In an unpredictable world, an emergency fund acts as your financial safety net, providing peace of mind and protection against life’s curveballs. Aiming for three months’ worth of essential living expenses is a common and highly recommended goal. While it might seem daunting to accumulate such a sum quickly, with focused effort and smart strategies, it’s entirely achievable.

Why a Three-Month Emergency Fund is Essential

Unexpected events like job loss, medical emergencies, or car repairs can derail even the most carefully laid financial plans. Without an emergency fund, you might be forced to go into debt, liquidate investments prematurely, or make difficult choices that compromise your long-term financial health. A three-month buffer provides a crucial period to recover, find new employment, or manage unexpected costs without succumbing to financial stress.

Aggressive Strategies to Build Your Fund Quickly

1. Drastically Cut Non-Essential Spending

This is where the rubber meets the road. For a short, defined period, be ruthless with your budget. Identify all discretionary spending: dining out, entertainment subscriptions, impulse purchases, and even daily coffees. Temporarily pause or significantly reduce these until your emergency fund goal is met. Track every dollar to see where your money is truly going and find areas to save.

- Create a “Bare Bones” Budget: For 3 months, focus only on essential housing, utilities, groceries, transportation, and debt minimums.

- Cook at Home: Pack lunches, make your own coffee, and avoid restaurant meals.

- Cancel Unused Subscriptions: Review all recurring charges and cut anything you don’t absolutely need.

2. Boost Your Income Rapidly

Saving more isn’t just about spending less; it’s also about earning more. Look for opportunities to bring in extra cash quickly.

- Side Hustles: Consider temporary part-time jobs, freelancing (writing, graphic design, virtual assistant), or gig economy work (delivery, rideshare).

- Sell Unused Items: Declutter your home and sell clothes, electronics, furniture, or collectibles on online marketplaces or at garage sales. Every dollar adds up.

- Overtime or Bonuses: If your job offers overtime, take advantage of it. Any performance bonuses or commissions should go straight to your fund.

3. Automate Your Savings

Make saving non-negotiable. Set up an automatic transfer from your checking account to a separate, high-yield savings account immediately after each paycheck. Treat this transfer like any other bill – one that’s paid to your future self. Start with a substantial amount and gradually increase it as your budget allows.

Even small, consistent transfers add up rapidly, especially when coupled with aggressive saving from other sources.

4. Direct Windfalls Straight to Your Fund

Any unexpected money that comes your way should be immediately redirected to your emergency fund. This includes tax refunds, work bonuses, gifts, or even a small lottery win. Resist the urge to spend these funds and instead view them as accelerated contributions to your financial security.

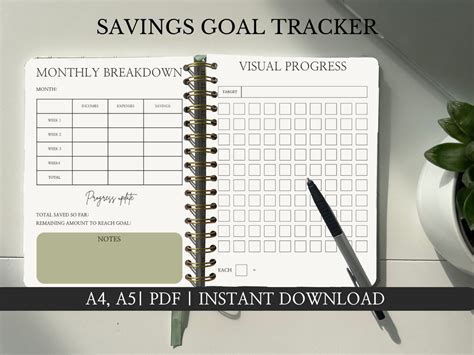

Stay Motivated and Track Your Progress

Building an emergency fund quickly requires discipline and focus. Keep your goal visible – perhaps write it down and stick it on your fridge. Celebrate small milestones. Regularly review your budget and progress to stay on track. Remember, this is a temporary sprint for a long-term benefit.

Once you hit your three-month target, consider if you want to expand it to six months, especially if you have a variable income or dependents. The peace of mind you gain is invaluable.

Conclusion

Building a 3-month emergency fund quickly is an empowering financial goal. By combining aggressive expense cutting, income boosting, automated savings, and smart allocation of windfalls, you can achieve this vital safety net faster than you might imagine. Prioritize this financial sprint, and you’ll lay a strong foundation for a more secure and stress-free financial future.