The siren song of credit cards can quickly turn into a financial nightmare, leaving many feeling trapped by high-interest debt. Simultaneously, the absence of an emergency fund creates a constant underlying anxiety, knowing that one unexpected expense could derail your financial stability. The good news? You don’t have to choose between tackling debt and building savings. This article provides a comprehensive action plan to do both, setting you on a path to financial freedom and peace of mind.

Acknowledge the Dual Challenge

It’s a common dilemma: should you throw every extra penny at your debt, or prioritize building a safety net? While conventional wisdom often suggests tackling high-interest debt first, completely neglecting savings leaves you vulnerable. Our strategy advocates for a balanced approach, making progress on both fronts so you’re protected against life’s curveballs while aggressively reducing what you owe.

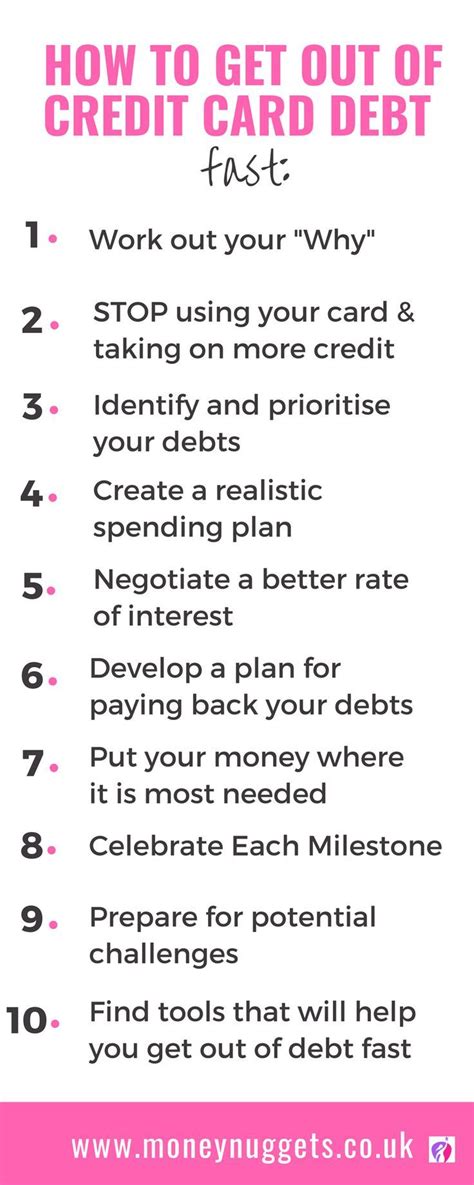

Step 1: Assess Your Debt Landscape

You can’t defeat an enemy you don’t understand. Start by gathering all your credit card statements. For each card, note down:

- The total balance owed.

- The interest rate (APR).

- The minimum monthly payment.

Organize this information in a spreadsheet or a simple list. This clear overview will be crucial for the next step.

Step 2: Choose Your Debt-Crushing Strategy

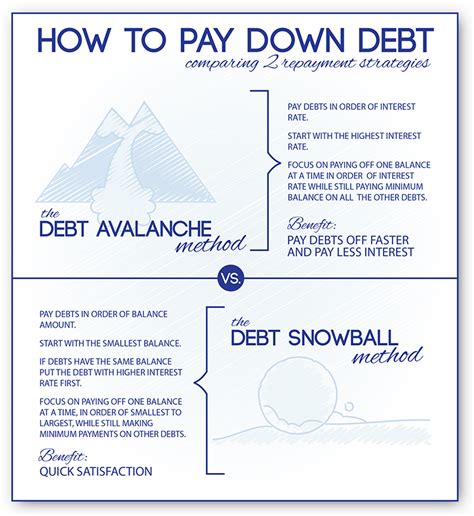

There are two primary methods for paying off multiple debts:

- Debt Avalanche: List your debts from highest interest rate to lowest. Make minimum payments on all cards, but throw any extra money at the card with the highest interest rate. Once that’s paid off, roll that payment (minimum + extra) to the next highest interest rate card. This method saves you the most money on interest.

- Debt Snowball: List your debts from smallest balance to largest. Make minimum payments on all cards, but focus extra money on the smallest balance. Once paid, roll that payment to the next smallest. This method provides psychological wins, helping you stay motivated.

Choose the method that best suits your personality and financial situation. Consistency is key, regardless of the chosen path.

Step 3: Build Your Emergency Fund Foundation (Simultaneously)

While aggressively attacking debt, you need a small, immediate emergency fund. Aim for an initial $1,000 to $2,000. This fund acts as your first line of defense against unexpected expenses (car repair, medical bill, job loss) so you don’t have to rely on credit cards again. Dedicate a small, consistent amount each month to this fund, even if it’s just $50 or $100. This isn’t about fully funding it yet, but creating a crucial buffer.

Step 4: Automate Your Progress

Set up automatic payments for your minimum credit card payments to avoid late fees and protect your credit score. More importantly, automate your debt acceleration payment and your emergency fund contribution. If you’ve decided to put an extra $300 towards debt and $100 towards savings each month, set up automatic transfers from your checking account. This removes the temptation to spend the money elsewhere and ensures consistent progress.

Step 5: Cut Unnecessary Spending

Review your monthly budget with a fine-tooth comb. Look for areas where you can reduce expenses and redirect that money towards debt repayment and savings. This might mean cutting back on dining out, canceling unused subscriptions, or finding cheaper alternatives for daily necessities. Every dollar saved is a dollar that can accelerate your journey to financial freedom.

Step 6: Consider Extra Income Streams

If your current income isn’t enough to make significant progress, explore options for earning extra money. This could be a side hustle, selling unused items, or taking on temporary contract work. Even a few hundred extra dollars a month can dramatically speed up both debt payoff and emergency fund growth.

Commit to Your Financial Future

Crushing credit card debt and building a powerful emergency fund is not a sprint, but a marathon. It requires discipline, consistency, and a clear vision of your financial goals. By following this action plan, you’ll not only eliminate the burden of high-interest debt but also build a strong financial foundation that protects you against future uncertainties. Start today – your future self will thank you.