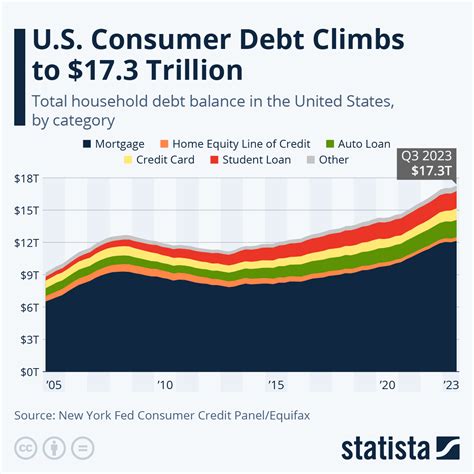

Confronting the Credit Card Beast: A Man’s Guide to Rapid Debt Elimination

For many men, managing finances is about building a secure future, providing, and achieving independence. High-interest credit card debt, however, can feel like a heavy anchor dragging down those aspirations. It’s not just a number; it’s a source of stress, limited opportunities, and delayed dreams. But you’re not powerless. This guide is designed for men ready to take decisive action, offering proven strategies to not just manage, but to absolutely crush high-interest credit card debt, and do it fast.

Understanding the Real Threat: High-Interest Rates

Before you can defeat an enemy, you need to understand it. High-interest credit card debt is particularly insidious because the interest itself compounds rapidly, often making minimum payments barely cover the interest, let alone reduce the principal. This creates a frustrating cycle where you feel like you’re treading water. The first step to crushing this debt is acknowledging its power and committing to stop feeding it.

Strategy 1: Attack with the Debt Avalanche Method

While the debt snowball method (paying off smallest debts first for motivational wins) has its merits, when it comes to high-interest credit card debt, the debt avalanche is your most potent weapon. This strategy focuses on prioritizing debts by their interest rate, paying off the one with the highest rate first, while making minimum payments on all others.

- List All Debts: Get a clear picture. List every credit card debt, its outstanding balance, and its interest rate (APR).

- Order by APR: Arrange your list from the highest interest rate to the lowest.

- Focus on the Top: Direct all extra money you can muster towards the card with the highest APR. Make only minimum payments on the rest.

- Roll Over: Once the highest-interest card is paid off, take the money you were paying on it and add it to the minimum payment of the next highest-interest card. This creates a powerful snowball (or avalanche) effect, accelerating your repayment.

This method saves you the most money in interest over the long run, leading to a faster overall debt-free date.

Strategy 2: Free Up Cash Flow Aggressively

To make the debt avalanche truly effective, you need extra money to throw at your highest-interest debt. This isn’t about minor adjustments; it’s about finding significant funds. Think of it as a financial boot camp.

Trim the Fat: Budgeting and Expense Reduction

Go through your budget with a fine-tooth comb. Every dollar counts. Identify non-essential spending that can be temporarily cut or significantly reduced.

- Subscription Purge: Are you using every streaming service, gym membership, or app subscription? Cancel what you don’t absolutely need.

- Dining Out & Entertainment: Drastically reduce restaurant meals, takeout, and expensive leisure activities. Cook at home, find free or low-cost entertainment.

- Discretionary Spending: Postpone purchases of new gadgets, clothes, or hobbies until your debt is under control.

Boost Your Income: Hustle Harder

Increasing your income can be the fastest way to accelerate debt repayment, especially if your budget is already lean.

- Side Gigs: Explore freelancing, ride-sharing, delivery services, consulting, or selling items online. Even a few hundred extra dollars a month can make a massive difference.

- Overtime/Extra Shifts: If your job offers it, volunteer for extra hours.

- Sell Unused Items: Declutter your home and sell anything of value you no longer need on platforms like eBay, Facebook Marketplace, or local consignment shops.

Negotiate Interest Rates

It sounds simple, but it works surprisingly often. Call your credit card companies and ask for a lower interest rate. Explain your commitment to paying off the debt and your financial situation. If you have a good payment history, they might be willing to work with you to keep you as a customer.

Strategy 3: Strategic Debt Consolidation (Use with Caution)

Consolidating high-interest debt can be a powerful tool, but it requires discipline. The goal is to move multiple high-interest debts into a single, lower-interest payment.

Balance Transfer Credit Cards

Look for credit cards offering a 0% APR introductory period on balance transfers. This can give you 12-18 months (or more) to pay down a significant portion of your debt without incurring any interest charges. Be extremely cautious:

- Avoid New Spending: Do NOT use the new card for new purchases. Focus solely on paying off the transferred balance.

- Understand Fees: Most balance transfers come with a fee (typically 3-5% of the transferred amount). Factor this into your decision.

- Plan for the End Date: Ensure you have a solid plan to pay off the balance before the 0% APR period expires.

Personal Loans

A personal loan, especially from a credit union, can offer a lower fixed interest rate than your credit cards. This converts multiple revolving debts into a single, predictable installment loan with a clear payoff date. Again, the discipline to not rack up new credit card debt is paramount.

Strategy 4: The Mental Game – Discipline and Persistence

Crushing debt isn’t just about numbers; it’s about mental fortitude. It requires a sustained effort and a shift in mindset.

- Set Clear Goals: Define your exact payoff date. Visualize yourself debt-free.

- Track Your Progress: Seeing balances shrink is incredibly motivating. Use apps, spreadsheets, or even a physical chart.

- Celebrate Milestones: Acknowledge and celebrate small wins along the way. Paying off one card is a huge accomplishment!

- Stay Accountable: Share your goals with a trusted friend, partner, or mentor who can offer support and keep you on track.

Remember, this is a temporary sprint towards long-term financial freedom. The sacrifices you make now will pave the way for a more secure and less stressful future.

Your Path to Financial Freedom Starts Now

High-interest credit card debt doesn’t have to be a permanent fixture in your life. By adopting an aggressive, disciplined approach – utilizing the debt avalanche, aggressively increasing cash flow, strategically consolidating, and maintaining a strong mindset – you can systematically dismantle your debt. It will take effort, focus, and sacrifice, but the freedom and control you gain are immeasurable. Take charge, make a plan, and start crushing that debt today. Your future self will thank you for it.