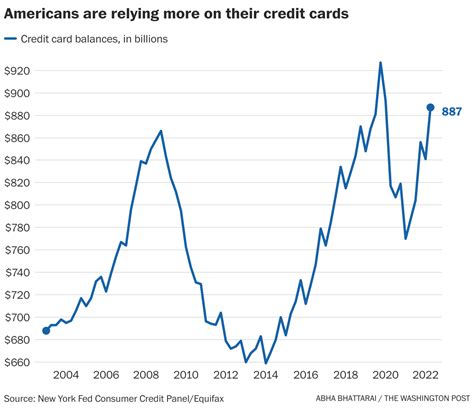

Conquering High-Interest Credit Card Debt: An Aggressive Approach

High-interest credit card debt can feel like a relentless uphill battle, with interest charges often eroding any progress you try to make. However, with a focused and aggressive strategy, you can break free from this cycle and regain control of your financial future. It requires discipline, a clear plan, and sometimes, a little creativity.

Understand Your Debt Landscape

Before you can aggressively attack your debt, you need to fully understand its scope. Compile a list of all your credit cards, their outstanding balances, and, most importantly, their Annual Percentage Rates (APRs). This clear picture will be your roadmap.

Knowing which cards carry the highest interest rates is crucial, as these are the ones costing you the most money over time. Prioritizing these will be key to an aggressive payoff strategy.

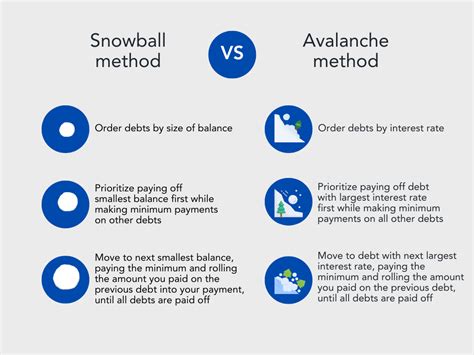

The Debt Avalanche vs. Debt Snowball Method

Two popular strategies for debt repayment are the Debt Avalanche and the Debt Snowball. For an aggressive approach, the Debt Avalanche is generally superior for saving money.

Debt Avalanche: This method prioritizes paying off the debt with the highest interest rate first, while making minimum payments on all other debts. Once the highest-interest debt is paid off, you take the money you were paying on it and apply it to the next highest-interest debt. This approach saves you the most money in interest over time.

Debt Snowball: With this method, you pay off the smallest debt balance first, while making minimum payments on all others. Once the smallest debt is paid off, you roll that payment amount into the next smallest debt. While it may cost more in interest, the psychological wins of quickly eliminating smaller debts can provide motivation.

Leverage Balance Transfers

If you have good credit, a 0% APR balance transfer credit card can be a powerful tool for aggressively paying down high-interest debt. These cards allow you to move existing credit card balances to a new card, offering an introductory period (often 12-21 months) with zero interest.

This grace period gives you a crucial window to make significant progress on your principal without interest charges adding up. Be mindful of transfer fees (typically 3-5% of the transferred amount) and ensure you can pay off the balance before the 0% APR expires, or you’ll face high interest rates on the remaining balance.

Consider a Debt Consolidation Loan

Another aggressive strategy is to consolidate your high-interest credit card debt into a single, lower-interest personal loan. This can simplify your payments into one monthly bill and, more importantly, potentially reduce your overall interest rate.

A debt consolidation loan can make your monthly payments more manageable and help you pay off debt faster by reducing the amount of interest accruing. However, you’ll need a decent credit score to qualify for favorable rates, and it’s essential to avoid racking up new credit card debt after consolidating.

Drastically Adjust Your Budget

To aggressively pay down debt, you’ll likely need to free up more money in your budget. This means taking a hard look at your spending and making significant cuts. Differentiate between needs and wants, and be prepared to temporarily sacrifice non-essential expenses like dining out, entertainment, and subscriptions.

Simultaneously, explore ways to increase your income. This could involve taking on a side hustle, working overtime, selling unused items, or negotiating a raise. Every extra dollar you earn should be directly applied to your highest-interest debt.

Negotiate with Creditors

If you’re struggling to make payments, don’t hesitate to contact your credit card companies directly. Explain your situation and ask if they can lower your interest rate, waive fees, or offer a hardship plan. Many creditors are willing to work with you to avoid default.

For more severe situations, a reputable non-profit credit counseling agency can help you create a Debt Management Plan (DMP). They can often negotiate lower interest rates and a single monthly payment to your creditors on your behalf, providing a structured path to debt freedom.

Stay Motivated and Consistent

Aggressively paying down debt is a marathon, not a sprint. Set clear, achievable milestones and celebrate your progress along the way. Automate your payments to ensure consistency, and commit to not taking on new debt while you’re paying off old balances.

The path to being debt-free requires unwavering commitment, but the financial freedom and peace of mind you gain will be well worth the effort. By combining strategic methods with rigorous budgeting, you can effectively conquer high-interest credit card debt.