High-interest credit card debt can feel like a relentless burden, trapping you in a cycle of minimum payments that barely touch the principal. The good news is that with a strategic approach and unwavering discipline, you can quickly pay off this debt and reclaim your financial freedom. This guide will walk you through proven methods to tackle your high-interest credit card balances head-on.

1. Get a Clear Picture of Your Debt

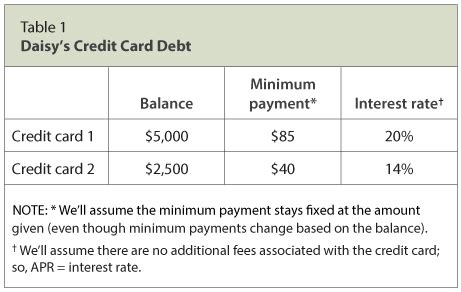

Before you can conquer your debt, you need to understand it thoroughly. Compile a list of all your credit cards, their current balances, and most importantly, their annual percentage rates (APRs). Organize them from highest APR to lowest. This detailed overview will be crucial for determining the most effective repayment strategy.

2. Choose Your Debt Repayment Strategy

Two popular and effective methods for debt repayment are the Debt Avalanche and the Debt Snowball. Understanding both will help you decide which aligns best with your financial personality.

The Debt Avalanche Method

This method prioritizes paying off the credit card with the highest interest rate first, while making minimum payments on all other cards. Once the highest-APR card is paid off, you take the money you were paying on it and apply it to the card with the next highest interest rate. This strategy saves you the most money in interest over time.

The Debt Snowball Method

The Debt Snowball method focuses on psychological wins. You pay off the smallest balance first, regardless of its interest rate, while making minimum payments on all other cards. Once the smallest debt is eliminated, you roll that payment amount into the next smallest debt. This creates momentum and motivation as you quickly knock out smaller debts.

3. Explore Debt Reduction Tools

Sometimes, external tools can accelerate your debt repayment process, especially when dealing with very high interest rates.

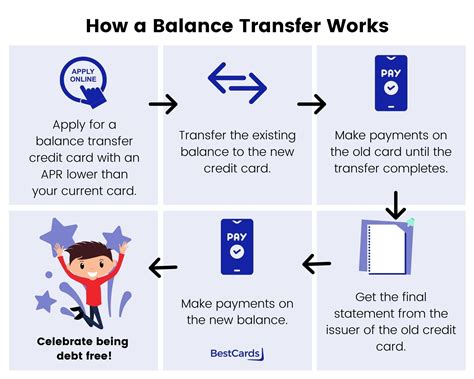

Balance Transfer Credit Cards

If you have good credit, you might qualify for a balance transfer credit card offering a 0% introductory APR for a period (e.g., 12-21 months). Transferring your high-interest balances to one of these cards can give you a crucial window to pay down a significant portion of your principal without accruing additional interest. Be mindful of balance transfer fees, which are typically 3-5% of the transferred amount, and ensure you can pay off the balance before the promotional period ends.

Personal Loans for Debt Consolidation

A personal loan can be used to consolidate multiple credit card debts into a single loan with a fixed interest rate, which is often lower than credit card APRs. This simplifies your payments and can reduce your overall interest costs. However, ensure the new loan’s interest rate is truly lower and that the repayment terms are manageable.

Credit Counseling Services

Non-profit credit counseling agencies can help you create a budget, negotiate with creditors for lower interest rates or a debt management plan (DMP), and provide financial education. A DMP combines your debts into one monthly payment, often with reduced interest rates, but it typically requires closing your credit card accounts.

4. Boost Your Repayment Power

To truly accelerate your debt payoff, you’ll need to free up more money to put towards your principal.

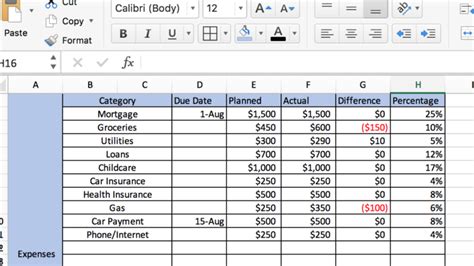

Create a Strict Budget

Analyze your spending habits and identify areas where you can cut back. Even small cuts to discretionary spending – dining out less, canceling unused subscriptions, reducing entertainment costs – can add up significantly. Allocate every extra dollar directly to your highest-priority debt.

Increase Your Income

Consider ways to bring in more money. This could involve taking on extra shifts at work, starting a side hustle, selling unused items, or negotiating a raise. The more income you can generate, the faster you can attack your debt.

Automate Your Payments

Set up automatic payments for at least the minimum amount on all your cards to avoid late fees. For your priority card, consider automating a larger payment than the minimum to ensure consistent progress.

5. Maintain Momentum and Stay Disciplined

Paying off debt is a marathon, not a sprint. Consistency and discipline are key to long-term success.

Avoid New Debt

While paying off existing debt, resist the temptation to take on new credit card debt. If necessary, put your credit cards away or even freeze them (literally) to remove the temptation for impulse purchases.

Track Your Progress

Seeing your balances shrink is incredibly motivating. Use a spreadsheet, a debt tracking app, or even a simple chart on your wall to visualize your progress. Celebrate small victories along the way.

Build an Emergency Fund

Once your high-interest credit card debt is gone, shift your focus to building a robust emergency fund. This will prevent you from relying on credit cards again when unexpected expenses arise.

Paying off high-interest credit card debt requires a combination of smart strategy, consistent effort, and unwavering discipline. By understanding your debt, choosing an effective repayment method, utilizing available tools, boosting your repayment capacity, and staying committed, you can quickly move towards a debt-free future and achieve lasting financial stability. Start today – your financial freedom awaits!