Understanding High-Interest Credit Card Debt

Credit card debt can be a significant burden, and for many, it’s the high-interest rates that make it feel insurmountable. When you carry a balance on multiple credit cards, the interest charges can quickly compound, turning a manageable amount into a financial nightmare. Understanding which debts are costing you the most is the first step toward regaining control and accelerating your path to becoming debt-free.

The core principle behind prioritizing high-interest debt is simple: the more interest you pay, the more expensive your debt becomes. By focusing your efforts on the cards with the highest Annual Percentage Rate (APR), you minimize the total amount of interest you’ll pay over the life of your debt, ultimately saving you money and shortening your repayment timeline.

The Avalanche Method: Your Most Potent Weapon

When it comes to debt repayment strategies, two popular methods stand out: the debt snowball and the debt avalanche. While the snowball method focuses on paying off the smallest balances first to build momentum, the debt avalanche method is financially superior for those looking to save money on interest. It dictates that you prioritize debts by their interest rate, paying off the highest APR debt first.

This strategy is highly effective because it directly attacks the most expensive debt, systematically reducing the overall interest accrual. By consistently applying extra payments to the highest interest rate card, you chip away at the principal that generates the most interest, allowing you to pay off your total debt faster and at a lower overall cost.

Step-by-Step Guide to Prioritizing Your Debt

1. List All Your Debts

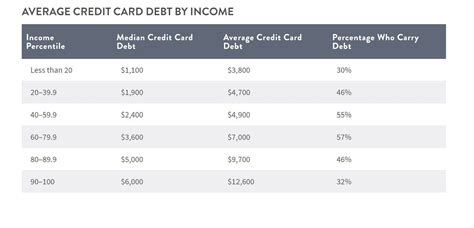

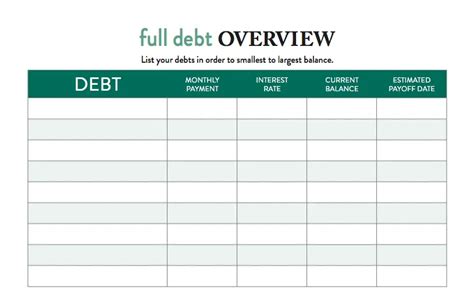

Begin by compiling a complete list of all your credit card debts. For each card, note down:

- The current balance

- The Annual Percentage Rate (APR)

- The minimum monthly payment

Gathering this information from your statements or online accounts will give you a clear picture of your entire debt landscape.

2. Identify the Highest Interest Rate

Once you have your list, sort your credit cards from the highest APR to the lowest. This step is critical because it will reveal which card is costing you the most money in interest every month. This card will be your primary target.

3. Commit to the Avalanche Strategy

With your highest APR card identified, commit to the avalanche strategy. This means you will make only the minimum payment on all your credit cards except for the one with the highest interest rate. All additional funds you can spare will go towards attacking that priority debt.

4. Attack Your Priority Debt

Direct every extra dollar you can find—whether it’s from a bonus, cutting expenses, or a side hustle—to the credit card with the highest interest rate. The goal is to aggressively reduce its balance as quickly as possible. Every extra payment directly reduces the principal, which in turn reduces the interest you’ll pay.

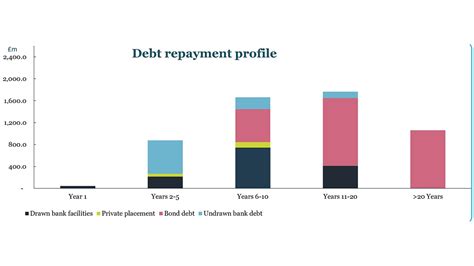

5. Roll Over and Repeat

Once you completely pay off the credit card with the highest interest rate, celebrate your success! Then, take the money you were paying on that card (the minimum payment plus any extra funds) and apply it to the next credit card on your list with the highest interest rate. This is the ‘snowball’ effect within the avalanche method, as your payment amount grows with each paid-off card, accelerating your progress even further.

Beyond the Avalanche: Complementary Strategies

While the avalanche method is powerful, you can enhance your debt repayment journey with other financial strategies:

- Balance Transfers: If you have excellent credit, consider transferring high-interest balances to a new card with a 0% APR introductory offer. Be mindful of transfer fees and ensure you can pay off the balance before the promotional period ends.

- Debt Consolidation Loans: A personal loan with a lower, fixed interest rate can consolidate multiple credit card debts into one monthly payment, potentially saving you money and simplifying your finances.

- Budgeting: Creating and sticking to a strict budget is fundamental. Identify areas where you can cut expenses to free up more money for debt payments.

- Avoid New Debt: While paying off existing debt, commit to not taking on any new credit card debt. Cut up or freeze cards if necessary to remove temptation.

Conclusion

Prioritizing credit card debt by its interest rate using the debt avalanche method is a strategic and financially sound approach to becoming debt-free. It requires discipline and consistency, but the rewards—less interest paid, a faster repayment timeline, and ultimately, financial peace of mind—are well worth the effort. Start by organizing your debts, identify your highest APR card, and commit to an aggressive repayment plan. With a clear strategy and determination, you can conquer your credit card debt and build a stronger financial future.