings or investment accounts.

- Budgeting as a tool: View budgeting not as restriction, but as a roadmap to your financial goals.

- Educate yourself: Understand basic investment principles; knowledge builds confidence and reduces fear.

- Review regularly: Just like checking your fitness progress, regularly review your financial standing.

Embracing Productive Discomfort

Both effective workouts and smart financial decisions often involve a degree of discomfort. Pushing through a challenging set, denying yourself an impulse purchase, or having difficult conversations about money can be uncomfortable. The mindset shift here is to redefine discomfort not as a barrier, but as a signal of growth.

In the gym, discomfort signifies muscle adaptation and strength building. In finance, it represents the discipline required to build long-term security. Learning to sit with and push through this productive discomfort is a hallmark of success in both domains, training your mind to prioritize future rewards over immediate ease.

The Synergy: How Fitness Fuels Financial Success

The connection between physical well-being and financial prosperity isn’t coincidental:

- Increased Energy & Focus: Regular exercise boosts energy levels and cognitive function, making you more productive at work and better equipped to make sound financial decisions.

- Reduced Stress: Physical activity is a powerful stress reliever. Less stress often leads to clearer thinking and reduced impulsive spending.

- Improved Health, Lower Costs: A healthy body means fewer medical bills, fewer sick days, and a longer, more active working life.

- Enhanced Confidence & Discipline: Achieving fitness goals builds self-efficacy and discipline, qualities that seamlessly transfer to managing money and pursuing career advancement.

Conclusion: Invest in Yourself, Reap the Rewards

Beating gym procrastination and building wealth isn’t about finding a magic bullet; it’s about a fundamental mindset shift. It’s about recognizing that your body and your bank account are both vital assets that require consistent, disciplined investment. By adopting a long-term, investor’s perspective and prioritizing systems over fleeting motivation, men can transform their approach to health and wealth simultaneously.

Start small, stay consistent, embrace productive discomfort, and watch as the discipline you cultivate in one area spills over, empowering you to achieve remarkable results in all aspects of your life. The greatest investment you can make is in yourself.