Retirement planning often feels like navigating a complex maze, and for men, the pressure to secure a comfortable future can be particularly acute. A common question that arises is: “How much should I invest monthly?” The answer, while not one-size-fits-all, can be determined by carefully considering several critical factors. Taking control of your financial future starts with understanding these variables and making informed decisions today.

Understanding Your Retirement Horizon and Goals

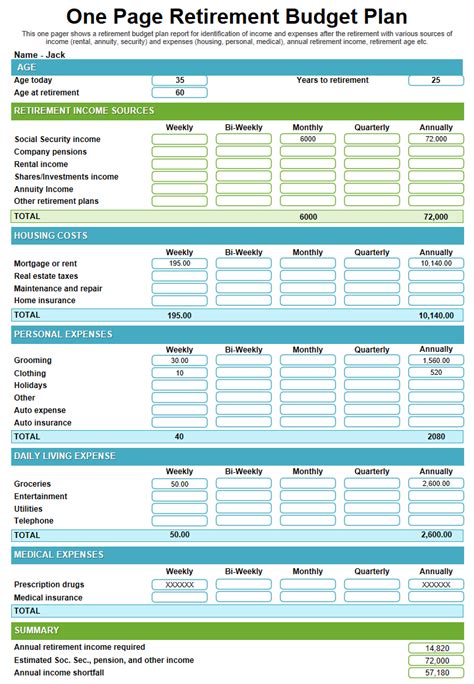

Before you can pinpoint a specific monthly investment amount, you need a clear vision of your retirement. What age do you plan to retire? What kind of lifestyle do you envision? Will you travel extensively, pursue new hobbies, or simply enjoy a quiet life at home? Your desired lifestyle directly influences your estimated annual expenses in retirement, which forms the bedrock of your savings goal.

Consider the impact of inflation over decades. A comfortable income today will need to be significantly higher in 20-30 years to maintain the same purchasing power. Factoring in potential healthcare costs, which tend to rise with age, is also crucial for a realistic retirement budget.

Key Factors Influencing Your Monthly Investment Amount

Several personal and economic factors will shape how much you need to contribute regularly:

Your Current Age and Time Horizon

The younger you start, the less you generally need to invest each month, thanks to the power of compound interest. A 25-year-old has 40 years to save for retirement, while a 45-year-old has only 20 years. This shorter time horizon means the 45-year-old will need to contribute significantly more each month to reach the same target.

Desired Retirement Lifestyle and Expenses

Estimate your annual expenses in retirement. Will it be 70% of your pre-retirement income, or do you aspire to a more luxurious lifestyle requiring 100% or more? Use online retirement calculators to project these costs, accounting for inflation.

Current Savings and Debts

Take stock of what you’ve already saved and any outstanding high-interest debts. Prioritizing debt repayment can free up more capital for investments. Existing savings give you a head start, potentially reducing future monthly contributions.

Risk Tolerance and Expected Investment Returns

Your comfort level with investment risk affects the potential growth of your portfolio. Higher-risk investments often promise higher returns but come with greater volatility. Younger investors typically have a higher risk tolerance, allowing them to invest more aggressively. As you approach retirement, a more conservative approach is often recommended.

General Rules of Thumb and How to Personalize Them

While individual circumstances vary, several general guidelines can offer a starting point:

- The 10-15% Rule: Many financial experts suggest saving at least 10-15% of your pre-tax income for retirement throughout your career. This includes employer contributions like 401(k) matches. If you start later, you might need to aim for 20% or more.

- The “Age 30, 1x Salary” Rule: A common benchmark is to have savings equal to your annual salary by age 30, 3x by 40, 6x by 50, and 8-10x by 60/67. This gives a rough idea of whether you’re on track.

- Catch-Up Contributions: If you’re 50 or older, the IRS allows you to make additional “catch-up” contributions to 401(k)s and IRAs, significantly boosting your savings in the years leading up to retirement.

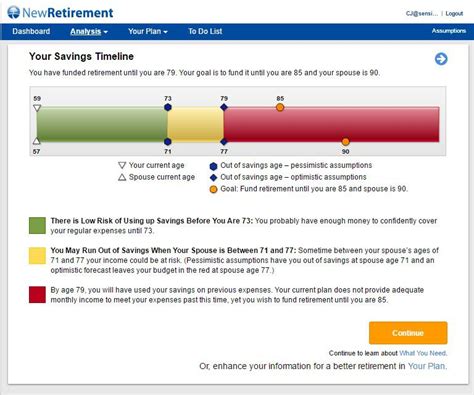

To personalize these rules, utilize online retirement calculators. Input your age, current savings, desired retirement age, and expected expenses. These tools can project different scenarios and recommend a monthly savings amount to meet your goal.

Maximizing Your Investment Vehicles

Choosing the right accounts for your retirement savings is as important as the amount you invest. Leverage tax-advantaged accounts first:

- 401(k) or 403(b): If offered by your employer, contribute at least enough to get the full employer match – it’s free money! These contributions are typically pre-tax, reducing your current taxable income.

- Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred until retirement.

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are completely tax-free. This can be very beneficial if you expect to be in a higher tax bracket in retirement.

- Health Savings Account (HSA): Often called the “triple-tax advantaged” account. Contributions are tax-deductible, earnings grow tax-free, and qualified withdrawals for medical expenses are tax-free. After age 65, funds can be withdrawn for any purpose, subject to income tax if not used for medical expenses.

- Brokerage Accounts: For savings beyond your tax-advantaged limits, a taxable brokerage account offers flexibility, though investments are subject to capital gains tax.

Diversifying your investments across different asset classes (stocks, bonds, real estate) and within various account types can help manage risk and optimize returns.

Taking Action and Seeking Professional Guidance

The journey to a secure retirement doesn’t have to be walked alone. If you’re unsure about your calculations or investment strategy, consulting a qualified financial advisor can provide invaluable personalized guidance. They can help you assess your current situation, clarify your goals, create a tailored investment plan, and keep you accountable.

Remember that retirement planning is not a one-time event but an ongoing process. Review your plan annually, especially after significant life changes like marriage, a new child, or a career change. Adjust your contributions and investment strategy as needed to stay on track.

Conclusion

Determining “how much should I invest monthly?” for retirement planning as a man requires a thoughtful assessment of your age, desired lifestyle, current financial standing, and risk tolerance. By setting clear goals, leveraging tax-advantaged accounts, and consistently reviewing your progress, you can build a robust financial future. Start early, stay disciplined, and don’t hesitate to seek professional advice to ensure your golden years are truly golden.