The High-Interest Debt Trap: How to Break Free

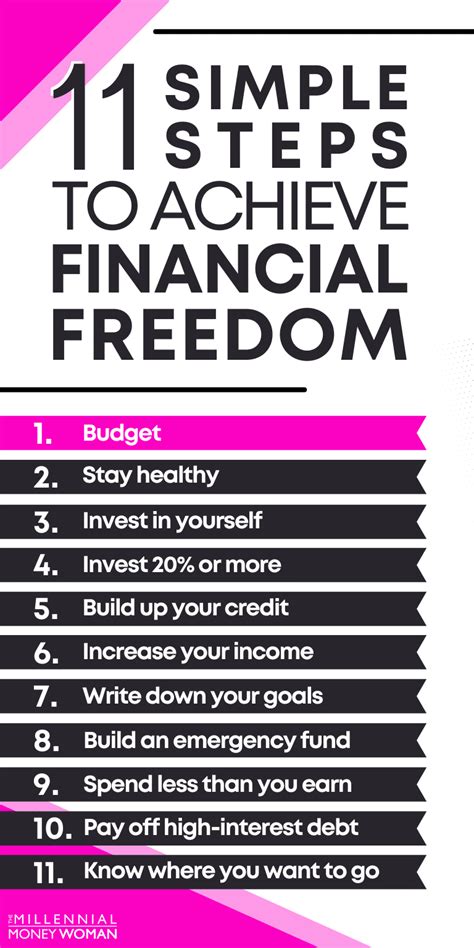

High-interest debt, often from credit cards, personal loans, or store cards, can feel like a heavy anchor dragging down your financial aspirations. The rapid accumulation of interest makes it incredibly difficult to make progress, creating a cycle of frustration and stress. However, achieving financial freedom is not just a dream; it’s an achievable goal with the right strategy and consistent effort. This article will outline actionable steps to crush high-interest debt and pave your way to lasting financial stability.

Step 1: Confront Your Debt Reality

Before you can tackle your debt, you need to understand its full scope. Gather all your statements for credit cards, personal loans, and any other high-interest debts. Create a detailed list including the creditor, current balance, interest rate (APR), and minimum monthly payment for each. Prioritizing debts by interest rate will be crucial for an effective repayment strategy.

Knowing exactly what you owe and to whom is the first, most critical step. This clarity will empower you to make informed decisions rather than feeling overwhelmed by the unknown. You might be surprised by how much of your minimum payment is going directly to interest, underscoring the urgency of tackling these debts.

Step 2: Forge a Strict, Realistic Budget

A budget is your roadmap to financial control. Start by tracking every dollar you earn and every dollar you spend for a month. Categorize your expenses into ‘needs’ (housing, food, utilities, transportation) and ‘wants’ (dining out, entertainment, subscriptions). Once you have a clear picture, identify areas where you can cut back significantly.

The goal here is to free up as much money as possible to direct towards your high-interest debt. Be ruthless but realistic; sustainable cuts are better than drastic, short-lived ones. Small sacrifices in the ‘wants’ category can add up to substantial extra payments that accelerate your debt repayment.

Step 3: Choose Your Debt Repayment Strategy: Snowball or Avalanche

Once you have extra funds, you need a method to apply them. Two popular and effective strategies are the Debt Snowball and Debt Avalanche:

- Debt Snowball Method: List your debts from smallest balance to largest. Pay the minimum on all debts except the smallest, on which you throw all your extra money. Once the smallest debt is paid off, take the money you were paying on it (minimum + extra) and apply it to the next smallest debt. This method provides psychological wins, keeping you motivated.

- Debt Avalanche Method: List your debts from highest interest rate to lowest. Pay the minimum on all debts except the one with the highest interest rate, on which you throw all your extra money. Once that’s paid off, move to the next highest interest rate. This method saves you the most money on interest over time.

Choose the method that best suits your personality. The avalanche saves money, but the snowball offers early motivation. Either way, consistency is key.

Step 4: Boost Your Income & Accelerate Payments

Beyond cutting expenses, increasing your income can dramatically speed up your debt repayment. Consider options like:

- Taking on a side hustle (freelancing, gig work, selling crafts).

- Working overtime at your current job.

- Selling unused items around your house (clothing, electronics, furniture).

- Asking for a raise or seeking a higher-paying job.

Every additional dollar you can direct towards your high-interest debt is a dollar that reduces the principal faster, thereby reducing the total interest you’ll pay and shortening your repayment timeline.

Step 5: Explore Debt Consolidation or Refinancing

For some, consolidating or refinancing high-interest debt can be a game-changer. This involves taking out a new loan (often a personal loan or a balance transfer credit card) at a lower interest rate to pay off multiple high-interest debts. This simplifies your payments into one monthly bill and, more importantly, reduces the overall interest you pay.

Caveats: Be cautious with balance transfer cards – ensure you can pay off the balance before the promotional 0% APR period ends. For personal loans, always compare interest rates and fees. Only pursue consolidation if it genuinely lowers your interest rate and you commit to not accumulating new debt.

Step 6: Build a Starter Emergency Fund (Crucial Step)

While aggressively paying down debt, it’s vital to simultaneously build a small emergency fund. Aim for at least $500 to $1,000. This fund acts as a buffer against unexpected expenses (car repair, medical bill) that could otherwise force you back into high-interest debt.

Having even a small safety net prevents the frustrating cycle of making progress on debt only to incur new debt when life inevitably happens. Once your high-interest debt is conquered, you can then focus on building a more robust emergency fund (3-6 months of living expenses).

Step 7: Automate Savings & Investments for Lasting Freedom

Once your high-interest debt is crushed, don’t revert to old habits. Redirect the money you were using for debt payments into automated savings and investment accounts. Set up automatic transfers to a retirement account (401k, IRA), a general investment account, and a high-yield savings account for future goals.

This is where lasting financial freedom truly begins. By consistently saving and investing, you’ll build wealth, generate passive income, and gain the security and flexibility to live life on your terms. Review your financial goals regularly and adjust your automation as your income and expenses change.

Step 8: Stay Consistent & Celebrate Milestones

The journey to debt freedom and financial independence is a marathon, not a sprint. There will be good months and challenging ones. Stay consistent with your budget and repayment plan. Celebrate small victories – paying off a credit card, hitting an emergency fund goal, or making an extra payment – to maintain motivation.

Surround yourself with supportive individuals and educate yourself continuously on personal finance. The discipline you develop during this period will serve as a powerful foundation for all your future financial endeavors.

Conclusion

Crushing high-interest debt and building lasting financial freedom requires commitment, discipline, and a clear plan. By understanding your debt, budgeting effectively, choosing a smart repayment strategy, boosting your income, using consolidation wisely, building an emergency fund, and finally automating your savings, you can systematically dismantle your debt and construct a robust financial future. Start today, stay persistent, and enjoy the profound peace that comes with financial independence.